Weekly Market Pulse: Where Are The Extremes?

Every weekend I sit down at my desk and write the title of this post at the top of a legal pad. I make a list of everything I can identify as trading at an extreme in markets.

If an investor is to make tactical changes to their portfolio it is in the extremes where they will find their greatest opportunities. It isn’t a simple task to identify extremes because, if I have learned nothing else in over 30 years of playing this game, it is that markets can go much further, become much more extreme, than you think they can. What looks like an extreme today might be merely a waystation on the path to something even more extreme.

What gets written on that pad doesn’t come from one indicator or one methodology or one source. It starts with just thinking about the dominant narratives that are currently driving the markets. While I am not a believer in the idea of a strong version of the efficient market hypothesis, I do believe that markets are right most of the time. Even when I think there is good reason to believe markets are pricing some asset wrong, it is better to assume that I am the one that is wrong rather than the millions of people who make up the market. To do otherwise would require a hubris the market has beaten out of me in the parts of the last 5 decades I’ve spent trading and investing.

When I first got in this business a very smart man, a veteran whose hair was as gray then as mine is gone today, told me that he used the cocktail party indicator to test his ideas. If he mentioned a new investment idea at a party and it elicited laughs or cringes or questions about his sanity, he knew he was onto something. He also used the opposite tactic, talking about whatever he perceived as the most popular trade of the day, to see what kind of response he got.

If you think about the latter of those two approaches today, the obvious popular trade is anything related to artificial intelligence. You could shorten that to large tech stocks but I don’t think that would get the same response. But even with AI, I’m not sure it has really reached its ultimate extreme just yet. Yes, Nvidia seems ridiculously priced and there seems little chance that AI lives up to the absurd expectations of today, but its going to take some time before everyone figures that out. This might be one of those times when extreme just isn’t extreme enough.

When you think about the opposite, the things that would make people ask if you’re feeling okay, there are some good candidates. In the US, the obvious one is real estate, especially anything vaguely associated with office buildings. Regional banks are also pretty well hated although that particular fear seems confined to non-professional investors; hedge funds have been buying those pretty consistently. Interestingly, both of those sectors would be pretty well healed by lower interest rates, which a lot of people, me included, think are peaking or pretty close to it. The markets for short term rates agrees with us but it does give me pause.

But the one that would really get you some sideways glances is….China. Everybody is afraid of China and for seemingly good reasons. Their real estate and financial sectors appear to be on the precipice of an abyss. The Yuan is in a steady downtrend despite the government’s best intentions and interventions; capital flows have reversed. The geopolitical situation is fraught, with some very smart people talking about the inevitability of a Taiwan invasion. China and the US are in a tit for tat trade war over advanced technology in addition to all the Trump era tariffs that the Biden administration kept in place. The move away from China, not just by the US, seems well underway.

China is so well identified as the thing to avoid that is has made the cover of The Economist twice this year:

There are ample examples of the contrarian nature of The Economist cover so I won’t go into them here. Suffice it to say that a double negative cover is enough by itself to get me interested in the potential of investing in China. But I also have another problem with China which has little to do with their economy – I don’t trust them. The structure of the available investments in China has always presented a problem for anyone willing to investigate. Let’s just say that if you buy stock in many of the well known Chinese stocks trading in US markets you often aren’t really getting stock in that Chinese company. Your “investment” is likely secure only as long as Xi says it is. And that is a big problem in my opinion.

So, is there another way to invest in China without actually investing in China? A backdoor to the Chinese economy that doesn’t come with the direct risks of investing in Chinese companies? I give you the latest Economist cover:

If there is an economy that is more directly affected by the slowdown in China than Germany I’m not sure what it is. Yes, Germany’s economy has some other issues but most of those, like an aging population, are shared by many developed and developing economies. Much of the recent slowdown in the German economy – what some have already labeled a recession – is a consequence of reduced trade, a direct connection to China. The rest of Europe doesn’t share Germany’s reliance on exports and thus Europe’s economy as a whole looks better than its largest component.

