Volatility’s Taking A Holiday

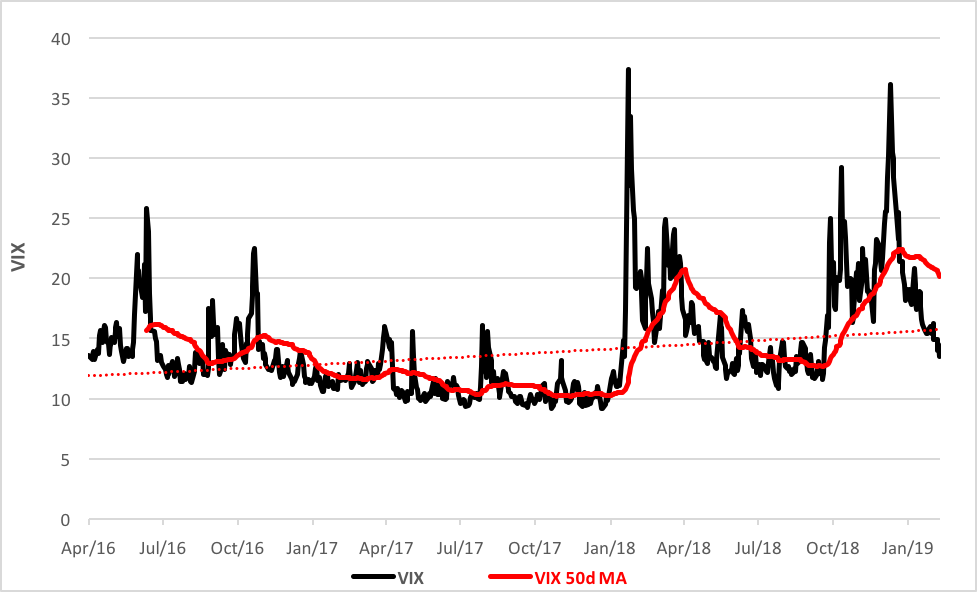

The U.S. stock market seems to have recovered from last year’s not-so-jolly Christmas meltdown (see: “What, Me Worry?”). Well, not FULLY recovered. There’s still some climbing to do to attain 2018’s high point again, but the market’s regularly finding sturdy footholds. And during the ascent, market volatility’s been waning. Notice the last spike in the Cboe Volatility Index (VIX) in the chart below. After peaking on December 24 at 36, VIX has been on a pretty-much-uninterrupted slide. At last look, the so-called “fear index” was under 14.

(Click on image to enlarge)

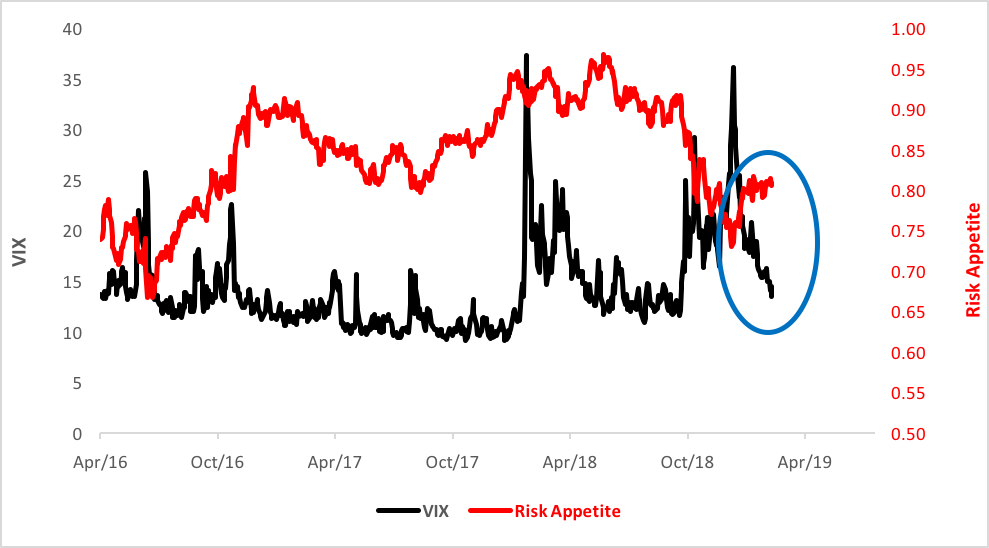

You’d think, then, that investors would be grabbing stocks with relish, risk be damned. After all, risk appetite has risen in the past whenever VIX slumped. And, to be sure, investors’ taste for risk was piqued in January but now it’s mired despite a continuing slide in VIX. This paradigm is highlighted by the blue oval in the chart below.

(Click on image to enlarge)

Are investors a little gunshy now? Have punters learned something about volatility over the past year?

