USD/JPY Price Analysis: Pulled Back From Weekly High As Buyers Eyed Further Gains

Image Source: Unsplash

- The USD/JPY currency pair dipped but retained gains for the week with a slight 0.17% increase, hinting at a bullish undertone.

- The technical outlook seemed to suggest neutrality with an upward bias, as the pair was positioned above the Ichimoku Cloud.

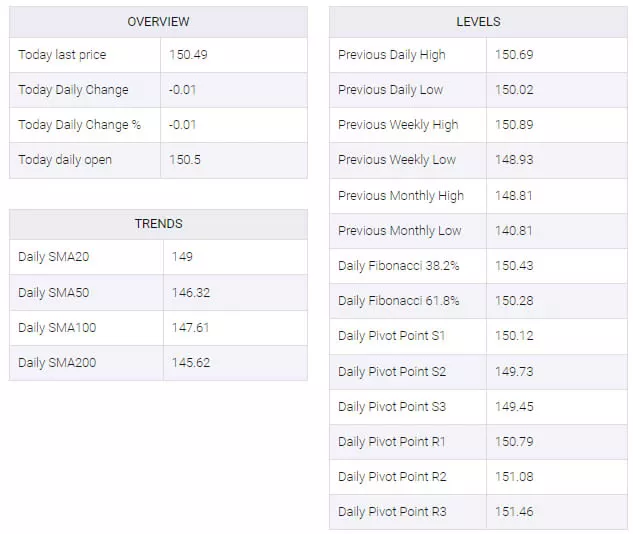

The USD/JPY currency pair retreated on Friday after hitting a weekly high of 150.77, as the duo fell back below the 150.50 figure late in the North American session. The major currency cross was seen exchanging hands at around 150.44, down 0.05%, but it appeared set to finish the week with gains of 0.17%.

From a technical perspective, the pair appeared to be neutral-to-upward biased, as it remained well positioned above the Ichimoku Cloud (Kumo) structure. Recent price action seemed to suggest that buyers need to push the USD/JPY currency pair above the Feb. 13 high at 150.88 to remain hopeful for a bullish continuation.

The next resistance would be seen at the 151.00 mark, followed by last year’s high at 151.91. Relative Strength Index (RSI) studies remained bullish, indicating that buyers perhaps had the upper hand.

Conversely, if sellers drag could the USD/JPY duo below the 150.00 mark, that would pave the way for a pullback. The next demand area would be the Tenkan-Sen formation at 150.05, followed by the Senkou Span A at 149.22. Further downside can be seen at the Kijun Sen formation at 148.39.

USD/JPY Price Action – Daily Chart

(Click on image to enlarge)

USD/JPY Technical Levels

More By This Author:

Gold Price Rallied, Eyed Weekly Finish In The Green Amid Lower US Bond Yields

USD/CAD Refuses To Let Go Of 1.3500 As Markets Twist On Quiet Friday

USD/CAD Price Analysis: Remains Subdued Below 1.3500

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more