Weekly Forex Forecast - Sunday, Sept. 15

Image Source: Pixabay

Fundamental Analysis & Market Sentiment

I previously wrote on Sunday, Sept. 8 that the best trade opportunities for the week were likely to be:

- Long of the EUR/USD currency pair following a bullish daily close above $1.1066. This did not set up.

- Long of gold in US dollar terms following a daily close above $2,525. This set up at Thursday's close, and the price rose by 0.78%.

- Short of the USD/JPY currency pair.

- Short of the 2-year US Treasury yield.

Last week’s key takeaways were:

- US CPI data: The headline rate dropped from 2.9% annualized to 2.5%, as expected, but the Core CPI came in a fraction higher than expected, which lowered expectations of a 0.50% rate cut and temporarily boosted a formerly weak US dollar.

- US PPI: Like the CPI data, this was a fraction higher than expected, showing a month-on-month increase of 0.2% when only 0.1% was anticipated. This also strengthened the case against a deep rate cut.

- European Central Bank Main Refinancing Rate and Monetary Policy Statement: The ECB cut its Official Rate from 4.25% to 3.65%, as expected.

- UK GDP: This came in notably lower than expected, showing no month-on-month increase when an increase of 0.2% was anticipated.

- US Unemployment Claims: This came in as expected.

- UK Unemployment Claims (Claimant Count Change): this was considerably better than expected.

The Week Ahead: Sept. 16-20, 2024

It will be a busier week ahead in terms of data, and it includes three central bank policy releases, including in the US, so it will be an important week to monitor. The week's notable events include the following:

- US Federal Funds Rate / Economic Projections / FOMC Statement

- Bank of Japan Policy Rate and Monetary Policy Statement

- UK Official Bank Rate and Monetary Policy Summary

- UK CPI (inflation)

- Canadian CPI

- US Retail Sales

- US Unemployment Claims

- UK Retail Sales

- Canada Retail Sales

- New Zealand GDP

- Australian Unemployment Rate

Monthly Forecast for September 2024

(Click on image to enlarge)

I forecasted that the EUR/USD currency pair would rise in value during September. The performance of my forecast so far is as follows:

Weekly Forecast for Sunday, Sept. 15, 2024

I made no forecast last week, as there was no large group of currency crosses with unusually large directional movement, which is the basis of my weekly trading strategy.

This week, I once again will not give a weekly forecast, as there were no unusually large price fluctuations in any currency crosses.

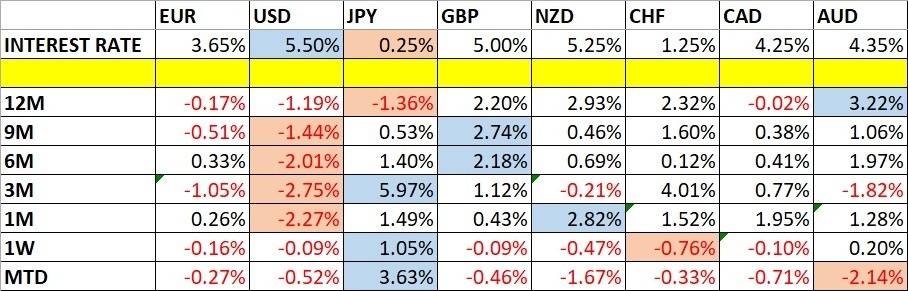

Directional volatility in the Forex market fell last week, as only 22% of the most important currency pairs and crosses fluctuated by more than 1%. During this period, the Japanese yen was the strongest major currency, while the Swiss franc was the weakest.

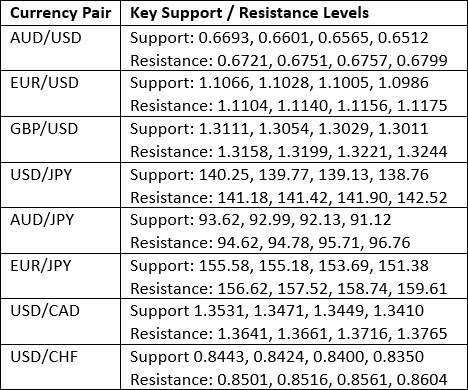

Key Support/Resistance Levels for Popular Pairs

Technical Analysis - US Dollar Index

Last week, the US Dollar Index printed a bearish inside candlestick, which was also a pin bar, suggesting the price is more likely to fall than rise over the coming week. The price is below its levels three and six months ago, suggesting a long-term bearish trend may lie in the greenback. Recently, the price broke down below the long-term consolidating triangle pattern, which was a significant bearish sign.

The overall picture is bearish, but the price will likely consolidate until next Wednesday's US Federal Reserve policy meeting. Analysts are evenly split as to whether the Fed will cut rates by 0.25% or by 0.50%, meaning that whatever happens, the US dollar will likely react.

This week, I am cautiously bearish on the US dollar due to the bearish trend and price action.

