USD/JPY Closes Above 146.00, Bulls Prepare For Another Upwards Leg

Yen. Image Source: Pixabay

At the start of the week, the USD/JPY saw little movement, with both currencies trading weak against most of their rivals. The USD traded soft after last week's key events. Nonfarm Payrolls showed a mixed picture, while the ISM Manufacturing PMI rose higher than expected and the Core Personal Consumption Expenditures came in hot. Focus now shifts to Service sector PMI surveys from the ISM to be released on Wednesday, which will help investors to continue modelling their expectations regarding the next Federal Reserve (Fed) decisions.

The USD is trading soft on Monday after last week's key events. Nonfarm Payrolls showed a mixed picture, while the August ISM Manufacturing PMI rose higher than expected as well as the Core Personal Consumption Expenditures from July. Focus now shifts to Service sector PMI surveys from the ISM to be released on Wednesday, which will help investors to continue modelling their expectations regarding the next Federal Reserve (Fed) decisions.

According to the CME FedWatch tool, the odds of an extra 0.25% tightening throughout the period leading to the December meeting had somewhat eased, but investors are still placing some bets on it. If the Fed opts for another hike, it would lift rates to 5.75%.

On the Yen’s side, local wage and inflation data will play a pivotal role in the Bank of Japan’s (BoJ) considerations for potential adjustments to monetary policy. In that sense, at the early Asian session on Thursday, Japan will report household spending and earnings figures from July, and their outcome will influence the expectations of the following BoJ decisions.

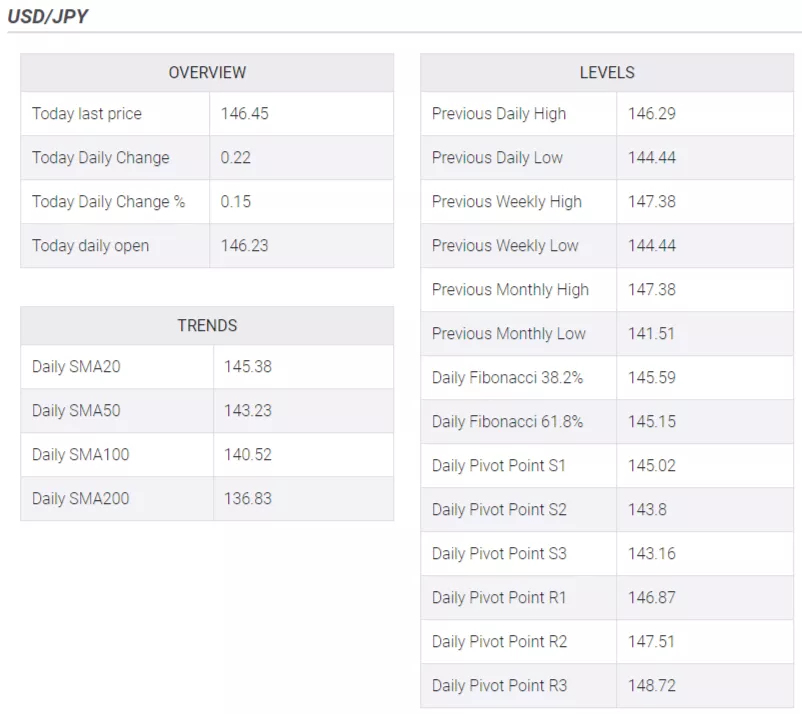

USD/JPY Levels to watch

Analysing the daily chart, the USD/JPY technical outlook is bullish in the short term. The Relative Strength Index (RSI) is positioned above its midline in positive territory. It has a northward slope, indicating a favourable buying momentum. It is further supported by the positive signal from the Moving Average Convergence Divergence (MACD), which displays green bars, underscoring the growing bullish momentum. Also, the pair is above the 20,100,200-day Simple Moving Average (SMA), indicating a favourable position for the bulls in the bigger picture.

Support levels: 145.72 (20-day SMA), 145.00, 144.00.

Resistance levels: 146.80, 147.00, 147.40.

USD/JPY Daily Chart

(Click on image to enlarge)

-638294604806512018.png)

More By This Author:

WTI Price Analysis: WTI Clears Daily Gains Amid A Weaker USD, OPEC Production Cuts

NZD/USD Pressured Amid Subdued Conditions, Below 0.6000

Natural Gas Takes Step Back In Thin US Holiday Trading

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more