Weekly Market Pulse: What Changed?

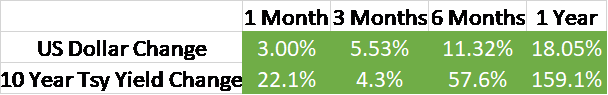

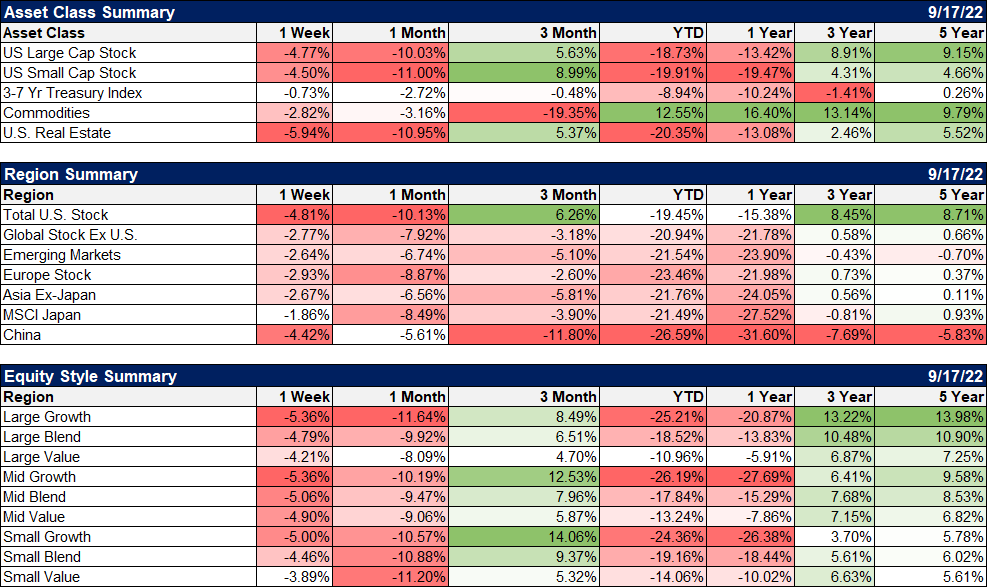

The S&P 500 fell 4.8% last week and is now down 19.4% year to date. Bonds were also down with yields up all across the yield curve. Gold was down 2.5% and the GSCI commodity index was down 2.3%. Rate sensitive REITs were down nearly 6%. The list of what went up last week would be quicker: the dollar, platinum, silver and some of the agriculture commodities. That’s about it.

So, it was a lousy week but maybe we should zoom out a little. Stocks generally made their low in mid-June with the S&P 500 (SPX) hitting an intraday low of 3636.87 on June 17th. We closed last Friday at 3873.33 so we’re still well above the lows (although a couple more days like last Tuesday would get us down there pretty quickly). The 10 year yield peaked at 3.48% on June 14th just a few days before stocks hit their low. We closed Friday at 3.45% so, close, but still below the previous peak. All the other asset classes we track are also above their lows (although some of the lows were July) with the exception of gold which continues to struggle with rising real rates.

If the June stock market lows really were the lows for this cycle, this latest pullback would be just a normal retracement; it wouldn’t be out of the ordinary when we looked back with the benefit of hindsight. In fact, we probably wouldn’t even notice it. But we don’t know if the June low was the low for this bear market.

So, what has changed since June? Well, it turns out not much. The economy is flatlining as it was back then. The first half of the year saw GDP contract slightly and GDI expand slightly and I interpret that as little to no growth. It isn’t recession and it isn’t growth and it isn’t good but it isn’t a new crisis either. I see nothing in the data for this quarter that moves us off that trajectory, higher or lower. The trigger for the selloff last week was the latest CPI report which didn’t show as much cooling in prices as everyone hoped to see. The immediate market reaction was to factor in more Fed tightening and that required a markdown in stock values.

The money market futures I follow and the market based models I track all put the peak in rates somewhere between March and June of next year. What that means to me is that, for now, the earliest we might enter recession would be March of 2023. Every recession since 1950 has seen short term rates (3 month T-bill rate) peak before or within a couple of months after the onset of recession. Of course, rates peaking and then falling does not have to be associated with recession but if we assume that’s where we’re headed, then the earliest we get there is spring.

Stocks would be generally expected to sell off before the onset of recession – markets anticipate – but the lead time between market peaks and the onset of recession can be as short as a couple of months or over a year. The average time from stock market peak to the onset of recession since 1957 is 6.4 months so we’re well past that already. Since 1980 the longest lead from stock market peak to recession is just 7 months in the 2001 recession. We’re now 8 1/2 months past the stock market peak and still not in recession. We also have no way of knowing how deep or shallow any recession might be, so it is hard to judge whether stocks have fallen sufficiently to discount it.

