USD/JPY Price Analysis: Firm Above 138.00 On Fed Hawkish Comments, Boosting The US Dollar

USD/JPY resumes its uptrend, creeping higher above the 138.00 figure as the US Dollar (USD) strengthens, underpinned by higher US Treasury bond yields. Hawkish comments by Federal Reserve (Fed) officials, and positive discussions on the US debt ceiling, keeps the USD/JPY pair trading higher. Hence, the USD/JPY is trading at 138.51, a gain of 0.43%.

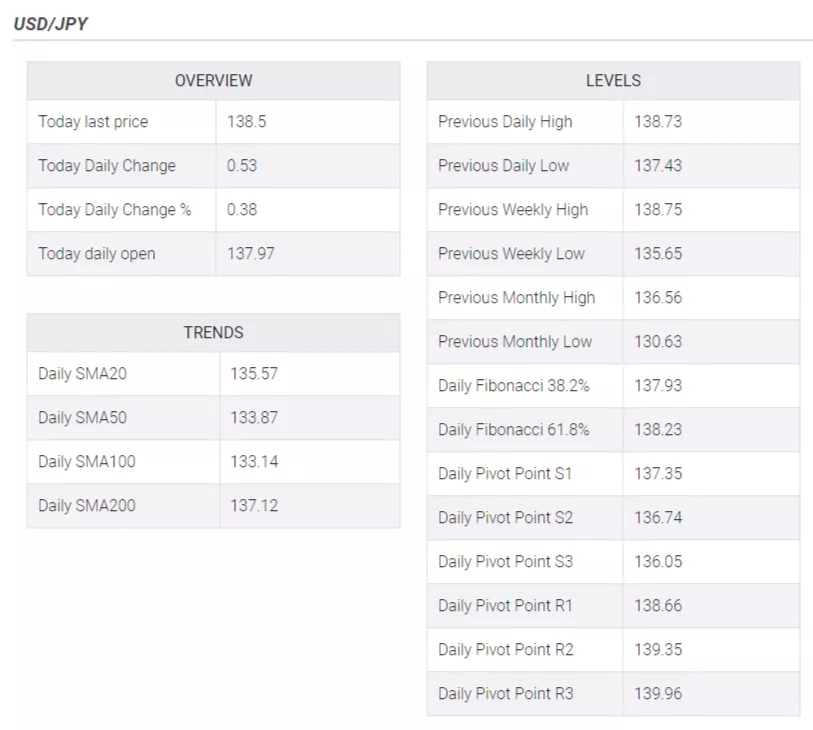

USD/JPY Price Analysis: Technical outlook

After finishing the last week with a negative session, the USD/JPY is still trading above a five-month-old resistance trendline, which turned support on May 18, which opened the door to a new year-to-date (YTD) high of 138.74, before a pullback to 137.25. The USD/JPYs bounced off that level and reclaimed the 138.00 figure.

Of note, the USD/JPY reached a new higher-high, while the Relative Strength Index (RSI) did not, peaking around 69.00 before entering overbought conditions, retraced towards the 65.00 area, suggesting buyers are losing momentum. The 3-day Rate of Change (RoC) it’s declining as buyers lose steam.

If USD/JPY breaks above the YTD high at 138.74, the next resistance would be the 139.00 figure, a zone that could propel the pair towards the 140.00 area, but buyers must crack the November 30 daily high of 139.89.

On the other hand, the USD/JPY first support would be 138.00. Break below will expose the May 18 low of 137.28 before challenging the 137.00 mark.

USD/JPY Price Action – Daily chart

(Click on image to enlarge)

More By This Author:

Natural Gas Price Analysis: XNG/USD Prods Resistance-Turned-Support Around $2.66

Mullen Automotive Stock Forecast: Muln Meets Nasdaq 10-session Requirement

Gold Futures: Decline Now Appears Contained

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more