Contrarian investing isn’t easy but the hardest investments to make, the ones that everyone is telling you are dumb, are often the best of all. The great thing about that is that if they work out, the gains are large enough that you don’t have to make a large initial bet for it to make a difference. Always be wary of the trade you can’t wait to put on and embrace the ones that make you sick when you push buy or sell. Right now the obvious choice is anything related to China.

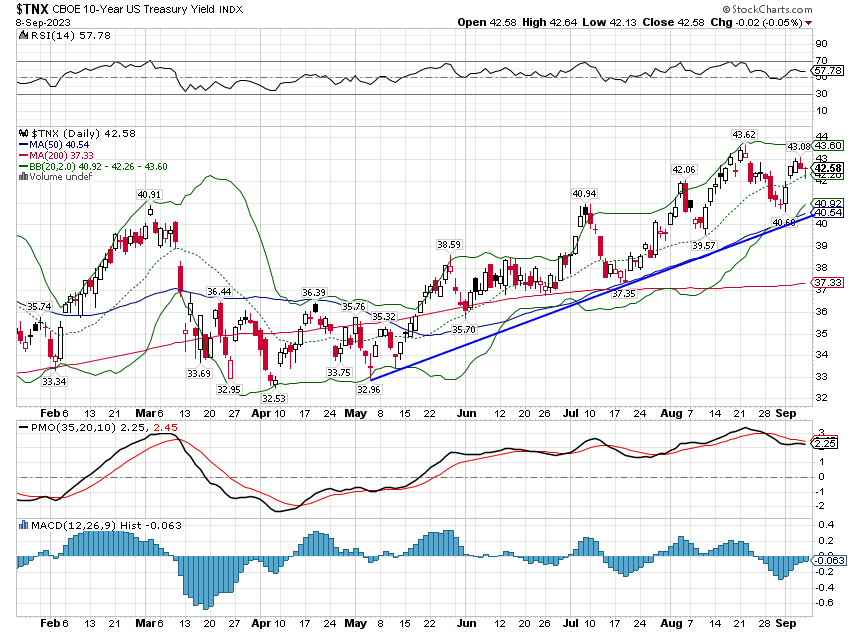

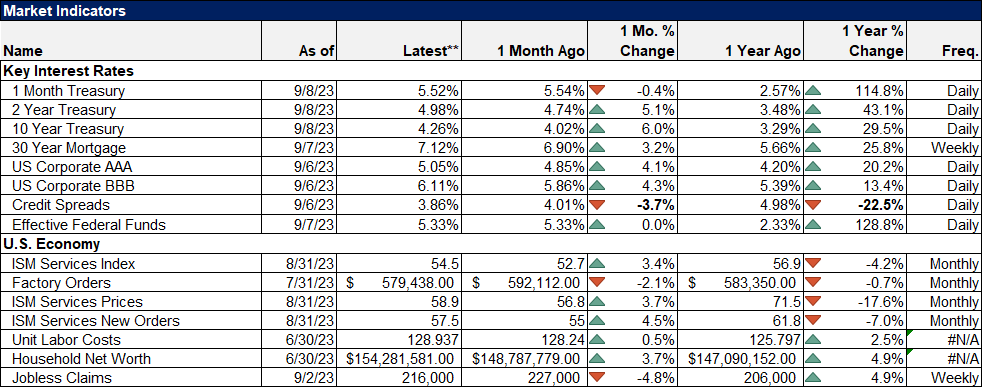

Environment

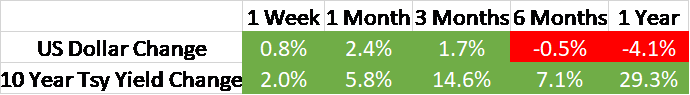

The 10 year Treasury yield rose last week and is still in an uptrend but the peak for the week was below the August 21 peak. That may or may not turn out to be a lower high (in technical parlance). I’ve been looking for rates to peak on a cyclical basis so that could also be my own bias peaking through. But the 10 year and 2 year yields, as I’ve mentioned recently, have essentially been marking time up here for months. The 10 year yield did have a move above the October high by 3 basis points but that isn’t enough to make any kind of technical judgment.

