Weekly Forex Forecast - Sunday, May 18

Image Source: Pixabay

Fundamental Analysis & Market Sentiment

I previously wrote on Sunday, May 11, 2025 that the best trades for the week would be the following:

- Long of gold following a daily (New York) close above $3,432. This did not set up.

- Long of Bitcoin following a daily (New York) close above $106,187. This did not set up.

- Short of the USD/MXN currency pair. The price fell by 0.22% over the week.

The overall win of 0.22% translates to a win of 0.07% per asset.

Last week saw slightly lower-than-expected US inflation, while PPI, another inflation indicator, came in much lower than was expected.

There has also been continued progress by the US in drumming up new trade and trade deals to replace proposed tariffs, notably the memorandums signed by Saudi Arabia, Qatar, and the UAE, which the Trump administration claims will be worth something like $1.8 billion to the US economy, although the size is disputed.

We have seen a continued improvement in stocks and in some commodities too, while the US has bucked its long-term bearish trend for another week, moving a bit higher.

Last week’s most important data releases were as follows:

- US CPI (inflation) – this unexpectedly fell from 2.4% to 2.3%.

- US PPI – this was expected to show a 0.2% increase on the month, but it fell by 0.5%, suggesting deflationary pressure.

- US Preliminary UoM Inflation Expectations – contradictorily, this moved higher.

- US Preliminary UoM Consumer Sentiment Expectations – this came in lower than expected.

- UK GDP – this came in slightly higher than expected, showing a 0.2% increase on the month when no change was expected.

- Australia Wage Price Index – this came in a fraction higher than expected.

- US Unemployment Claims

- UK Claimant Count Change (Unemployment Claims)

The Week Ahead: May 19-23, 2025

The coming week has a less important schedule of high-impact data releases. The week’s important data points, in order of likely significance, are as follows:

- UK CPI (inflation)

- RBA Cash Rate & Rate Statement

- Canada CPI (inflation)

- USA, Germany, UK, France Flash Services / Manufacturing PMI

- UK Retail Sales

- Canada Retail Sales

- US Unemployment Claims

The most impactful events on the Forex market will likely be the RBA policy meeting, followed by the two items of inflation data.

Monthly Forecast for May 2025

(Click on image to enlarge)

For the month of May 2025, I did not provide a monthly forecast. Although there was a long-term trend against the US dollar, the price action suggested that a major bullish reversal could be underway.

Weekly Forecast for Sunday, May 18, 2025

As there were no unusually large price movements in Forex currency crosses over the past week, I will not provide a weekly forecast.

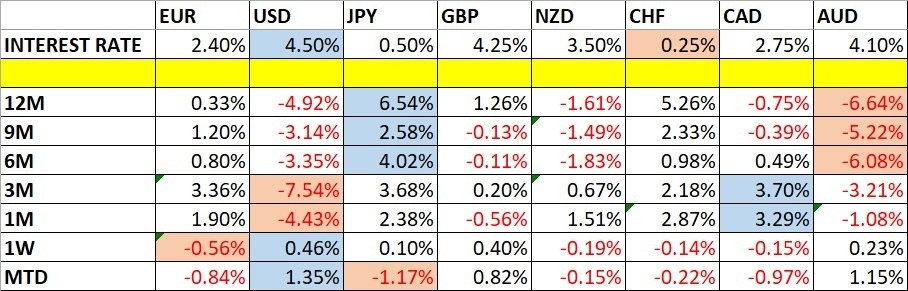

The US dollar was the strongest major currency last week, while the euro was the weakest, although their values were relatively low. Volatility decreased again during this time, as not a single one of the most important Forex currency pairs and crosses changed in value by more than 1%. Next week’s volatility is likely to remain relatively low.

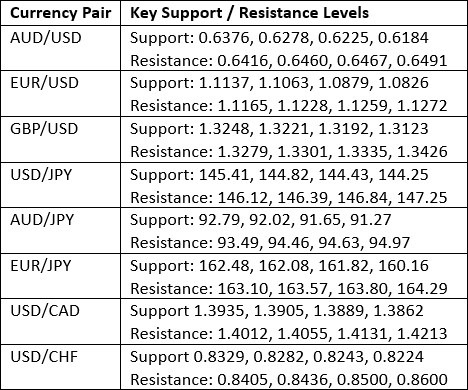

Key Support/Resistance Levels for Popular Pairs

Technical Analysis - US Dollar Index

Last week, the US Dollar Index printed a candlestick which closed higher for the fourth week in a row. However, the candlestick has a large upper wick and looks a little like a bearish pin bar after rejecting the resistance level at 100.88.

