US Stock-Bond Duel To Get Foreigners’ Money Going Latter’s Way – Likely Continues

For a while now, foreigners have been reducing exposure to US stocks. They have been buying Treasury securities, and it is likely the pace quickens. If so, this will come at the expense of US stocks.

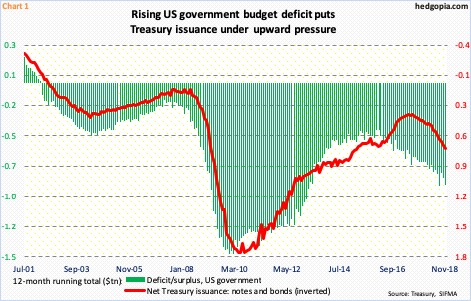

In November, the US government ran a deficit of $205 billion, bringing the 12-month total to minus $883 billion. The red ink has been rising since January 2016 when the 12-month difference between receipts and outlays dropped to minus $404 billion (Chart 1). This is occurring in an economic expansion. The last time the government ran a surplus was in March 2002.

Post-Great Recession, federal deficit swelled to as high as $1.5 trillion in February 2010, before shrinking. It is rising – again. The tax cuts of last December, combined with subsequent fiscal stimulus, did not help matters. The economy is decelerating, although from a decent pace. A recession will occur sooner or later – timing and duration notwithstanding.

Odds favor continued increase in the deficit in quarters to come, and with that in Treasury issuance. In July 2017, on a 12-month basis, issuance of Treasury notes and bonds totaled $335 billion. By this November, this had grown to $674 billion.

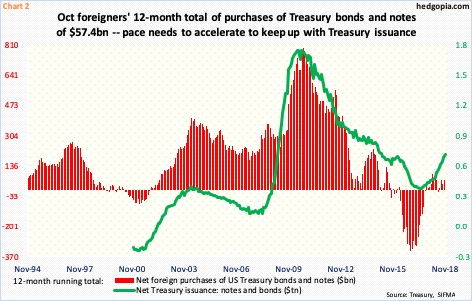

From the Treasury’s perspective, the good thing is that foreigners continue to be a good source of demand for these securities. On a 12-month basis, they purchased $57 billion worth of notes and bonds. But it is possible they will pick up speed. The green line in Chart 2 is rising much steeper than the rather-sideways red bars. Historically, the two tend to move together.

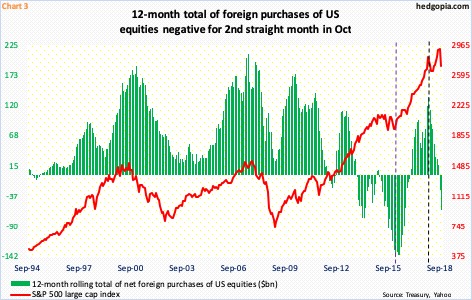

This can have repercussions for Chart 3, which plots foreign purchases of US equities against the S&P 500 large cap index. Capital is a finite source. The risk facing US stocks is, what goes into foreign purchases of Treasury securities comes at their expense.

Foreigners have already grown cautious over US stocks. This apathy continued in October, when they sold $22 billion worth. This was the sixth consecutive monthly selling and eighth in the last nine. The 12-month rolling total was minus $61 billion in October. In January this year, they purchased $136 billion worth. Since then, it has been all downhill.

US stocks took it on the chin in October. The S&P 500 fell 6.9 percent. As in evident in Chart 3, foreigners had been selling for a while leading up to that month. Amidst this rout, it would have sent quite a contrarian signal if foreigners did a U-Turn and started buying October’s weakness. That did not happen.

Their activity is worth watching. Back in February 2016, when US stocks reached a major bottom, foreigners’ 12-month selling peaked at $145 billion before reversing (violet dashed line in Chart 3).

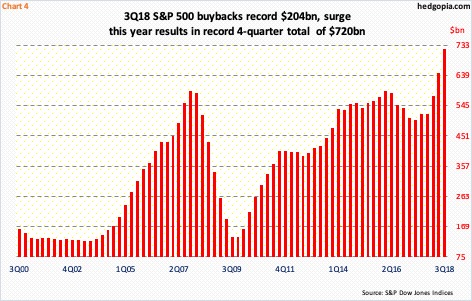

For all of 3Q, the S&P 500 jumped 7.2 percent. Foreigners sold $48 billion worth during the quarter. Here is the irony. Buybacks by S&P 500 companies in that quarter totaled $204 billion – a new record. In fact, post-tax cuts of last December, buybacks took off, with $583 billion in the first nine months this year. In the current quarter, S&P Dow Jones Indices expects the momentum to continue. That said, the pace is clearly unsustainable. One can just imagine how stocks would have fared without all this corporate buying. With seven and a half sessions of trading left for the year, the S&P 500 is down 4.8 percent.

Next year, in all probability, buyback growth decelerates. In this scenario, equity bulls surely hope foreigners turn around and start buying US equities. But continued rise in Treasury issuance could throw a monkey wrench into this.

Disclaimer: This article is not intended to be, nor shall it be construed as, investment advice. Neither the information nor any opinion expressed here constitutes an offer to buy or sell any ...

more