Well Known Facts Can Hurt You

Our long-time readers are aware that we analyze the U.S. stock market through the prism of what we call “well-known facts.” A well-known fact is a body of economic information which is pretty much known to all market participants and has been acted on by almost everyone with available capital. Former Intel CEO Andy Grove use to say, “when everyone knows something is so, nobody’s knows nothin’.” Today there are several well-known facts which we believe are leading investors down a destructive path.

Fact No. 1: Data Mining and Artificial Intelligence (A.I.) Will Change the World

Investors have been so jacked up about data mining and A.I. that they have distorted nearly every major U.S. stock market sector. Anybody who can walk while chewing gum knows that data mining and A.I. are in use, and the companies connected to it trade for 100 times profits (if they have any). The S&P 500 Index is loaded with tech stocks that would be at the heart of this phenomena, and Invesco is giving us nightmares with advertisements to invest in the QQQ exchange-traded fund. The QQQ is comprised of the 100 largest Nasdaq companies and gives a little purer heroin to tech-hungry buyers of the well-known fact.

George Gilder, in his book, Life After Google, argues that data mining and A.I. should begin to suffer from diminishing marginal utility going forward. Regardless of whether he is right or not, the price you pay to be on the data mining and A.I. train make five to ten-year investment success unlikely.

Fact No. 2: Home Building is Driven by Affordability

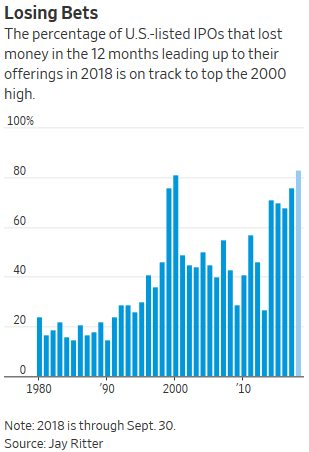

This might be the dumbest well-known fact the markets have ever bought into. Investments do well when purchased at an affordable moment. Stocks were affordable in 2009. Most investors were afraid of them and nobody had an urge to manufacture new ones via initial public offerings (IPOs). In 2018, common stocks as a group are very unaffordable. Despite the lack of affordability, there are the most low-quality IPOs this year as any year in the last twenty (see chart below):

Source: The Wall Street Journal

The same is true in houses. Stand-alone residences were the most affordable to buy in 2011 as in any year of my adult life. We built 320,000 in the year 2011. They were the least affordable in the 1970s and 1980s, and we built one million homes many of those years with 65% of the existing population base. There is an inverse correlation between home building and affordability.

Fact No. 3: Big Tech Will Avoid Anti-Trust Scrutiny

There is a well-known fact that goes like this, “Since search, social media and e-commerce delivery are basically free and are benefitting the consumer, the public doesn’t need to be protected from the anti-competitive behavior.” Under this flawed and very selfish logic, controlling 80% of the profits in advertising through social media or search is acceptable to the masses. Selling things online and delivering them at a loss to drive traffic to your cloud business seems to be fine with those who aren’t worried about the massive long-term dislocation it could cause in our economy.

In the eyes of the kings and queens of tech, as long as they conquer the world, it is the job of our ever-inflated U.S. government bureaucracy to take care of everyone dislocated by these anti-competitive activities.

The fallout from this well-known fact is all over the news. Facebook has used its monopoly in social media to brainwash the masses, violate the public’s long-lost privacy and then claim to not have had any idea what they were doing. In effect, we are a nation of Ed Saverin’s, the buddy of Facebook’s CEO, who almost got swindled out of his share of the company. He had to go to court and so will the public to right the wrong.

Google gets 80% of the profits in search and arguably knows more about you than your spouse or the federal government. They control your privacy and shut out competitors in every non-search business in which they operate. Expedia’s largest expense item is Google advertising and their biggest competitor is Google themselves. I’m sure that Google never uses what they know about Expedia to do more in travel commissions each year than Expedia does.

Amazon has a massive market share in e-commerce and in cloud services, which we mentioned is not mutually exclusive. We assume their e-commerce business is among the nation’s three largest users of the cloud (pornography, Netflix and Amazon e-commerce). Therefore, who can compete in e-commerce when someone like Amazon can lose money on most deliveries? Amazon’s AWS division gets a cut of each dollar of e-commerce revenue. The Wall Street Journal has weighed in on the activities of these three companies as follows:

“U.S. tech companies are increasingly facing a backlash from consumers, businesses and politicians about the widespread exploitation of personal data. In Europe the regulatory remediation has gone further, but action in the U.S. seems inevitable too.”1