The price reached a new four-year low four weeks ago before bouncing strongly off the support level shown in the price chart below, at 97.67. As the rise has continued, these are bullish signs, but the long-term bearish trend is a bearish sign, and this rise seems to be running out of momentum

It is hard to say what will happen to the US dollar next week after this bullish bounce, but trading in line with the long-term trend would be short of the greenback. If there is short-term bearish momentum, you might be more confident in going short here. If the price remains below the 100.88 mark that would be another bearish sign.

(Click on image to enlarge)

The Nasdaq 100 Index

The Nasdaq 100 Index rose firmly last week as risk-on sentiment continued to solidify, helped by pledges from Qatar, Saudi Arabia, and the UAE to complete large trade agreements with the US.

This rise puts the price well above the 200-day moving average, as can be seen in the daily chart below. The price ended the week near the high of the week, which is a bullish sign, although momentum faded at the end of the week. The price closed only 800 points from the all-time high which this index made in February.

The outlook is certainly more bullish. I would be very happy to go long of this Index in the unlikely event that we get a daily close above the 22,161 mark.

The Nasdaq 100 index is worth considering seriously on the long side as it has such an amazingly good record of positive returns since the Index was created in the 1980's, easily beating broader US indices such as the S&P 500.

(Click on image to enlarge)

The S&P 500 Index

The S&P 500 Index rose firmly last week as risk-on sentiment continued to solidify, as previously mentioned.

This rise puts the price well above the 200-day moving average, as can be seen in the daily chart below. The price ended the week near the high of the week, which is a bullish sign. Another bullish sign is that the price was still rising on the last couple of days of last week, unlike the Nasdaq 100 Index. The price closed only about 200 points from the all-time high which this index made in February.

The outlook is certainly more bullish. I would be very happy to go long of this Index in the unlikely event that we get a daily close above the 6,142 figure.

(Click on image to enlarge)

Bitcoin

Bitcoin spent the week consolidating, but you can take a look at the daily price chart below to see just how bullish that consolidation was. The price has clearly held up neatly from the $102,750 area. As I write, the price looks like it might be heading for a significant bullish breakout right now, which I would describe as the area above $105,000.

Despite this bullish outlook, it is worth nothing that the highest daily closing price should still be exceeded before entering a new long trade here, and that is further ahead at $106,187. Some traders will want to be even more cautious and wait for a new absolute high to be made above the $109,000 mark or even for the price to clear the more significant, round number above that at $110,000.

It is hard to say why Bitcoin is suddenly now looking so bullish; apart from the continually improving risk-on sentiment which is dominating markets right now. I will enter a new long trade if we get a daily (New York) close above the $106,187 level this week.

(Click on image to enlarge)

USD/ZAR

The USD/ZAR currency pair looks very heavy as it sits on the support level at 18.0159, which seems to be the only thing which is preventing the price from making a very significant bearish breakdown to new five-month low prices.

The daily candlestick chart below shows we are experiencing quite bearish price action, suggesting there will be a breakdown. There are no support levels in sight for a long way down, so we might see such a breakdown produce a significant drop, potentially making a short trade attractive.

The US dollar has become more attractive as we get progress on trade deals mitigating Trump’s tariffs, while the South African rand is plagued by the weaknesses inherent to the South African economy, not to mention South Africa’s relatively poor standing with the US Presidency and Congress.

I would be happy to enter a short trade once we get a daily (New York) close below the 17.98 mark, targeting the support level at 17.62.

(Click on image to enlarge)

Bottom Line

I see the best trades this week as the following:

- Long of the Nasdaq 100 Index following a daily (New York) close above 21,161.

- Long of the S&P 500 Index following a daily (New York) close above 6,142

- Long of Bitcoin following a daily (New York) close above $106,187.

- Short of the USD/ZAR currency pair following a daily (New York) close below 17.98.

More By This Author:

Forex Today: Markets Drifting Ahead Of Key US DataForex Today: US Inflation Lower At 2.3%, Boosting Stocks

BTC/USD Forex Signal: Retreated From Challenge To Highs

Risk Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more