Gold Price Rebounded From $2,009 Amid Mixed US Data

The gold price dropped as low as $2,009 in the last trading session, where it has found a demand again. The metal has rallied again and is trading at $2,026 at the time of writing.

After its massive downside movement, a rebound was expected. The US dollar’s leg higher forced the yellow metal to drop. Further rise could drag the price of gold towards new lows.

The XAU/USD turned to the upside after the US JOLTS Job Openings came in worse than expected yesterday. The indicator was reported at 8.73M, far below the 9.31M expected and compared to 9.35M in the previous reporting period.

Gold rallied in the short term even though the US ISM Services PMI came in better than expected, while Final Services PMI matched expectations.

Today, the Australian GDP reported only a 0.2% growth versus the 0.5% growth expected. Later, the US economic data and the BOC should move the rate. The Bank of Canada is expected to keep the Overnight Rate at 5.00%. Still, the BOC Statement could bring sharp movements.

In addition, the US ADP Non-Farm Employment Change could be reported at 131K versus 113K in the previous reporting period.

Gold Price Technical Analysis: Bullish Momentum

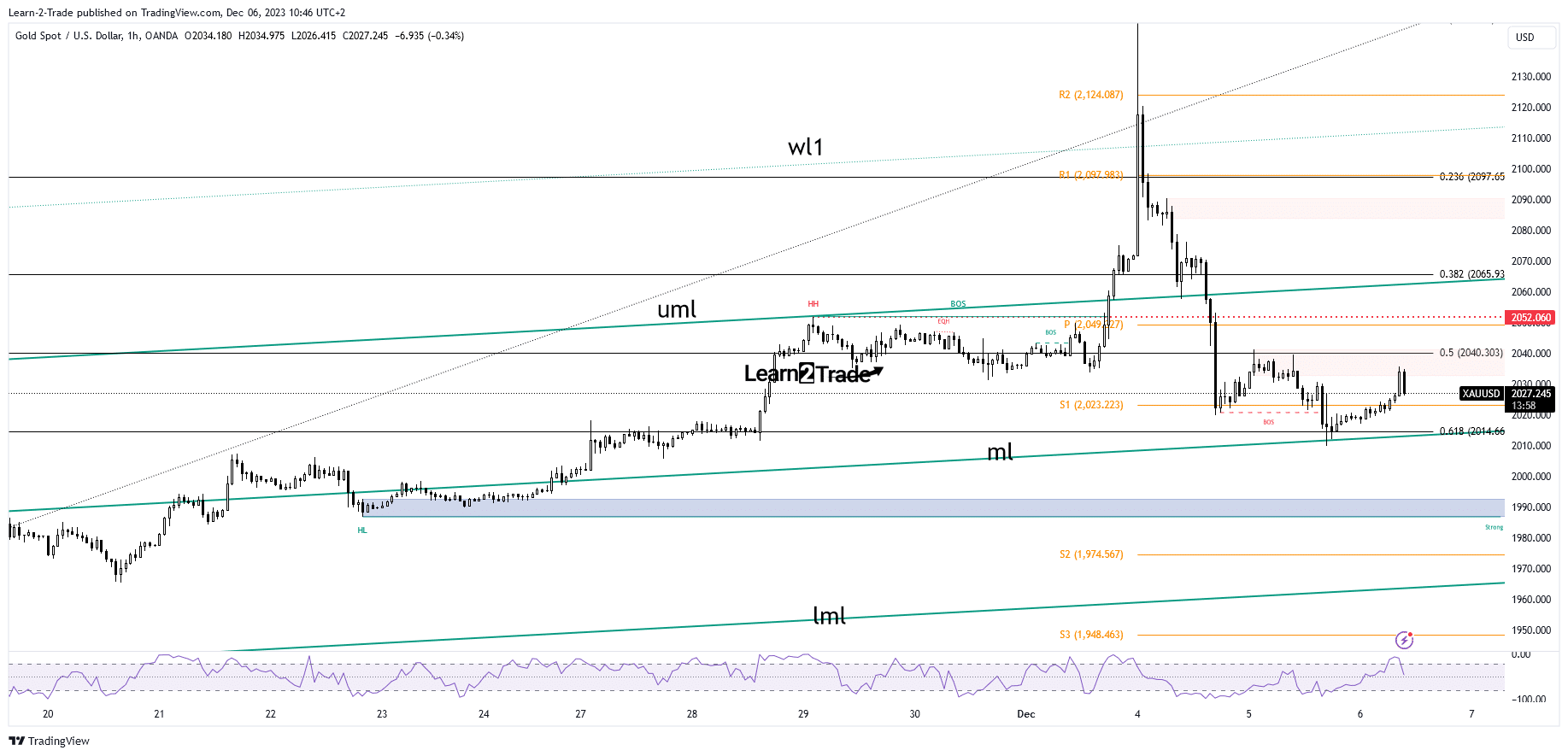

Gold 1-hour chart

The gold price found support on the 61.8% (2,014) and the median line (ml) of the ascending pitchfork. The false breakdown revealed a bounce back. It has reached the supply zone from right below the 50% (2,040) retracement level.

The downside pressure remains high as long as it stays below this static resistance. Only jumping and stabilizing above the 50% retracement level could open the door for a larger rebound. On the other hand, dropping below 61.8% and under the median line, a new lower low activates more declines.

More By This Author:

AUD/USD Price Analysis: Aussie Takes A Hit in the Wake Of RBAGold Price Struggling To Recover After 6% Dip from All-Time High

USD/JPY Outlook: Yen Firm Despite Downbeat Tokyo CPI

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more