Weekly Forex Forecast - Sunday, March 2

Image Source: Unsplash

Fundamental Analysis & Market Sentiment

I previously wrote on Sunday, Feb. 23, 2025 that the best trade opportunities for the week were likely to be the following:

- Long of the S&P 500 Index following a daily close above the 6141.60 mark. This did not set up.

- Long of gold in US dollar terms. Unfortunately, gold fell by 2.78% over the week.

- Long of corn futures following a daily close of the next ZC future at or above the 502 mark. This did not set up.

The weekly loss of 2.78% equals 0.93% per asset. Meanwhile, last week saw several data releases that affected the Forex market. These data releases included the following:

- US Core PCE Price Index – this showed a 0.3% month-on-month increase as expected.

- US Preliminary GDP – this showed an annualized rate of 2.3% as expected.

- German Preliminary CPI – this showed a 0.4% month-on-month increase as expected.

- German Federal Election Result – this release announced that the CDU will lead the next government, without the AfD, which is no surprise.

- Australia CPI – the Australian inflation rate came in a tick lower than expected, showing an annualized rate of 2.5%, which helped weaken the Aussie over the rest of the week.

- Canadian GDP – this came in a tick lower than expected, showing a month-on-month increase of only 0.2%.

- US Unemployment Claims – this was a bit higher than expected.

Additionally, last week’s key takeaways were as follows:

- It was a bad week for stock markets, especially in the US, where major indices dropped sharply enough to shake out trend followers from long positions, with institutions either reducing or eliminating their exposure. Friday saw some gains, however. Many analysts see global equity markets facing headwinds from the Trump administration’s tariff threats plus other factors. It may also be that the global rally in equities is simply overbought and due for a major correction. However, the Atlanta Fed revised its GDP data to -1.5% on Friday, which may be a blip, or might be the first sign of an impending recession in the US.

- Market sentiment has shifted firmly into risk-off mode, with commodities and commodity currencies taking a serious beating. Even gold, which had been holding up relatively well, suffered a serious decline,

- In the Forex market, commodity currencies are very weak, and the euro is also looking weaker. The Japanese yen and US dollar are currently strong, with the British pound also showing some relative strength.

- Economic data releases last week were not the major story, and they had little impact.

The Week Ahead: March 3-7, 2025

The coming week has a similarly heavy schedule of releases, so we are likely to see a similar level of activity and volatility in the Forex market. The coming week’s significant data points, in order of likely importance, are as follows:

- US Average Hourly Earnings

- ECB Main Refinancing Rate & Monetary Policy Statement

- US Non-Farm Employment Change

- US ISM Services PMI

- US ISM Manufacturing PMI

- Australian GDP

- Swiss CPI (Inflation)

- US Unemployment Claims

- US Unemployment Rate

- Canadian Unemployment Rate

It should be noted that Monday is a public holiday in Japan.

Monthly Forecast for March 2025

(Click on image to enlarge)

For the month of February of 2025, I forecasted that the EUR/USD currency pair would decline in value. The final performance of that forecast is shown below.

For the month of March 2025, I will not provide a forecast due to the lack of clear trends in the market.

Weekly Forecast for Sunday, March 3, 2025

Last week, I forecasted that the following currency pairs would rise in value over the trading period:

- CAD/JPY – this fell by 0.83%

- EUR/JPY – this rose by 0.07%

This was not a profitable call. This week, I forecast that the following currency cross will fall in value:

- GBP/NZD

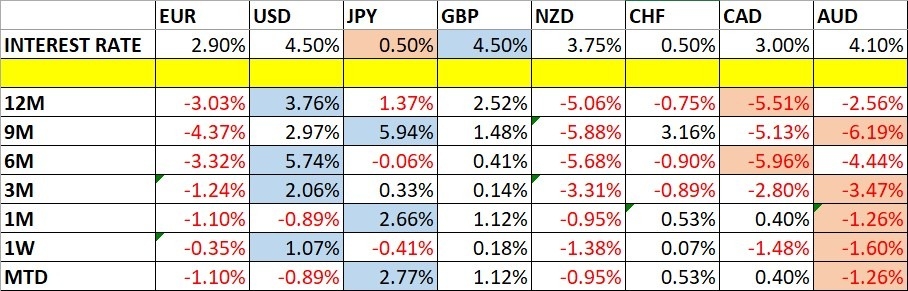

The US dollar was the strongest major currency last week, while the Australian dollar was the weakest, putting the AUD/USD currency pair in focus. Volatility increased over the trading period, as only 41% of the most important Forex currency pairs and crosses changed in value by more than 1%. Volatility is likely to remain at a similar level over the coming week.

