Mexican Peso Strengthens Ahead Of Friday’s NFP Data, With U.S.-Mexico Relations In Focus

Image Source: Unsplash

The Mexican Peso (MXN) is on track to extend its winning streak for a second consecutive session against the US Dollar (USD) on Thursday.

At the time of writing, USD/MXN is trading near the new yearly lows, around 19.15, as market participants shift their focus to the upcoming US Nonfarm Payrolls (NFP) report, due Friday, which could provide fresh direction for the pair.

USD/MXN continues to weaken with the US labour market in focus ahead of Friday’s NFP data

During the European session, risk appetite remained fragile, but confirmation of a productive phone call between US President Donald Trump and Chinese President Xi Jinping helped ease some market jitters, lifting overall sentiment.

For the United States, attention now turns to Friday’s release of the US Nonfarm Payrolls report, a key labor market indicator that could influence the Federal Reserve’s policy outlook. Analysts expect the US economy to have added 130,000 jobs in May, marking a slowdown from the 177,000 gain in April. The Unemployment Rate is expected to hold steady at 4.2%. Mexican Peso daily digest: USD/MXN monitors US-Mexican relations, US labour market conditions

- Weekly Initial Jobless Claims on Thursday rose to 247,000, above the expected 235,000. The report followed Wednesday’s weak ADP employment data, which showed that just 37Kjobs were added to the US private sector in May.

- On Wednesday, tariffs on steel and aluminum imports to the US increased from 25% to 50%.

- Mexican President Claudia Sheinbaum labeled the tariff increase as "unjust," "unsustainable," and lacking a legal basis, asserting that it violates the United States-Mexico-Canada Agreement (USMCA)

- Mexican Economy Minister Marcelo Ebrard argued that imposing tariffs on a product where the US has a trade surplus with Mexico lacks justification.

- With Mexico expected to file for an official exemption from the higher tariffs on Friday, in a pivotal meeting with US officials, both Ebrard and President Sheinbaum have stated that Mexico will announce countermeasures against the US if no agreement is reached this week.

USD/MXN bears remain in control below 19.20

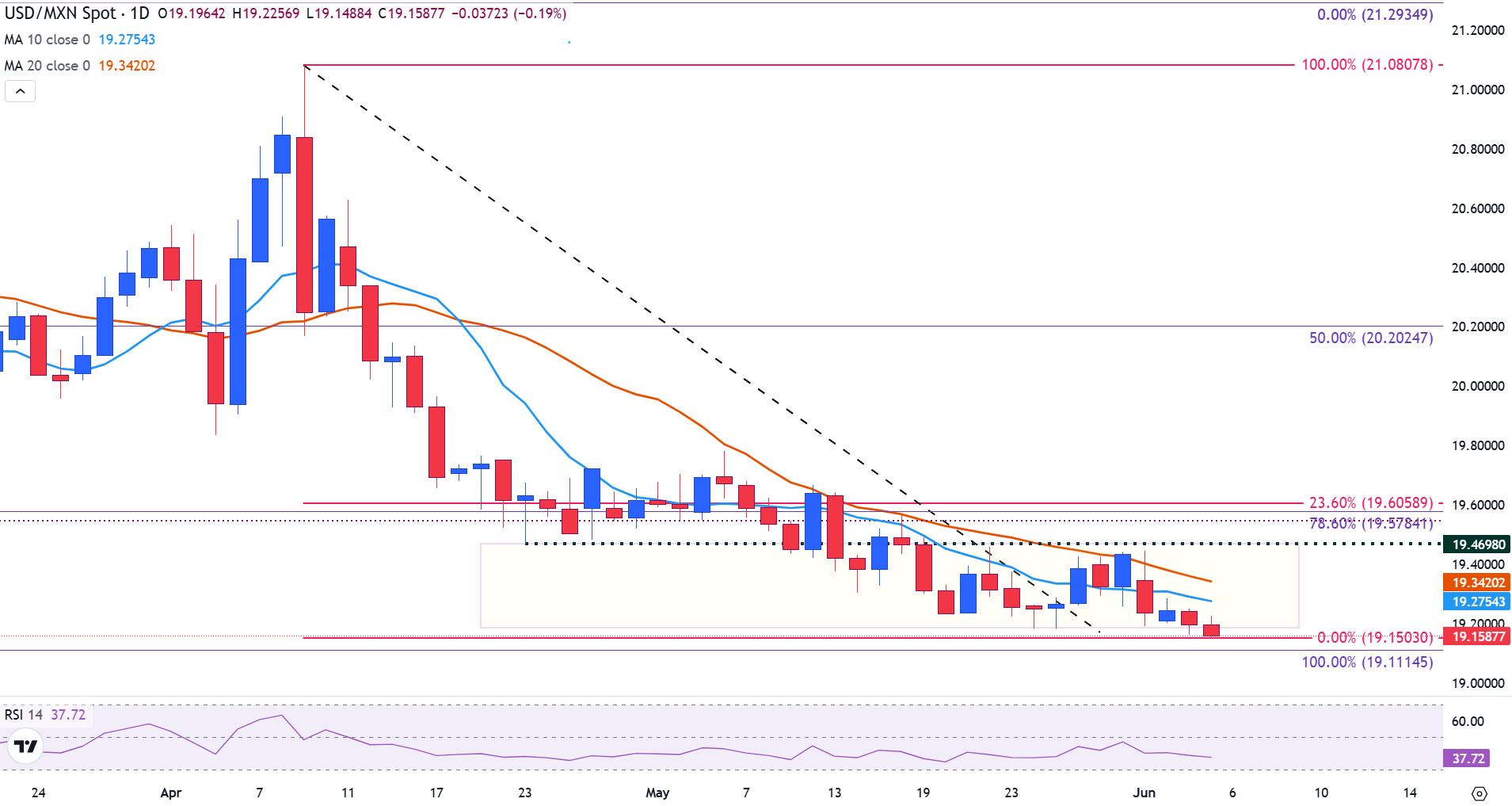

Price action on the USD/MXN daily chart continued to reinforce the broader bearish structure, as the pair posted another red candlestick, closing near the critical support zone between 19.15 and 19.20.

This decline keeps the price firmly below both the 10-day Simple Moving Average (SMA) at 19.28 and the 20-day SMA at 19.34. The 78.6% Fibonacci retracement level at 19.57, derived from the broader October–February rally, now acts as a key resistance level, further capping any recovery attempts.

The Relative Strength Index (RSI) near 38 signals bearish momentum, although the indicator has yet to reach oversold conditions, suggesting potential for further downside.

USD/MXN daily chart

(Click on image to enlarge)

From here, the bearish scenario would involve a decisive break below the 19.15 support, potentially exposing the next downside target at the October low of 19.11. A failure to hold above this level could accelerate selling pressure. On the other hand, the bullish scenario would require a sustained recovery above 19.28 (10-day SMA) and 19.34 (20-day SMA), followed by a breakout above the 19.60 resistance, which aligns with the 23.6% retracement of the same October–February move.

More By This Author:

USD/JPY Recovers On De-Escalating U.S.-China Trade Tensions Ahead Of Critical NFP ReportSilver Prices Surge To Multi-Year Highs, Posting Intraday Gains Near 3.50%

Mexican Peso Trades Sideways Against The U.S. Dollar As U.S. Jobs Data Remains In Focus

Disclosure: The data contained in this article is not necessarily real-time nor accurate, and analyses are the opinions of the author and do not represent the recommendations of ...

more