Weird Breadth From Small Businesses

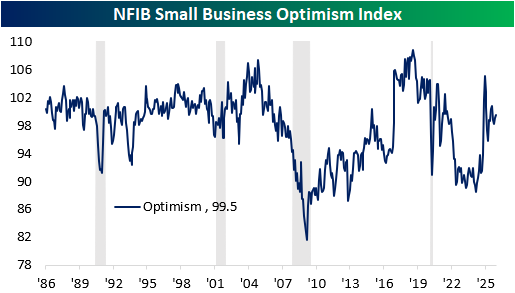

This morning's release from the NFIB indicated a modest uptick in small business optimism to end 2025. The headline index rose from 99 to 99.5, which is just above the historical median reading.

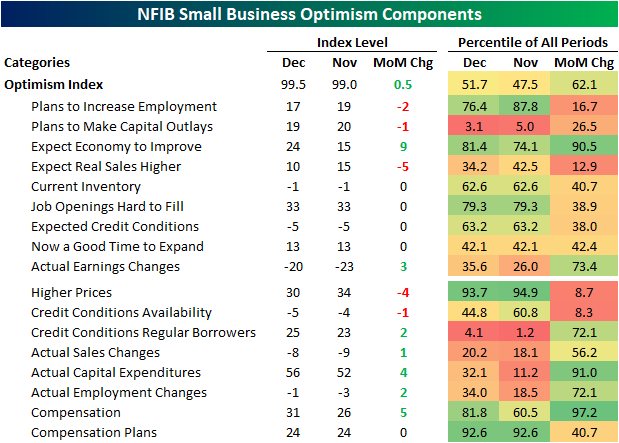

In the table below, we show each of the nine components that are inputs to the Optimism Index in addition to the eight other indices included with the report. As shown, the increase in the headline number was despite negative breadth among its inputs. Only two indices rose versus three that declined, however, the gainers were oversized including a 9-point jump in expectations for the economy to improve. That was a top decile monthly gain for that index, and brings it into the top quintile of readings historically. As for the indices that are not inputs for the headline number, breadth was much stronger as only two indices fell versus five that rose. That includes multiple strong readings from indices that track observed changes rather than expectations.

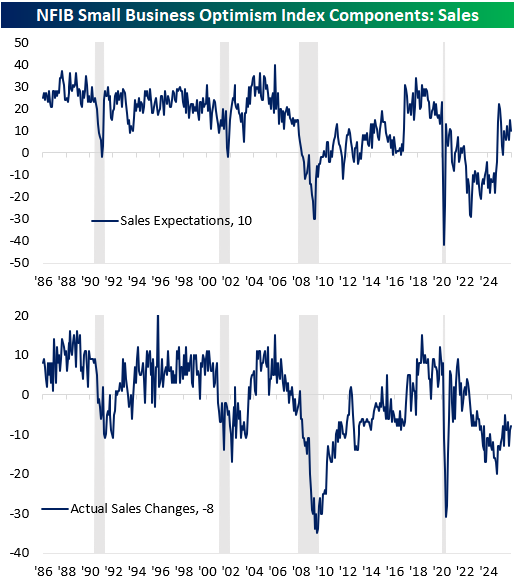

The largest negative impact on overall optimism in December was expectations for real sales to be higher. That index fell 5 points month over month, which is not anything too catastrophic. As shown below, readings remain net positive, and the December print is in the middle of the past several month's range. Actual sales changes, on the other hand, remains net negative. In other words, more firms continue to report falling instead of rising sales, however, the one point jump in December on top of a four point increase in November marks some improvement in recent months.

