USD/JPY Price Aiming To Pounce 145.0 After Downbeat US ADP

The USD/JPY price slumped well below yesterday’s low of 146.89. Fundamentally, the US dollar’s depreciation was expected after the US ADP Nonfarm Employment Change came in at 103K in November versus 131K expected, compared to 106K in October.

In addition, the Trade Balance, Revised Nonfarm Productivity, and Revised Unit Labor Costs also reported poor data in the last session.

Today, the JPY received a helping hand from the Japanese Leading Indicators indicator, which came in at 108.7%, above the 108.2% expected.

Later, the US data could move the markets. The Unemployment Claims could jump from 218K to 221K in the last week. The data on Challenger Job Cuts, Consumer Credit, and Final Wholesale Inventories will also be released.

The fundamentals will be critical to watch as the US releases the NFP, Unemployment Rate, and Average Hourly Earnings tomorrow. At the same time, Japan publishes the Economy Watchers Sentiment, Final GDP, Current Account, Household Spending, and Average Cash Earnings data.

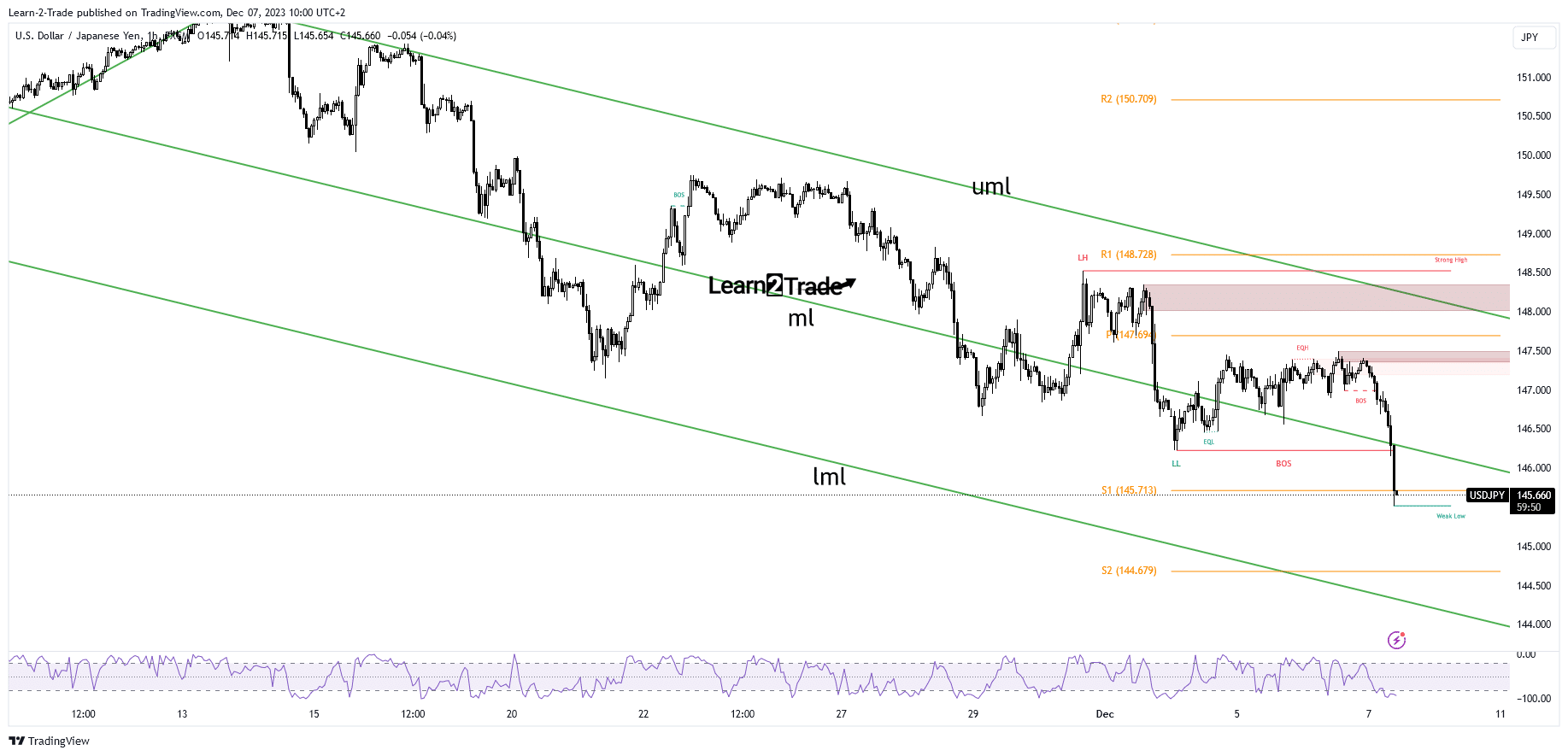

USD/JPY Price Technical Analysis: Key Level Breakout

(Click on image to enlarge)

USD/JPY 1-hour chart

From the technical point of view, the USD/JPY price plunged after failing to approach the weekly pivot point of 147.69 or the upper median line (uml). It came back below the median line (ml) and seems determined to hit new lows.

The 145.00 psychological level stands as the first downside target. In addition, the weekly S2 of 144.67 represents potential static support. As long as it stays below the median line (ml), the rate could approach and reach the lower median line (LML).

More By This Author:

USD/CAD Forecast: Loonie Loses Ground After BoC’s Pause

AUD/USD Price Analysis: Aussie Gains Despite Economic Hurdles

Gold Price Rebounded From $2,009 Amid Mixed US Data

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more