U.S.: The Worst Combination Of Sticky Inflation And Slower Growth

We've written a lot about the downturn in the housing market posing major risks for US economic activity, but the August personal income and spending report suggests the weakness is already broadening. With inflation pressures remaining intense we see the Fed hiking another 75bp in November, implying more economic pain to come.

Inflation ticks higher than expected

In terms of today's US data flow, the Federal Reserve's favored measure of inflation has come in higher than expected, which will keep the hawkish comments coming from Fed officials and reinforce expectations of a fourth consecutive 75bp interest rate hike on November 2nd.

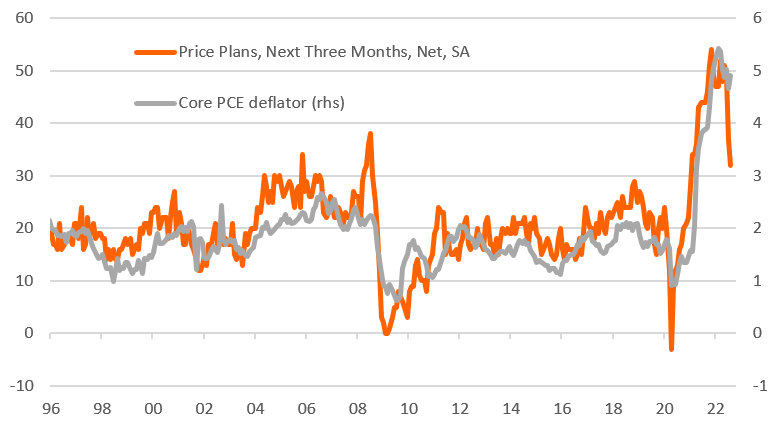

The August core personal consumer expenditure deflator rose 0.6%MoM/4.9%YoY (from an upwardly revised 4.7% year-on-year in July), above the consensus expectation of 0.5%/4.7%. This is a broader measure of inflation than the core CPI measure and we suspect it will stay close to these sorts of levels for another month or two. However, with inflation expectations numbers looking much softer and corporate pricing plans also heading lower (based on National Federation of Independent Business data in the chart below), we remain hopeful that a weakening growth environment will have the positive effect of taking some heat out of price inflation from early 2023.

NFIB price plans & core PCE deflator YoY%

Source: Macrobond, ING

While consumer spending looks much weaker

In addition to the inflation number, the monthly personal income and spending report is important for modeling US GDP growth forecasts. Consumer spending makes up around 70% of all economic activity in the US (versus, say 55-60% in most European economies). The monthly profile for US consumer spending is weaker than hoped in today's report with downward revisions to July real consumer spending (to -0.1% month-on-month from the initially reported +0.2% growth rate) while August spending came in at +0.1% MoM versus expectations of +0.2%.

This is a surprise given high-frequency people movement/restaurant diner/air passenger numbers and is not a great story for 3Q GDP at all. In fact, it is so weak it could mean some analysts predicting a possible third consecutive negative GDP print. We think we will avoid it given a strong contribution from trade, business Capex and inventory building, but with residential investment set to be a big drag and consumer spending seemingly flagging it isn't looking to be as strong as we would have liked. As such we are left with a broader sense of a slowing growth trajectory, but with lingering inflation, which only implies more rate hikes and more economic pain to come.

More By This Author:

The Commodities Feed: Price Caps And Production Cuts

FX Daily: Time For Even More Defensive Positions In FX

Asia Week Ahead: RBA Meeting Plus Regional Trade And Inflation Data

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more