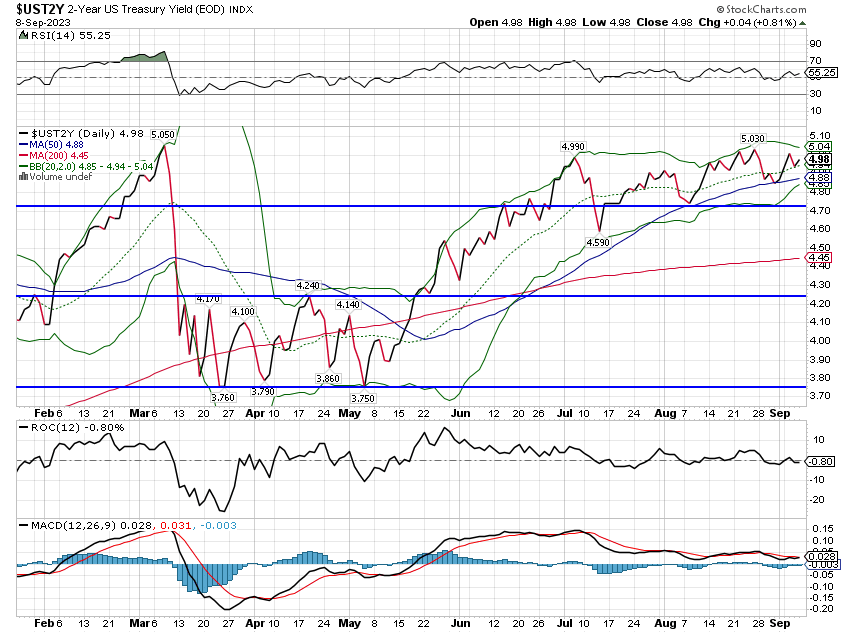

The 2 year yield rose last week as well but also stayed below its previous peak, this time from March. With the 1 and 3 month TBill yields also below their peaks it looks like rates are peaking. Expectations for the next Fed meeting are firmly in the do nothing camp.

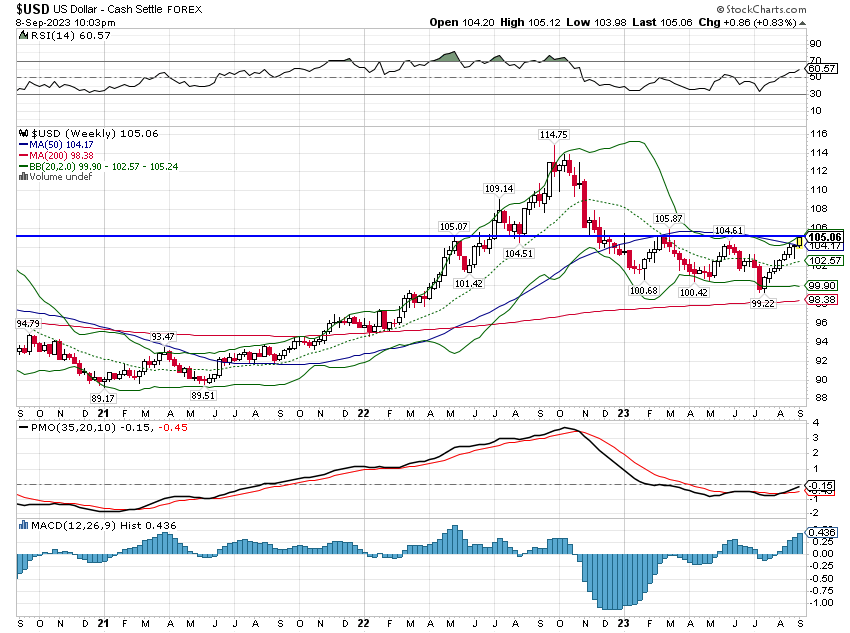

The dollar was up last week as well and is also butting up against its March highs. But it didn’t break out and there sure is a lot of talk about a strong dollar. Sentiment isn’t extreme though so maybe there’s more upside. Next week’s data could the deciding factor for the short term trend. For now though, the trend for the dollar is there isn’t one.