One of the things I’ve struggled with in this cycle – and I think a lot of people have – is that this bear market is so much different than anything we’ve experienced in recent decades. Indeed, considering COVID, it is really unprecedented. I tend to think though that comparing today to anything in the post 2000 era is probably not a good idea. We did have some higher inflation in the post dot com cycle but CPI yoy peaked in July 2008 at 5.5%. That’s high but nothing like today.

So, I’ve been looking back at the 60s, 70s and 80s for clues about what to expect. Inflation rose steadily from 1965 to 1970 (1% to 6.4%) and spiked rapidly in the post Bretton Woods era (dollar delinked from gold). Today seems somewhat similar to that period (72-74) when inflation rose from 3% to 12% in a little over 2 years, although today’s strong dollar doesn’t fit the narrative. There was another rapid rise in inflation between 1976 and 1980 (5% to 15%). What stands out about all these periods is that stocks were more correlated with inflation than interest rates, which tend to peak first.

Stocks fell when inflation was rising and tended to bottom right around the peak in the year over year change in inflation. Which makes the June lows in stocks this year very interesting; that is, so far, the peak in the year over year inflation rate. What is different from those pre-1980 recession though is that if that proves to be the peak it will have happened outside of recession. The peaks in ’70, ’74 and ’80 all happened during recessions. As I said, today’s economic environment is nothing if not unique.

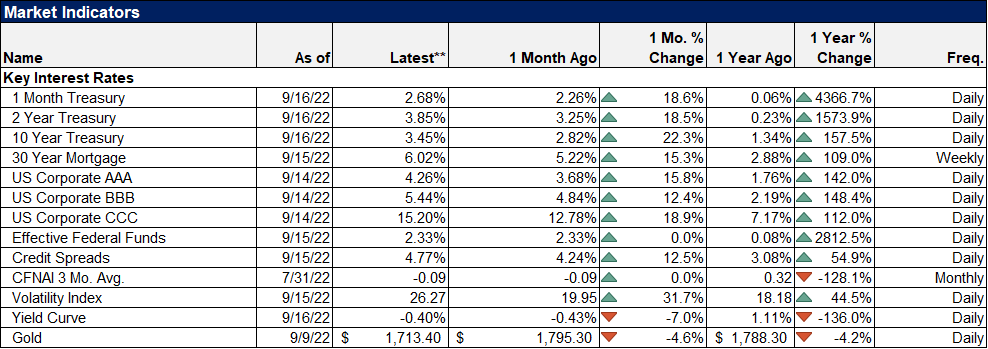

We will hear from the Federal Reserve this week and the expectation is that they will raise the Fed Funds rate by another 0.75%. There is a small chance of a 1% hike but I have my doubts. They don’t like to surprise markets so if they were going to do that I think they would have leaked a story to the WSJ by now. I suppose they could still do that Monday or Tuesday but I’m not sure what they would gain from doing so. The question for the market though is not what they do at this meeting but what they signal about future meetings. I don’t have any idea what Jerome Powell will say but the market seems braced for the worst.

It is often instructive to look at past markets and see how they reacted to various economic conditions. But no periods are ever exactly the same; this is not the 1960s or the 1970s. Furthermore, getting the economic cycle part right – figuring out when the recession starts and ends – may not help you get the market reaction correct. Sometimes bear markets start well in advance of recession and sometimes they come just as the recession is starting – and oh, by the way, all bear markets are not associated with recession. Sometimes bear markets end before the recession and sometimes months later. Why? Changes in human behavior, changes in information systems, changes in how the Fed manages monetary policy, the list goes on.

I don’t know if we’ll have a recession next year but I do know that’s what is expected. Spend an hour watching CNBC or Bloomberg and you’ll hear “recession next year” over and over from all corners of Wall Street. Maybe. But the market rarely does what everyone expects. So how will “Recession 2023” be wrong? Will it come before then or later or much later? All I know for sure is what we have right now. Short term interest rates are still rising and getting a recession while that is happening would be nearly unprecedented.

Environment

The trend of long term rates and the dollar is still up. The 10 year yield rising means that nominal growth expectations are rising but that doesn’t help us much by itself. NGDP growth expectations could be rising solely because inflation expectations are rising. In this case though, that isn’t what is going on. Inflation expectations peaked months ago and despite the angst generated by the CPI report, they fell last week too. In other words, TIPS were sold last week and real rates rose. That isn’t what you’d expect from investors supposedly scared to death of inflation.

