USD/JPY Weekly Forecast: Strong Hopes For A BoJ Policy Shift

The USD/JPY weekly forecast is bearish as yen bulls applaud a possible BoJ policy shift. Moreover, the US CPI data weighed on the dollar too.

Ups And Downs Of USD/JPY

The Bank of Japan (BOJ) is rumored to be considering changing or perhaps abandoning its yield curve control (YCC) policy as soon as next week. This caused the dollar to decline to its lowest level versus the yen since late May. This speculation also caused 10-year government bond yields to rise above the central bank’s 0.5% cap momentarily.

The BOJ then intervened to declare two distinct rounds of emergency buying to drive the yield back down.

Expectations of a change from the ultra-loose policy intended to keep yields at or below zero have intensified in response to a newspaper report indicating the possibility of more flexibility.

The yen also rose due to easing US inflation that saw the dollar weaken across the board. Investors hope the Fed will ease up on its aggressive monetary policy by shifting to a quarter-point hike at the next meeting.

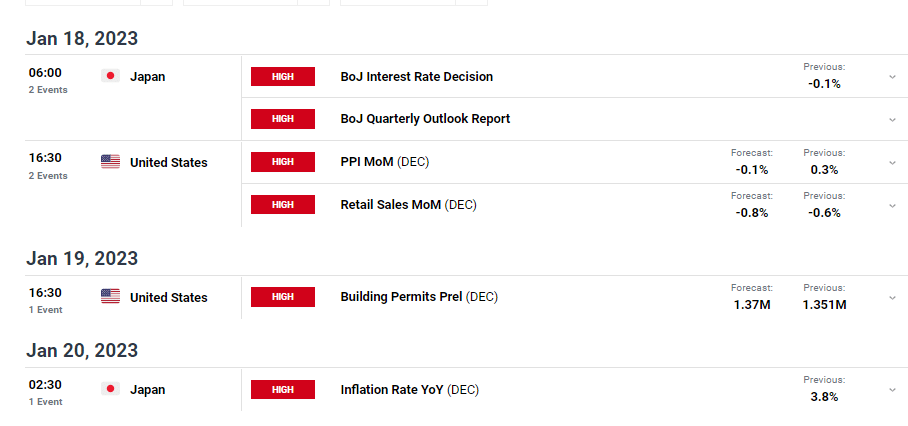

Next Week’s Key Events For USD/JPY

(Click on image to enlarge)

There will be inflation reports from the US and Japan next week. However, all focus will be on the BoJ meeting. There is growing speculation of a policy shift that could see the BoJ abandon its ultra-loose policy.

Although a rate hike next week looks improbable, Win Thin of Brown Brothers Harriman suggested that the BOJ might give up on the YCC to prepare for liftoff at the March or April meetings.

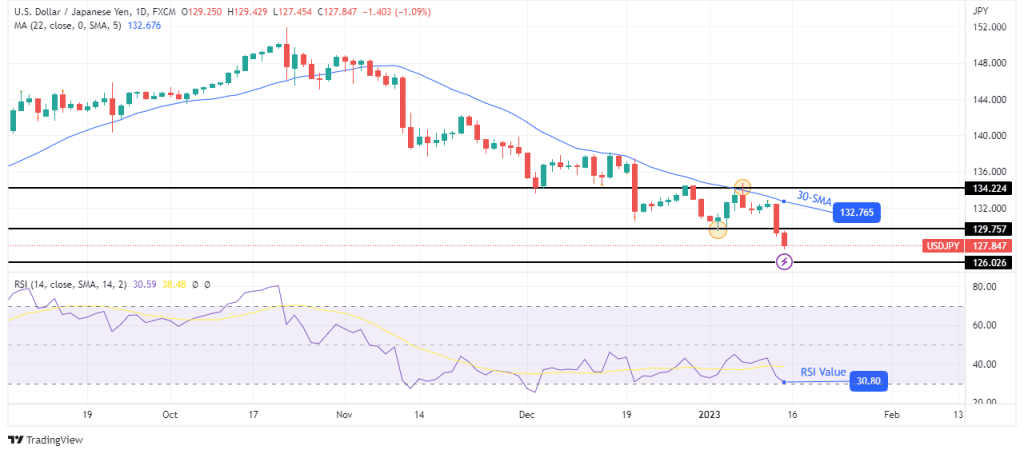

USD/JPY Weekly Technical Forecast: Bears Have The 126.02 Level In Their Sights

(Click on image to enlarge)

USD/JPY weekly forecast

The daily chart shows USD/JPY in a strong downtrend, with the price staying below the 22-SMA and respecting it as resistance. The price has consistently made lower lows and lower highs, showing bears are in control. The RSI has also not crossed above 50 since the downtrend began, another sign of strong bearish momentum.

This trend will likely continue in the coming week unless the price breaks above the 22-SMA. A continuation would mean retesting the 126.02 level and probably breaking below. The bearish bias will remain as long as the price trades below the 22-SMA, and the RSI stays below 50.

More By This Author:

EUR/USD Weekly Forecast: Euro Bulls Return On Easing US CPI

USD/CAD Forecast: Dollar Holds Steady Ahead Of US CPI

EUR/USD Forecast: Slow US Wage Growth Helping Buyers

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more