Fact No. 4: There is a Recession Out There Which Will Hurt Main Street

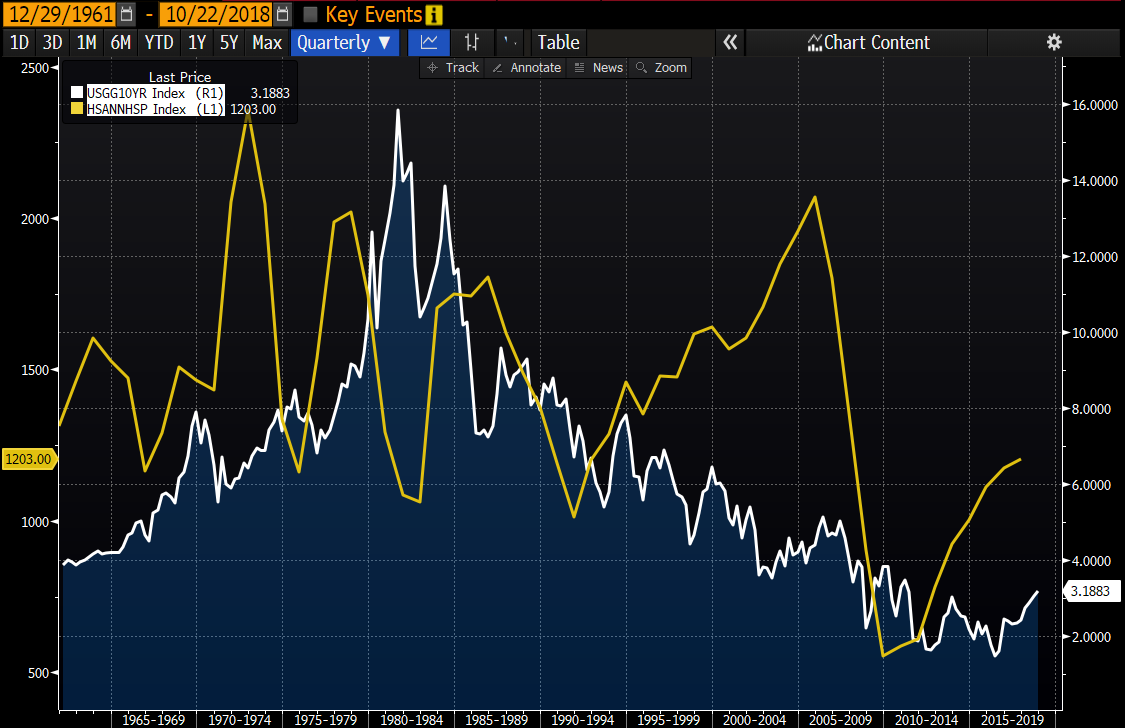

In 2000-2003, we had a recession in the U.S. when the dot-com technology bubble broke. We could do that again, but every region built around tech suffered while the rest of the country enjoyed continued economic growth. We believe a curse surrounds the expensive coastal cities and market readers are confusing a needed correction in Seattle, San Francisco, Boston, New York, and Miami, with a national residential real estate correction. There is no correlation between affordability and home building in the last 60 years (see chart below):

Source: Bloomberg

We believe the economy of the U.S. will be about what Steve Case calls, “The Rise of the Rest.” Tech employees who see their parent company stock decline will ask to move to affordable areas of the country where water and Wi-Fi are inexpensive and readily available. The well-known fact is that Millennials want to be in the coastal cities even after they marry and have kids. Eventually, their stagnant paychecks and the need to own a home will send them elsewhere in the country. Home building will boom in the other 85% of the places people in America live. Welcome to the next big thing, a huge intra-country migration to the fly-over states.

What investment implications can we draw from these well-known facts? First, if history is any guide, all things FAANG and glam tech should be avoided for an extended period. Five years of gross outperformance doesn’t get cured by a 90-day correction. When tech is a swear word and insiders are heavy buyers, we will be glad to do our research when those interested are lonely.

Second, those in stock picking who doubt the economic power of 86 million millennials will do so at their own risk. It is very difficult to have anything but a good Main Street economy when that many Americans get into the 30-45-year-old age bracket. We continue to like retailers (Target Corp., TGT), homebuilders (NVR Inc., NVR) and financial institutions (American Express, AXP; Bank of America, BAC; and JPMorgan Chase, JPM) which could prosper from this ten-year secular tailwind.

In conclusion, well-known facts give us insight into extremely popular and unpopular common stocks. Thank you for your attention and Happy Thanksgiving to all

Disclaimer: The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no ...

more

Good stuff!

As with all things, FANG stocks are not all the same and thus need to be valued and treated differently. Indeed Facebook is a dump. If you are concerned about growth and perception then you may wish to avoid Amazon although you are probably exposed to it in your mutual funds anyways. Netflix has nothing to do with the author's premises, but is a bit rich in valuation. And Google is indeed a giant company and is one reason why I think you should acquire it on the pullback rather than dump it because it's too strong. Google's valuation is also more decent than most of the rest. As for those that dump Apple into FAANG, Apple is a potential value play here although growth is a concern.

Interesting article. Most of it is great. Not sure if tariff wars will undermine mainstreet, but they could.