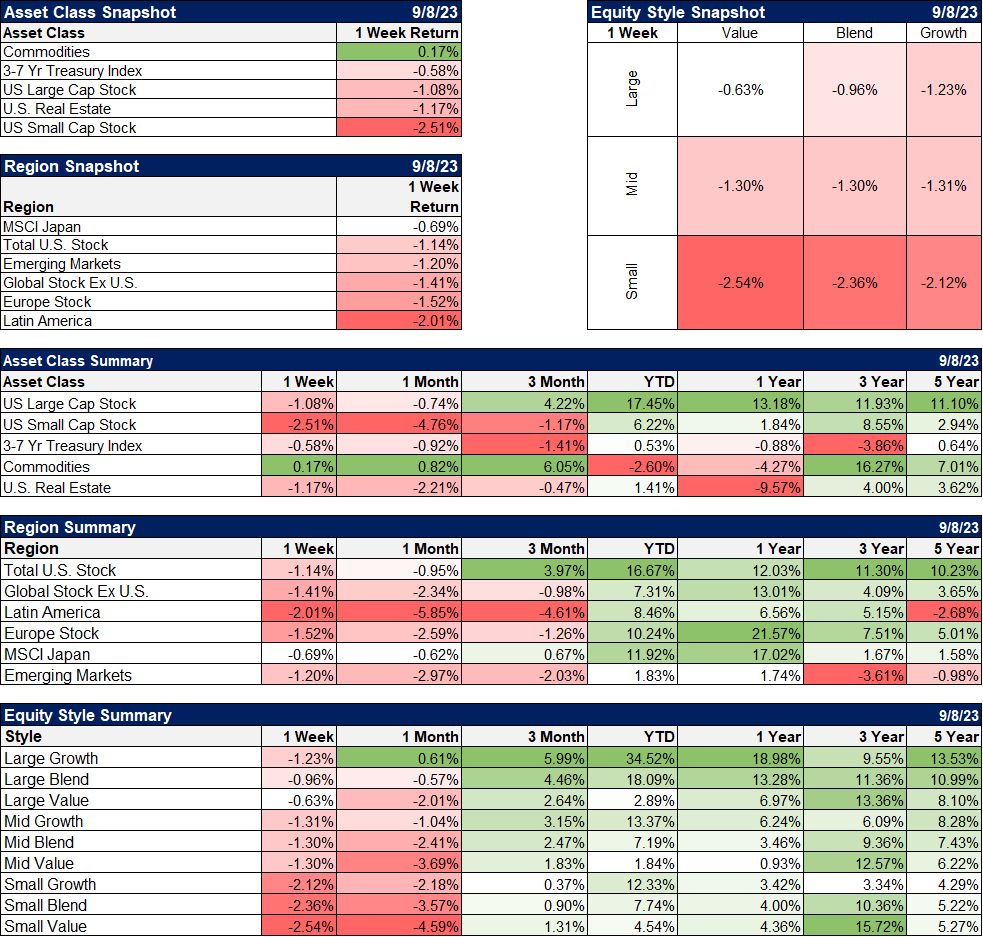

Markets

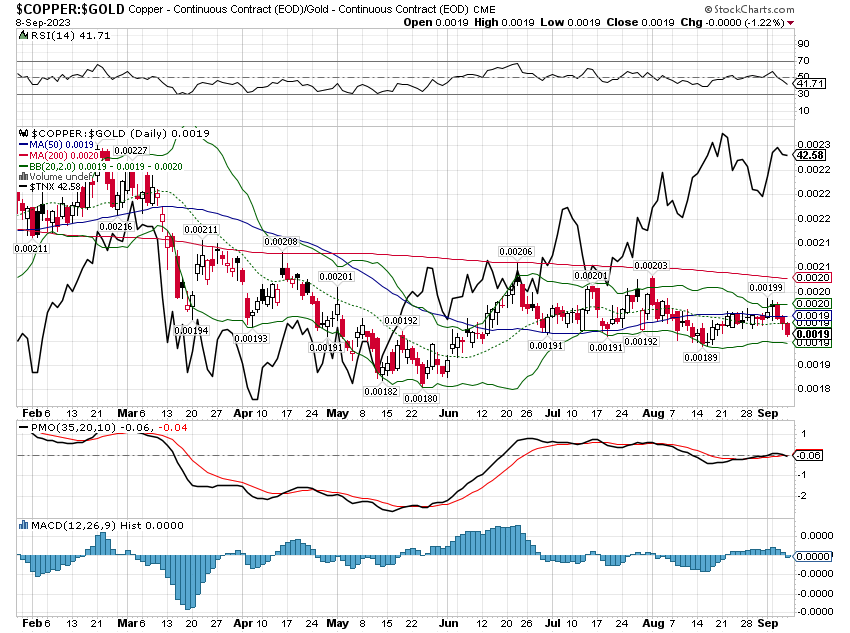

Despite a strengthening dollar, commodities continue to move higher and were the only one of the major asset classes we follow that managed to end the week in the green. That was, as it has been most of the time recently, a function of crude oil prices, up another 2.3% last week. Outside of energy and some softs (coffee, sugar) it was actually a pretty dour week for real assets. Copper was down 3.5% but the long term trend is still up while the shorter term has been rangebound. The copper/gold ratio is also neutral with essentially no change over the