Walking On Sunshine

S&P 500 did really well through quad witching, and the same goes for credit markets. 4-day streak of non-stop gains – very fast ones. Short squeeze characteristics in the short run, make me think this rally fizzles out before the month ends – 4,600 would hold. We‘re likely to make a higher low next, and that would be followed by 4-6 weeks of rally continuation before the bears come back with real force again. July would present a great buying opportunity in this wild year of a giant trading range.

As I wrote yesterday:

(…) The paper asset made it through quad witching in style – both stocks and bonds. The risk-on sentiment however didn’t sink commodities or precious metals. Wednesday’s FOMC brought worries over the Fed sinking real economic growth but Powell’s conference calmed down fears through allegedly no recession risks this year, ascribing everything to geopolitics. Very convenient, but the grain of truth is that the Fed wouldn’t indeed jeopardize GDP growth this year – that’s the context of how to read the allegedly 7 rate hikes and balance sheet shrinking this year still. Not gonna happen as I stated on Thursday already.

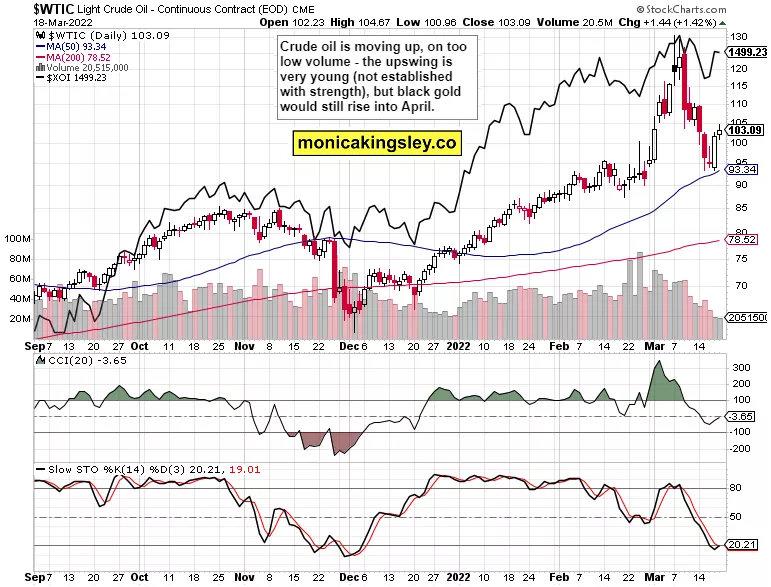

Such are my short- and medium-term thoughts on stocks. Copper remains best positioned to continue rising with relatively little volatility while crude oil isn‘t yet settled (its good times would continue regardless of the weak volume rally of the last two days, which is making me a little worried). Precious metals are still basing and would continue moving higher best on the Fed underperforming in its hawkish pronouncements. No way they‘re hiking 7 times this year and shrinking the balance sheet at the same time as I wrote on Thursday – Treasury yields say they‘ll take on inflation more in 2023. 2022 is a mere warm-up.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 is now past the 4,400 – 4,450 zone and hasn‘t yet consolidated. This week would definitely though not be as bullish as the one just gone by – the bulls will be challenged a little.

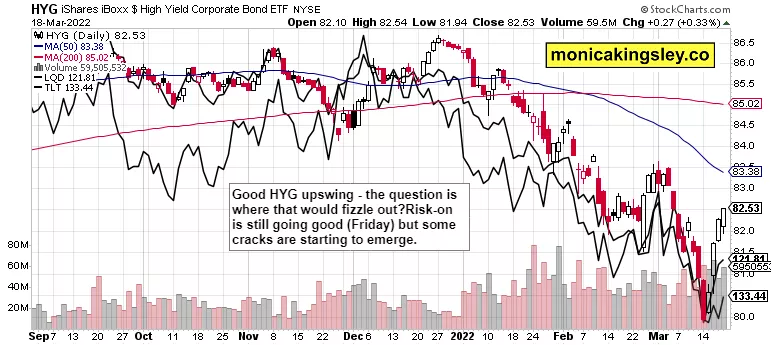

Credit Markets

HYG eked out more gains, but the air is slowly becoming thinner. As the sentiment turns more bullish through no deep decline over the coming few days, that‘s when junk bonds would start wavering.

Gold, Silver, and Miners

Precious metals aren‘t turning down for good here – I think they‘re deciphering the Fed story of hiking slower than intended, which in effect gives inflation a new lease on life. Not that it was wavering, though. More upside in gold and silver to come.

Crude Oil

Crude oil is rising again but look for a measured upswing that‘s not free from headwinds. While I think we would climb above $110 still, I‘m sounding a more cautious note given the decreasing volume – I would like to see more conviction next.

Copper

Copper is behaving and would continue rising reliably alongside other commodities. It‘s also the best play considering downside protection at the moment.

Bitcoin and Ethereum

Bitcoin isn‘t recovering from Sunday‘s setback – but the Ethereum upswing bodes well for risk-taking today, even that doesn‘t concern cryptos all too much.

Summary

S&P 500 has a bit more to run before running into headwinds, which would happen still this week. Credit markets are a tad too optimistic, and rising yields would leave a mark, especially on tech. Value, energy, and materials are likely to do much better. Crude oil is bound to be volatile over the coming weeks, but still rising and spiking – not yet settled. Copper and precious metals present better appreciation opportunities when looking at their upcoming volatility. Within today‘s key analysis, I‘ve covered the path of stocks, so do have a good look at the opening part. Finally, cryptos likewise paint the picture of risk-on trades not being over just yet.

Subscriber to Monica‘s Insider Club for trade calls and intraday updates. more