USD/CAD Weekly Forecast: March Tariff Plans Suppress Loonie

Image Source: Pexels

- The USD/CAD currency pair's weekly forecast seemed to indicate a dim outlook for Canada’s economy.

- US tariffs on Canadian goods will come into effect in March.

- The US dollar surged as traders sought safety amid economic uncertainty.

The USD/CAD currency pair's weekly forecast seemed to indicate a dim outlook for Canada’s economy as Trump plans to implement a 25% tariff in March.

The Ups and Downs of The USD/CAD Pair

The USD/CAD pair witnessed a bullish week as the US dollar rebounded amid safe-haven inflows. This week, the US dollar was on the front foot as Trump maintained his aggressive push for tariffs in Canada and Mexico.

The US president surprised markets by saying the tariffs would come into effect in March. Analysts had expected another delay to April. As a result, fears of a weaker economy in Canada amid lower demand hurt the loonie. On the other hand, the US dollar surged as traders sought safety amid economic uncertainty.

Next Week’s Key Events for USD/CAD

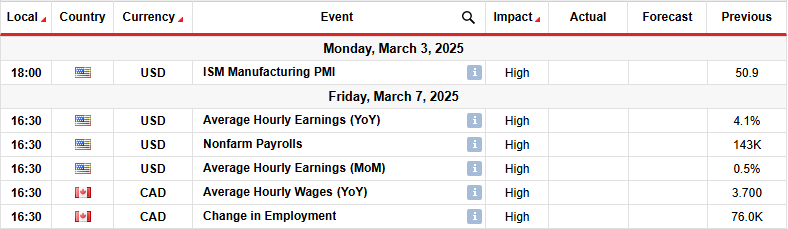

(Click on image to enlarge)

Market participants are looking forward to key reports from the US, including manufacturing PMI and employment. Meanwhile, Canada will only release its monthly employment figures.

Traders will keenly monitor employment numbers from the US and Canada to determine what the Fed and the Bank of Canada will do in the near future. Upbeat reports will lower bets for rate cuts. Meanwhile, a downbeat report will put pressure on both central banks to cut borrowing costs.

USD/CAD Weekly Technical Forecast: Bulls Resurfaced, Targeted the 1.4804 Level

(Click on image to enlarge)

On the technical side, the USD/CAD pair's price bounced back after an attempt by bears to reverse the trend. The price broke above the 30-SMA, indicating a bullish shift in sentiment. At the same time, the RSI has recently been seen trading above 50, suggesting solid bullish momentum.

The previous bullish trend paused just below the 1.4804 resistance level. The price had made a strong bullish gap to this level. However, bears emerged with stronger momentum, closing the gap and forming a bearish engulfing candle. This sudden strength pushed the price below the SMA, challenging the uptrend.

However, bears could not push the price beyond the 1.4150 support level, allowing bulls to return to the market. This return might only be brief to retest the 1.4804 level resistance. However, it might also allow the USD/CAD currency pair to continue its previous bullish trend. If bulls could maintain their position above the 1.4400 key level, the price would likely revisit the 1.4804 resistance.

More By This Author:

USD/JPY Price Analysis: Yen Slips Amid Missed Inflation

AUD/USD Forecast: AUD Struggles After Weak Inflation Report

Gold Outlook Vulnerable At Key Level, Deeper Correction In Sight

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity research ...

more