(Click on image to enlarge)

EUR/USD

I expected the EUR/USD currency pair to have potential support at the $1.1005 level.

The H1 price chart below shows how the price action rejected this support level with a small hourly pin bar, marked by the upward arrow. This rejection occurred just after the start of the overlap of the London/New York sessions, which can often be a great time for reversals such as these in the US dollar. So far, this trade made a profit of slightly less than 4 to 1.

The US dollar remains within a long-term bearish trend, but the euro is not strong enough to drive this pair's price higher. Instead, we have seen continuing, deep retracements from the long-term high made just a few weeks ago.

(Click on image to enlarge)

GBP/USD

I expected the GBP/USD currency pair to have potential support at the $1.3011 level.

The H1 price chart below shows how the price action rejected this support level with an inside bar, marked by the upward arrow. This rejection similarly occurred during the overlap of the London/New York sessions. This trade made a maximum profit so far of more than 3 to 1.

(Click on image to enlarge)

USD/CHF

I expected the USD/CHF currency pair to have potential support at the $0.8424 figure.

The H1 price chart below shows how the price action rejected this support level with a large hourly pin bar, marked by the upward arrow. This rejection occurred during Wednesday's Asian session, which is not typically optimal for reversals in the US dollar. However, the price action was strongly indicative that a reversal was happening. This trade made a maximum profit of approximately 7 to 1 so far.

The US dollar remains in a long-term bearish trend, but the Swiss franc lost much of its strength last week and was not able to drive the price to even lower long-term lows.

(Click on image to enlarge)

USD/JPY

The USD/JPY currency pair continues to be at the heart of the modern Forex market, and it still shows a high range of volatility.

The yen was once again the strongest of all major currencies last week. There are two good reasons for the strength of the Japanese yen:

- There is increasing fear in the market of recession, especially in the US, which has caused a run to safe havens. As the US dollar is seeing rate cuts in its monetary policy, the number one choice for a safe currency is now the Japanese yen—of course, there is a policy divergence between the Bank of Japan (likely to hike rates) and the Federal Reserve (likely to cut rates).

- The Bank of Japan has decisively shifted away from its former ultra-loose monetary policy after years of negative interest rates, which has prompted a belief that the yen will continue to advance.

Last week's candlestick was bearish—it was not very large, but the price closed relatively near the low of its range. It was the lowest weekly close seen in more than one year, and the price almost made an even longer-term low.

Despite these factors, bears may need some caution, as the price did seem to bounce near a long-term low and near a big, round number at JPY140. I see this currency pair as a sell, but only following a daily (New York) close below the JPY140 mark.

(Click on image to enlarge)

XAU/USD

Last week, I wrote that gold was in a long-term bullish trend and remained near its recently made all-time high. I thought the next move might be bearish, but I also said to watch out for the price turning decisively bullish, which decisively took out the record high. This was a good call, as entering long after the decisive bullish breakout yielded some easy profit at the end of last week.

This was a good illustration that when the price action rejects a high several times without making a deep, bearish move, the price will most likely make a strong, bullish breakout. This is exactly what happened here.

It is hard to say exactly why gold is advancing to new record highs. I am never convinced that gold has a special function. It tends to operate as a risk-on asset, and it has historically been positively correlated with major equity indices.

Gold is advancing strongly beyond a former area of resistance at a major round number ($2,500) into blue sky territory, so there is every reason to still see it as a buy. The size of the weekly candlestick and the lack of any meaningful upper wick are additional bullish signs.

(Click on image to enlarge)

US 2-Year Treasury Yield

Some CFD brokers offer trading in US Treasury Yields, and traders with larger bankrolls can access this asset through the CME micro futures market. Treasury yields can be great for trend traders, as they have historically tended to trend very reliably.

The continuing slowdown in the US economy, lower inflation, and increasing fears of a recession in the US have all combined to push expectations of the Federal Reserve in an increasingly dovish direction. This has pushed short-term (2-year) treasury yields lower and lower. This remains the case even though US inflation and PPI data last week were stronger than usual, moving markets to be evenly split between a 0.25% or a 0.50% rate cut this week.

The weekly price chart below shows that the yield fell again last week, marking its lowest weekly close in two years.

The downside over the coming week will depend mostly upon whether the Fed decides to cut by 0.50% or 0.25% -- if it is the bigger cut, the yield will likely fall strongly. However, it is worth remembering that "accidents tend to happen along the line of least resistance." I see the 2-year US treasury yield as a sell.

(Click on image to enlarge)

Bottom Line

I see the best trading opportunities this week as:

- Short of the USD/JPY currency pair following a daily close below JPY140.

- Long of gold in US dollar terms.

- Short of the 2-year US Treasury yield.

More By This Author:

BTC/USD Forex Signal: $55,724 Looks Pivotal TodayWeekly Forex Forecast - Sunday, Sept. 8

BTC/USD Forex Signal: First Signs Of Support After Selloff

Risk Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more