GBP/USD Weekly Forecast: Dollar Soars On Fading Fed’s Cut

The GBP/USD weekly forecast indicates a decline in 2025 Fed rate cut expectations, which is supporting the greenback.

Ups and downs of GBP/USD

The GBP/USD pair had a bearish week as the dollar soared on rate-cut expectations and the pound fell due to downbeat economic data. Notably, markets absorbed US inflation data showing an increase in price pressures that was in line with estimates. The report also showed that inflation had stalled its progress to the 2% target. As a result, market participants scaled back expectations for rate cuts in 2025, boosting the dollar.

Meanwhile, the UK released data showing an unexpected 0.1% contraction in the economy, further weighing on the pair.

Next week’s key events for GBP/USD

(Click on image to enlarge)

(Click on image to enlarge)

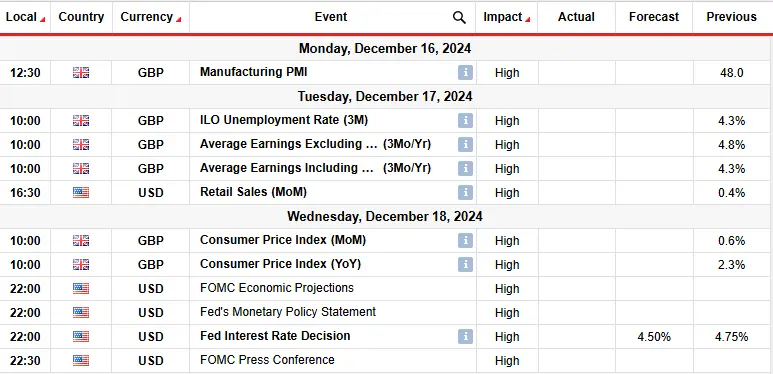

Next week will be a busy week for the pound with policy meetings in the UK and the US. At the same time, traders will watch data from the UK, including manufacturing business activity, employment, inflation, and sales. Meanwhile, the US will release figures on GDP and retail sales.

Markets are almost fully pricing a Fed rate cut on Wednesday. Therefore, data next week might have little impact on rate cut expectations. However, the report might shape the outlook for 2025. Moreover, market participants will watch policymakers’ tone on future rate cuts.

On the other hand, UK data, especially inflation, might play a big role in shaping the outlook for the Bank of England meeting. Nevertheless, markets expect a pause.

GBP/USD weekly technical forecast: Bears resurface after false breakout

(Click on image to enlarge)

GBP/USD daily chart

On the technical side, the GBP/USD price trades below the 22-SMA with the RSI under 50, suggesting a bearish bias. The price has been on a downtrend, making lower highs and lows. However, bulls have made several attempts to break above the SMA without success.

In the most recent attempt, the price broke above the 22-SMA and its resistance trendline. However, price action showed weakness when the price reached the 1.2800 resistance level.

Furthermore, bears returned with strong enthusiasm to push the price back below the trendline and the SMA. As a result, the price made a false breakout. However, bears seem ready to continue the downtrend. To do this, the price must break below the 1.2500 support to make a lower low.

More By This Author:

USD/CAD Outlook: Loonie Surges Amid BoC’s Cautious Tone

AUD/USD Forecast: Aussie Jumps As Jobs Data Surprises

GBP/USD Price Analysis: Sterling Holds Steady Ahead Of US CPI

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more