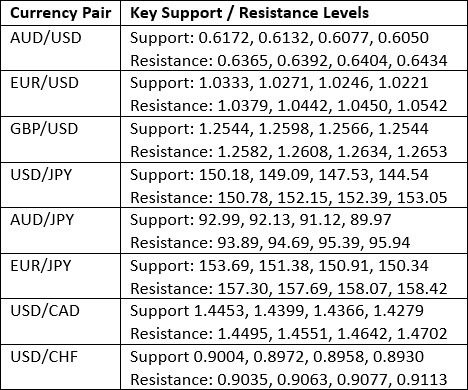

Key Support/Resistance Levels for Popular Pairs

Technical Analysis - US Dollar Index

Last week, the US Dollar Index printed a strongly bullish candlestick, completely engulfing the previous week’s candlestick and closing near the high of its range. Last week’s low was near a supportive confluence area.

The long-term trend is once again bullish, as the price is above its levels from both three and six months ago. The short-term momentum is also bullish.

Global markets have entered a strongly risk-off mode, which should also benefit the greenback. If there is any solid opportunity to be found in the market right now, it is likely to involve being long of the US dollar.

(Click on image to enlarge)

EUR/USD

The EUR/USD currency pair printed a fairly large bearish engulfing weekly candlestick, as it closed near its low. The euro itself is in a weak long-term bearish trend, while the US dollar is now back in a long-term bullish trend.

While there are seemingly good reasons to be bearish here, we are not seeing a technically significant price breakdown yet. For that to happen, I would want to see the price trading below the big quarter number at the $1.0250 mark.

If you have faith that the US will shortly hit the EU hard with new import tariffs, you might have a stronger reason to be short of the euro. If you are going to be long of the US dollar in the Forex market right now, the commodity currencies such as the Australian dollar, the New Zealand dollar, and the Canadian dollar are probably the best currencies to use on the short side.

(Click on image to enlarge)

AUD/USD

The AUD/USD currency pair printed a large bearish engulfing weekly candlestick, as it closed near its low. The Aussie is the weakest major currency, being hit hard by the dominant risk-off sentiment as a key risk barometer and commodity/exporting currency, while the US dollar is now back in a long-term bullish trend.

While there are seemingly good reasons to be bearish here, we are not seeing a technically significant price breakdown yet. For that to happen, I would want to see the price trading below the big quarter number at the $0.6132 mark.

Trends in this currency pair have historically been unreliable, but if you are convinced that the world is on the brink of an economic slowdown, being short of this currency pair could be an excellent move.

(Click on image to enlarge)

USD/CAD

The USD/CAD currency pair printed a large bullish weekly candlestick, as it closed near its high. The Loonie is similarly one of the weakest major currencies, being hit hard by the dominant risk-off sentiment as a key risk barometer and commodity/exporting currency, while the US dollar is now back in a long-term bullish trend.

Another reason for the Canadian dollar’s weakness is that the imposition of a 25% tariff on its imports to the US is back on the table and due on July 2, according to President Trump. If this position does not change, we can expect this currency pair to break out to reach a new multi-year high price by then.

While there are seemingly good reasons to be bullish here, we are not seeing a technically significant price breakout yet. For that to happen, I would want to see the price trading above the $1.4551 mark.

Trends in this currency pair have historically been unreliable, but if you are convinced that the Trump tariff is really going to happen next month, being long of this currency pair could be an excellent move.

(Click on image to enlarge)

Bottom Line

I see the best approach this week as staying out of the market and just getting money market interest from cash, as markets are in deep retracements but have not yet achieved stable trend reversals. Being involved in the US dollar should be a good move, generally.

More By This Author:

Forex Today: Fresh Trump Tariff Talk Sends Crude Oil To 2025 Low

Forex Today: Markets Stabilize After Selloff

AUD/USD Forex Signal: Bearish Price Channel On Risk-Off Sentiment

Risk Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more