USD/JPY Weekly Forecast: Odds Of Cautious Fed In 2025

The USD/JPY weekly forecast suggests continued dollar strength as markets price a more gradual Fed next year.

Ups and downs of USD/JPY

The USD/JPY pair had a bullish week as the dollar soared on expectations of a very gradual Fed rate-cutting cycle in 2025. Data from the US on inflation this week revealed that price pressures accelerated in November. However, since the CPI came in line with expectations, it solidified bets for a December Fed rate cut. Nevertheless, markets lowered expectations for rate cuts in 2025, boosting the US dollar.

At the same time, the likelihood of a December BoJ rate hike fell as Japan’s economy remained fragile.

Next week’s key events for USD/JPY

(Click on image to enlarge)

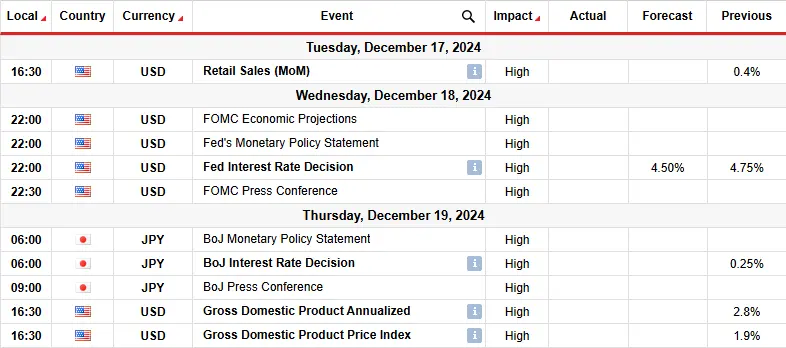

Next week, traders will watch the US retail sales report, the FOMC policy meeting, and the US GDP report. Meanwhile, in Japan, the BoJ will hold its policy meeting on Thursday.

The US sale report will come before the FOMC meeting. Therefore, the outcome will likely shape bets for the Wednesday policy meeting. Markets expect the Fed to cut interest rates by 25-bps. However, the focus will be on the messaging for future moves.

Meanwhile, the Bank of Japan might keep rates unchanged. However, traders will also watch the messaging to gauge the likely timing for the next rate hike.

USD/JPY weekly technical forecast: Bulls return with sights on the 156.53 resistance

(Click on image to enlarge)

USD/JPY daily chart

On the technical side, the USD/JPY price has broken above the 22-SMA, a sign that bulls are back in control. At the same time, the RSI has broken above 50 and now trades in bullish territory. Therefore, there has been a shift in sentiment to bullish.

The price was trading in a strong uptrend before pausing near the 156.53 resistance level. Here, bears resurfaced to reverse the trend by breaking below the 22-SMA. However, the decline met a solid support zone comprising the 149.02 key level and the 0.382 Fib retracement level. Here, bulls returned with renewed strength, pushing the price back above the 22-SMA.

Next week, USD/JPY will likely target the 156.53 resistance level. A break above this level would confirm a continuation of the bullish trend. Moreover, it will allow bulls to reach the 160.02 key level.

More By This Author:

GBP/USD Weekly Forecast: Dollar Soars on Fading Fed’s Cut

USD/CAD Outlook: Loonie Surges Amid BoC’s Cautious Tone

AUD/USD Forecast: Aussie Jumps As Jobs Data Surprises

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more