last 14 months. If the copper/gold ratio is still a good indicator for interest rates – as it has been in the past – either the ratio will move higher or rates will have to move lower.

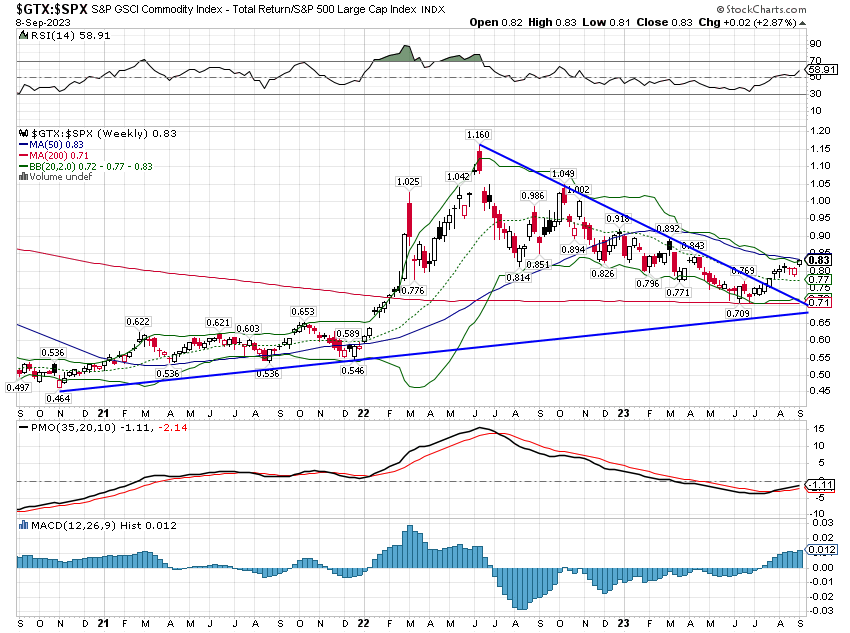

Arguing in favor of copper – and other commodities – rising is the longer term trend for commodities. It isn’t widely known or reported by commodities are the best performing of the major asset classes and by a pretty good margin. Over the last year, stocks did outperform but all that did was correct the commodity overshoot from the Russia/Ukraine war. Now commodities have started to outperform again, right on schedule.

