USD/CAD Forecast: Dollar Holds Steady Ahead Of US CPI

Today’s USD/CAD forecast is slightly bullish. The dollar generally stayed steady as traders awaited this week’s US consumer price figures to see if they would support the idea that inflation is on the decline.

Investors are paying close attention to the US CPI data after Fed Chair Jerome Powell failed to provide any policy hints during a panel discussion in Stockholm. Other Fed officials have stated that their future actions will depend on data.

According to Commonwealth Bank of Australia strategist Joe Capurso, the dollar’s downtrend would be further cemented if the core CPI showed another downward surprise.

“The US currency would ease further because another weak core CPI would encourage markets to continue shifting bets for the Fed’s February meeting from a 50 basis point hike to a 25bp increase.”

Although futures prices have been inconsistent, they now point to a 3/4 possibility of a 25 bp increase next month.

The world’s largest oil consumer, the US, unexpectedly built up its crude and fuel inventories on Wednesday, and economic uncertainty rekindled demand concerns, leading to a decline in oil prices. This hurt the Canadian dollar.

According to CMC Markets analyst Leon Li, the API estimates of US stockpiles have significantly increased, which has weighed down oil prices. Additionally, the short-term rally in oil prices is being restrained by the possibility of a recession.

USD/CAD Key Events Today

The price will likely consolidate ahead of tomorrow’s inflation report because neither the US nor Canada will release any significant economic data.

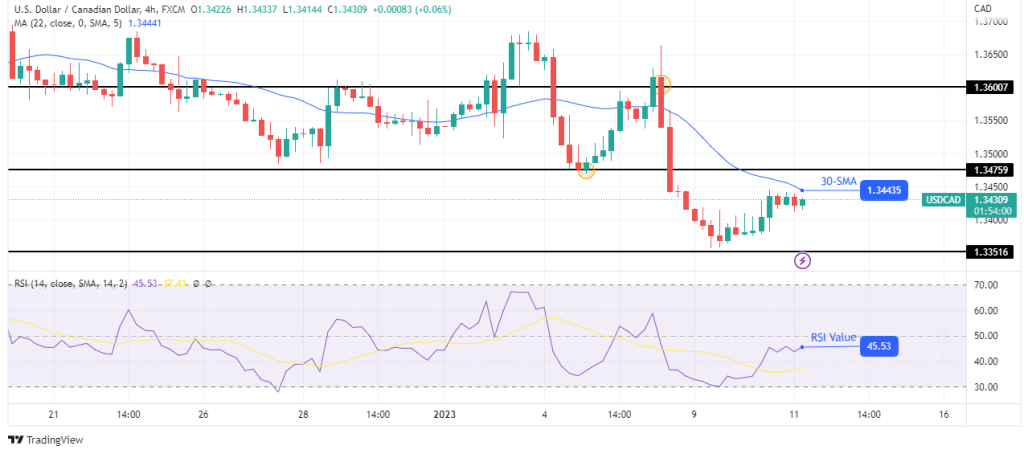

USD/CAD Technical Forecast: Consolidation Below The 30-SMA Resistance.

Looking at the 4-hour chart, we see USD/CAD trading close to the 30-SMA. This move is a pullback after a strong bearish leg in a downtrend. The downtrend is still intact as the price is trading below the 30-SMA, making lower lows and lower highs.

The downtrend will likely continue as the price has pulled back to a strong resistance zone comprising the 30-SMA and the 1.3475 resistance level. The next target for bears is at the 1.3351 support. Bulls can only take over if the price breaks above the resistance zone.

More By This Author:

EUR/USD Forecast: Slow US Wage Growth Helping BuyersUSD/JPY Weekly Forecast: Bears Dominating After BoJ Surprise

USD/CAD Weekly Forecast: Canada’s Eased Inflation To Weigh

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more