US Manufacturing & Services PMIs Come In Hot As Inflation Re-Surges

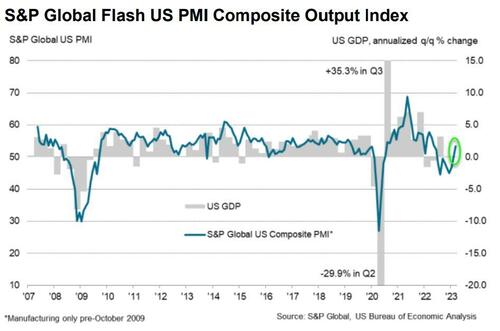

S&P Global's PMI data surprised to the upside in preliminary February data with both Manufacturing and Services coming in hotter than expected.

- Flash US Services Business Activity Index at 53.8 (February: 50.6). 11-month high.

- Flash US Manufacturing Output Index at 51.0 (February: 47.4). 10-month high.

- Flash US Manufacturing PMI at 49.3 (February: 47.3). 5-month high.

Commenting on the US flash PMI data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“March has so far witnessed an encouraging resurgence of economic growth, with the business surveys indicating an acceleration of output to the fastest since May of last year.

“The PMI is broadly consistent with annualized GDP growth approaching 2%, painting a far more positive picture of economic resilience than the declines seen throughout the second half of last year and at the start of 2023.

“The upturn is uneven, however, being driven largely by the service sector.

Although manufacturing eked out a small production gain, this was mainly a reflection of improved supply chains allowing firms to fulfil backlogs of orders that had accumulated during the post-pandemic demand surge. Tellingly, new orders have now fallen for six straight months in manufacturing. Unless demand improves, there seems little scope for production growth to be sustained at current levels.

“In services, there are more encouraging signs, with demand blossoming as we enter spring.

It will be important to assess the resilience of this demand in the face of the recent tightening of interest rates and the uncertainty caused by the banking sector stress, which so far only seems to have had a modest impact on business growth expectations.

“There is also some concern regarding inflation, with the survey’s gauge of selling prices increasing at a faster rate in March despite lower costs feeding through the manufacturing sector. The inflationary upturn is now being led by stronger service sector price increases, linked largely to faster wage growth.”

That 'good' news is definitely not what Powell and his pals were hoping to see.

Of course, all this 'good' news hit before the current 'credit-tightening' crisis occurred.

More By This Author:

US Durable Goods Orders Unexpectedly Drop In Feb; Weakest YoY In 2 Years

Fed Balance Sheet Surges By Another $100BN Amid Bank Runs As Foreign Repos Soar By Record And Cash Floods Into Reverse Repo, Money Markets

Disney Begins 7000 Job Cuts After String Of Theatrical Failures

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more