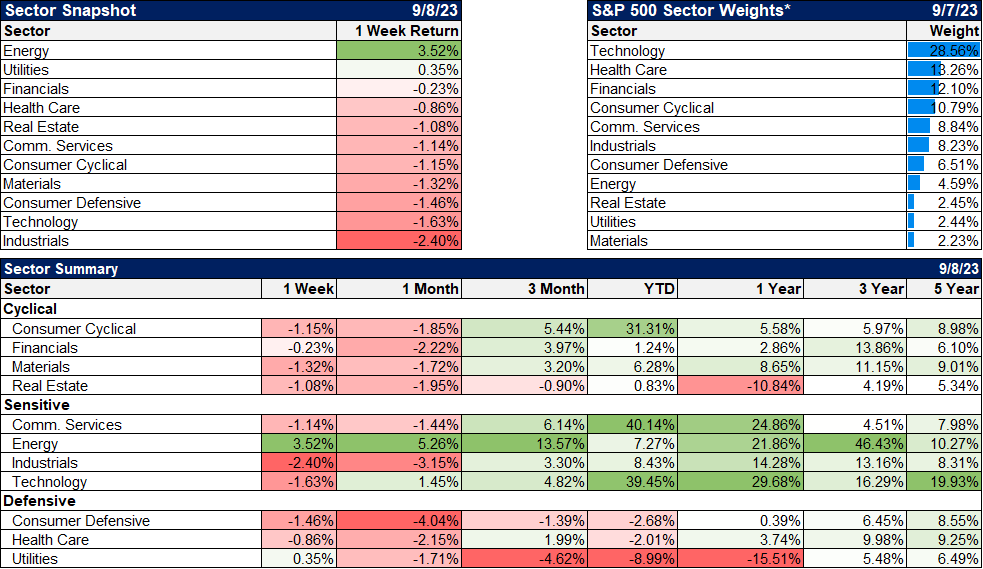

Stocks were down on the week with small cap stocks leading the way on the downside. Still, the move was a blip on the chart and the short term trend is still up. Large cap value was the best performing of the style indexes, down less than 1%. Japan was, again, the best international performer.

Consistent with the move in crude, energy stocks led on a sector basis. Utilities, which have been a pretty steep underperformer over the last year, had a nominal up week. The weakness in utilities is the source of the weakness in the dividend indexes by the way. I would not be too quick to throw in the towel if you own those ETFs as some of these utilities are starting to look pretty cheap.

Market Indicators/Economics

The economic data was generally pretty good last week. ISM Services was better than expected and that had bonds on the back foot most of the rest of the week. It is interesting though that just before the release of the ISM report, the S&P Services PMI report was weaker than expected. The S&P version covers smaller firms than the ISM and is generally more volatile so hard to say what that means. In any case, services are not a leading indicator and tend to peak after the start of any recession.

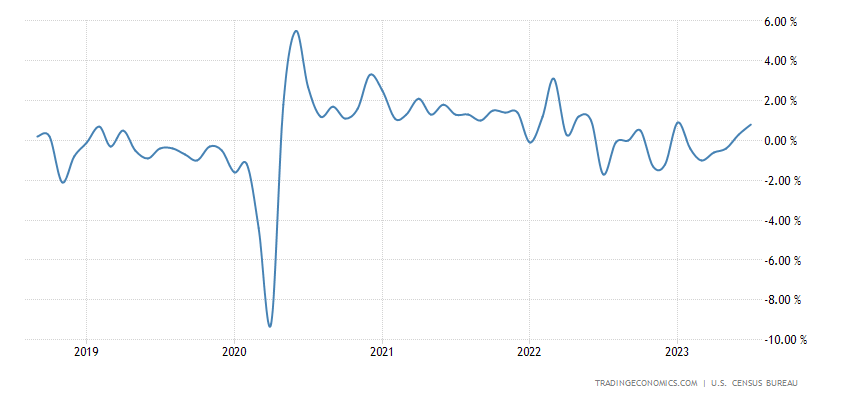

Factory orders were down 2.1% but ex-transportation were up 0.8% (Boeing). That’s the second up month in a row for the ex-transportation number which could be the start of a trend (especially with wholesale inventories continuing to drop).

The Flow of Funds report on household finances was released last week and while dated by a couple of months, it continues to show households with a large amount of cash on hand. Net worth was up $5 trillion in the second quarter (shown below) so households would seem to be in pretty good shape. We will eventually get a recession but I think it is unlikely as long as incomes are rising and cash levels are still above trend. For now, that is still where we are and I see no reason to think it is changing significantly even if we do see some slowing in the jobs market.

More By This Author:

Weekly Market Pulse: Wrong Again

Weekly Market Pulse: The Fault Is Not In R-Star

Weekly Market Pulse: Is The Correction Over?

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more