Watch Out For Bull Trap Via Wyckoff Upthrust In S&P 500

Image Source: Unsplash

Based on the Wyckoff trading method, S&P 500 is approaching the axis line and the bulls need to watch out for potential Wyckoff upthrust at these key levels as a bull trap.

Watch the video below to find out the direction for long-term, medium, and immediate short-term for S&P 500 and formulate your trading plan accordingly.

Video Length: 00:08:59

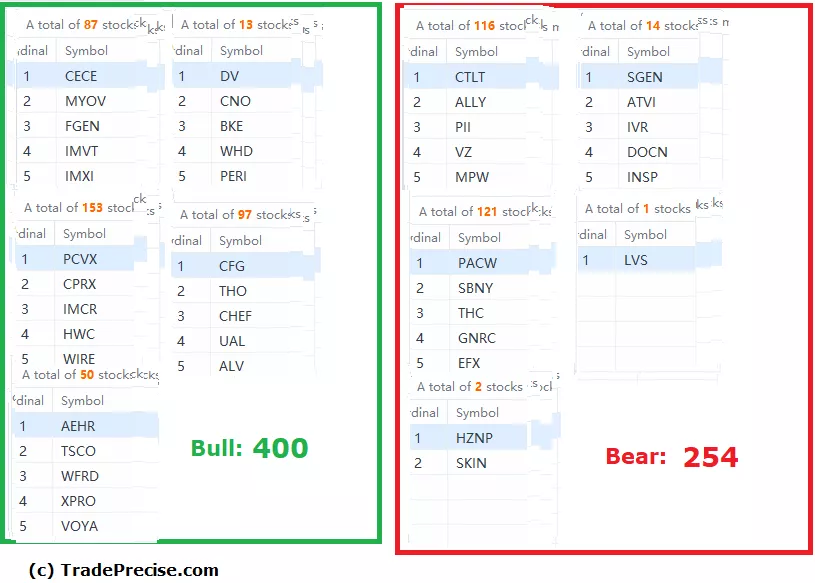

The bullish setup vs. the bearish setup is 400 to 254 from the screenshot of my stock screener below.

The bullish divergence in the market breadth created the condition for an attempt to rally in the past 3 weeks. Yet, it is essential to understand the context of the market structure and context to pinpoint the direction for a different timeframe that suits you.

More By This Author:

Does Chevron Still Have Fuel For Bull Run?

Has Coca-Cola (KO) Bull Run Finally Fizzled Out?

Will Amazon Succumb To The Pressure Of Bears?

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.