Weekly Measures Of Growth, Into The New Year

WEI accelerates, while WECI decelerates.

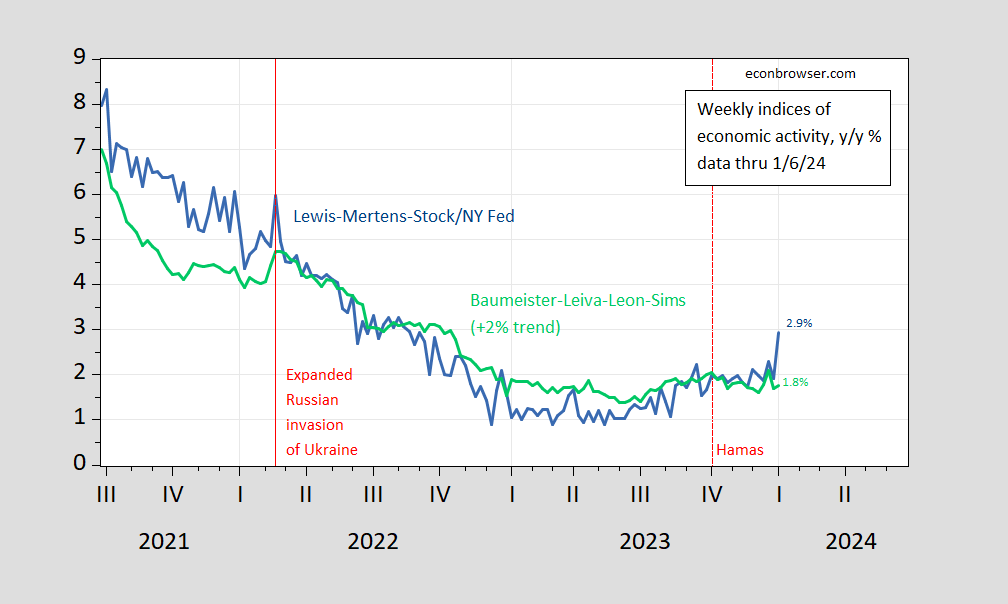

Figure 1: Lewis-Mertens-Stock Weekly Economic Index (blue), and Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green), all y/y growth rate in %. Source: NY Fed via FRED, WECI, accessed 1/11, and author’s calculations.

The WECI+2% thru 12/30 is 1.77%, while WEI reading is 2.94%. The latter is interpretable as a y/y quarter growth of 2.94% if the 2.94% reading were to persist for an entire quarter. The Baumeister et al. reading of -0.23% is interpreted as a 0.23% growth rate below the long term trend growth rate. Average growth of US GDP over the 2000-19 period is about 2%, so this implies a 1.77% growth rate for the year ending 1/6.

Recall the WEI relies on correlations in ten series available at the weekly frequency (e.g., unemployment claims, fuel sales, retail sales), while the WECI relies on a mixed frequency dynamic factor model.

More By This Author:

FX Reserve Holdings – 50 Years Of DataInflation Nowcasts And Expectations

Are We In Recession? The Sahm Rule Now & 2007

Disclaimer: This information is presented for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy any investment products. None of the ...

more