As for the dollar, why it is rising is probably as important as how much and right now, it seems as if the US is the preferred destination for global capital. Where else you gonna go? I could make a contrarian argument about Europe and Japan but it would be just that – contrary to the consensus view. And what I think probably isn’t going to impact how global investors allocate their capital. Having said that, I am beginning to wonder if we haven’t taken the dollar a tad too far. Large speculators are still very long the dollar but have been trimming their longs since late June. These traders are trend followers so that could be the beginning of a trend shift. I have no idea why the dollar uptrend might end though.

Most of all, the trend in rates and the dollar both point to lower inflation. Inflation expectations peaked way back in the spring and year over year CPI peaked in June. I don’t think it is coincidence that stocks bottomed exactly when inflation peaked.

Markets

One of the worst weeks of the year and there was – again – no place to hide. All the major asset classes we follow were down on the week. the “winner” was bonds down the least in a lousy week.

Let’s try to zoom out a little though and take a look at the 3 month numbers. We are, after all, supposed to be investors and not worried about the very short term. When we do that we see that while bonds and commodities are both down, stocks and real estate are in the green. Stocks and real estate bottomed in June when year over year inflation peaked. Should that prove to be the peak in year over year inflation, I would expect those June lows to hold. In rising inflation markets (60s to 80s), stocks tended to bottom near the peak in inflation and were not that correlated with the overall business cycle.

It is also interesting that growth has led over the 3 month period. That is more consistent with past rising dollar periods. I would not rush out to buy the S&P 500 though. Growth stocks are still quite expensive; the S&P 500 trades for 2.8 times sales while a longer term average would be more like 1.5. So, large cap is not cheap and would be very vulnerable to further weakness.

Small and mid cap stocks, on the other hand, do look cheap at 0.7 and 1 times sales. Both also have low P/Es and their expected growth puts the PEG less than 1.

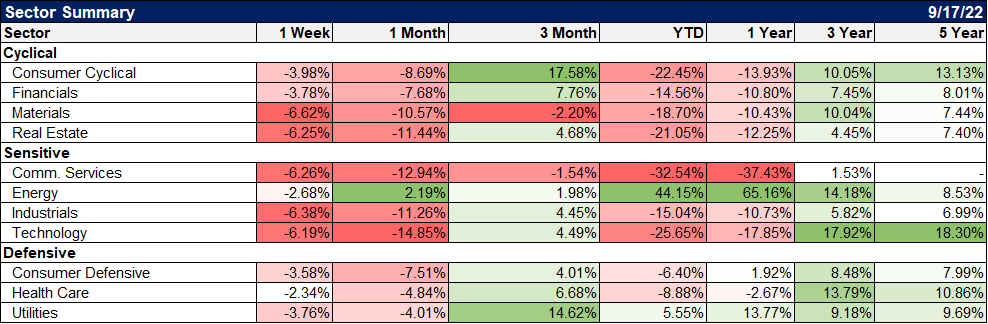

Energy and healthcare went down the least last week. I remain wary of the energy stocks as crude doesn’t seem to have found a bottom yet. By the way, on crude, the super backwardation that started with the Russian invasion of Ukraine, has been fully reversed. The spread was around $20 between spot and 6 months out at the peak. The spread between the October and November futures is now just $0.37 which is well within normal. The spread to the March contract is still $4 so it is still somewhat elevated. By the way, the fact that we are still in backwardation would tend to discount demand destruction as a cause of the drop in crude prices. If that were the case, we would see the curve slip into contango and we are a long way from that.

Looking again at 3 month returns we see a perfect encapsulation of the confusion that reigns in this market. The two best performers are Cyclicals (which do best when the economy is recovering) and utilities (which perform best when the economy is worsening).

I am still watching credit spreads for signs of stress and still not finding it. Spreads have widened ever so slightly over the last few weeks but aren’t anywhere near the levels we associate with fear of recession.

Past markets and economies can sometimes offer insight to the present situation. But looking at history should also warn you that getting the macroeconomic picture right is only a part of the investing puzzle. Markets don’t move in predictable ways based strictly on the economic data. Markets move because of emotion and there is no manual when it comes to human behavior. The only things that are constant in markets are fear and greed. Investors will always be hiding under the table at the bottom and swinging from the chandelier at the top.

Reading sentiment is much more art than science though and probably more abstract than landscape. Today, sentiment is very much like it was in June when stocks hit their lows. Put/call ratios are high, portfolio managers’ allocation to stocks is very low and speculators are very short the S&P 500 futures, all things contrarians love to see. Last week’s selloff seemed like a lot of people just giving up. It wasn’t panicky – the VIX never cracked 30 – but it was persistent.

Sentiment could still get more negative I suppose but everyone is already looking for bad news. The bigger risk now might be that something positive happens, although I’m hard pressed to say what it might be. Of course, that is always true at bottoms and this one will be no different.

More By This Author:

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more