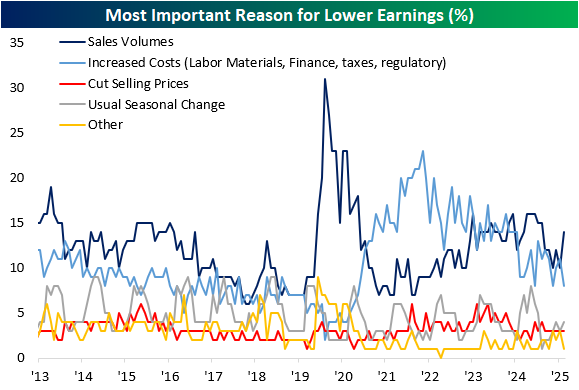

Like actual sales changes, observed earnings changes also remain in net negative territory. Granted, December also saw improvement in this category. For those reporting lower earnings, sales volumes receive the bulk of the finger pointing. That reading ticked up to 14%, which was the highest share of responses since June. Meanwhile, higher costs revisited the low end of the past few year's range. In other words, it appears weaker demand was the cause for lower earnings.

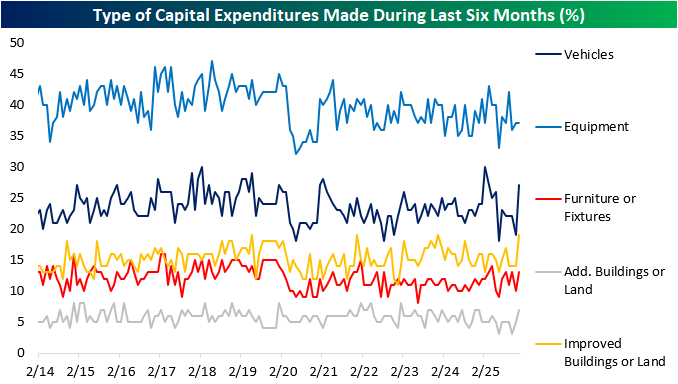

Firms reported an increase in capital outlays in the December report as that reading ended the year at one of the higher levels of the second half. The report offers insights into what companies are putting those expenditures towards, and as shown below, there was an increase in spend across categories save for equipment. Vehicles saw the biggest jump as that category registered the highest reading since the first quarter. Buildings and land typically get a seasonal bump in December, and last month's reading of 19% was the highest since December 2023, which tied the record high in data going back over a decade.

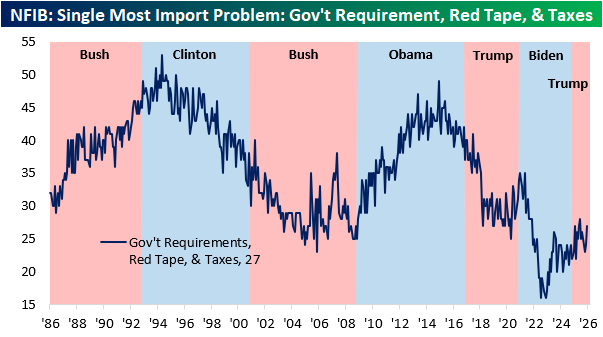

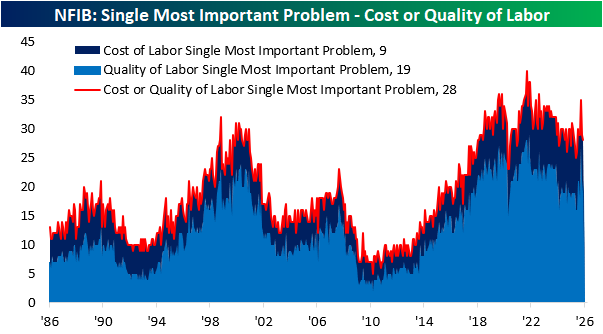

Turning over to the most important problems, the single largest concern is a combination of labor quality and costs. Only one point behind it is government related concerns (taxes combined with requirements and regulations). As shown below, those government concerns have risen steadily over the past few years as inflation has gone by the wayside, and December saw a combined 3 percentage point jump, which is the largest one month increase since the start of the Tariff turmoil of the spring.

As for labor concerns, there was a huge surge in those reporting quality of labor as their biggest issue in October (the reading went from 18% to 27%), but since then, that reading has almost completely reversed as it came in at 19% in December. Cost of labor pulled back one percentage point to 9% in December, which is basically inline with the past year's readings.

More By This Author:

Biggest Risks To The Market?Trillion Dollar Market Cap Changing Of The Guard

U.S. Market Cap Loses Ground

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more