USD/JPY Trades In A Tight Range As Interest Rate Differentials, Trade Talks Drive Sentiment

Yen. Image Source: Pixabay

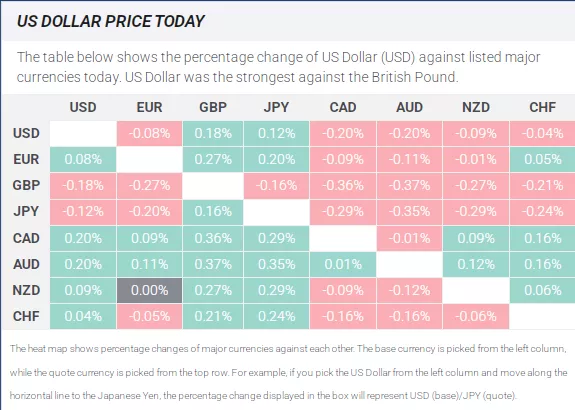

The Japanese Yen (JPY) is steadying against the US Dollar (USD) on Tuesday, with the USD/JPY pair hovering above the 144.00 level in relatively muted trade.

With markets focused on US–China trade negotiations and broader risk sentiment, USD/JPY remains sensitive to shifts in both geopolitical developments and interest rate expectations.

While the trade talks in London appear to be making progress, a more hawkish tone from the Bank of Japan (BoJ) has helped limit further downside in the Yen.

On Tuesday, BoJ Governor Kazuo Ueda stated that inflation still has some way to go to sustainably reach the 2% target. Ueda stated that “We will raise interest rates if we have enough confidence that underlying inflation nears 2% or moves around 2%.”

Market participants interpreted these remarks as reducing the likelihood of an imminent interest-rate hike.

On Wednesday, the next fundamental catalyst on the US economic calendar will be the release of US Consumer Price Index (CPI) data for May. Expectations are for headline US CPI to rise by 0.2% on a monthly basis. Inflation is expected to increase to 2.5% YoY, from 2.3% in April.

The core CPI, which excludes food and energy prices, is expected to show a 0.3% MoM increase in May compared to 0.2% in April. The YoY figure is also estimated to reflect a 0.1% increase, rising to 2.9% compared to 2.8% in April.

A hotter-than-expected print could reignite USD strength by reinforcing expectations for a Federal Reserve (Fed) rate hold, while a softer number may weigh on the Greenback.

More By This Author:

Silver Price Forecast: XAG/USD Hits A 13-Year High On Increased Demand For The Industrial Metal

Mexican Peso Climbs To Eight-month Highs Against The U.S. Dollar Despite Upbeat U.S. Jobs Data

Mexican Peso Strengthens Ahead Of Friday’s NFP Data, With U.S.-Mexico Relations In Focus

Disclosure: The data contained in this article is not necessarily real-time nor accurate, and analyses are the opinions of the author and do not represent the recommendations of ...

more