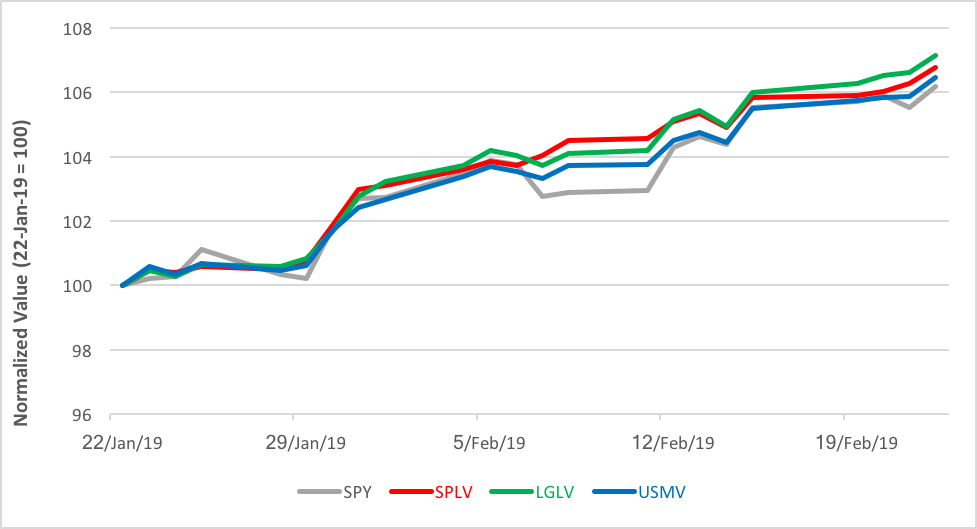

You’d think so if you look at the three largest low-volatility ETFs targeting the large-cap market. Over the past month, these ETFs outperformed the SPDR S&P 500 ETF (NYSE Arca: SPY), a proxy for the cap-weighted blue-chip index. SPY gained 6.2 percent over the last 30 days.

(Click on image to enlarge)

The Invesco S&P 500 Low Volatility ETF (NYSE Arca: SPLV) tracks 100 of the least volatile stocks in the S&P 500, a strategy that aims simply to tamp down beta. Over the past month that paid off in a 6.8 percent advance.

Taking a more complex approach, the iShares Edge MSCI Minimum Volatility USA ETF (NYSE Arca: USMV) relies on correlation and other constraints to optimize a "minimum variance" portfolio. The 30-day result? An increase of 6.5 percent.

Drawing its components from the Russell 1000, the SPDR SSgA US Large Cap Low Volatility ETF (NYSE Arca: LGLV) screens its portfolio for factors such as momentum and beta, among others. Holders were rewarded with a 7.2 percent boost over the past month.

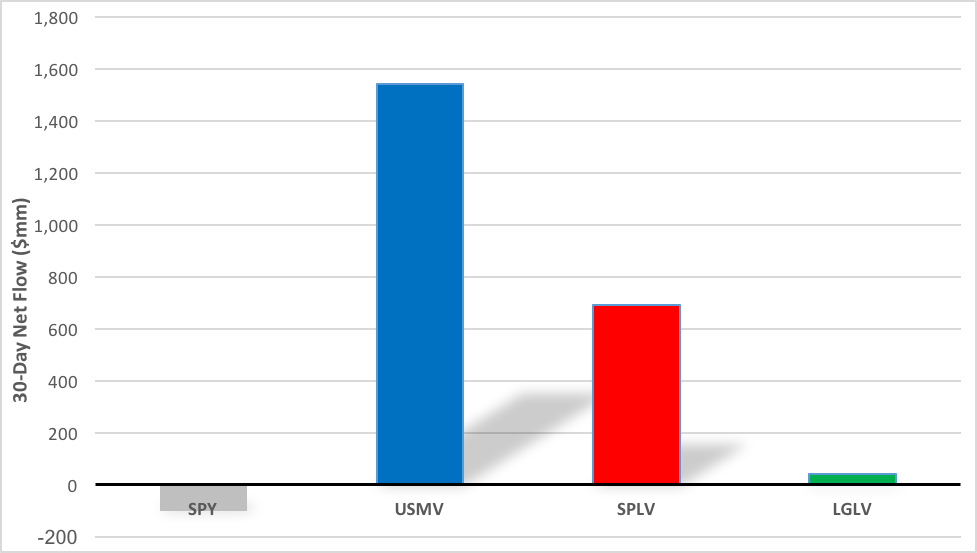

Returns don’t tell the whole story, though. Net flows—creations and redemptions—inform us of demand for ETF shares. Over the past month, all three of the low-vol ETFs have enjoyed net inflows. And the SPY fund? A net outflow.

(Click on image to enlarge)

So, have investors learned something about protecting their portfolios against the ravages of volatility? This seems to indicate that at least some investors have been taking notes.

Disclosure: None.