Fed Balance Sheet Surges By Another $100BN Amid Bank Runs As Foreign Repos Soar By Record And Cash Floods Into Reverse Repo, Money Markets

The much-awaited release of the Fed's latest weekly balance sheet update was released at exactly 4:30 pm, and not surprisingly, it showed that in the past week the bank bailout continued if at a less torrid pace.

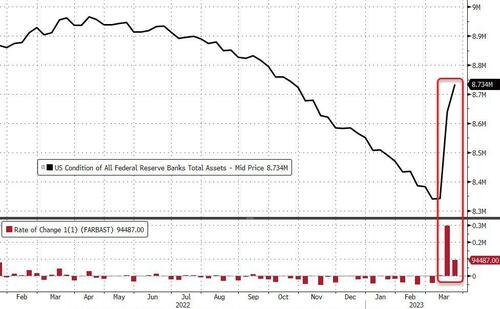

As of March 22, the Fed's balance sheet increased by $94.5 billion to $8.734 trillion from $8.639 trillion which in turn was a $297 billion increase from the previous week when the bank crisis started. In total, the Fed's balance sheet has increased by $393 billion in the past two weeks and is fast approaching its all-time high of $8.95 trillion one year ago, when QT kicked in and shrank the Fed's assets by $600 billion.

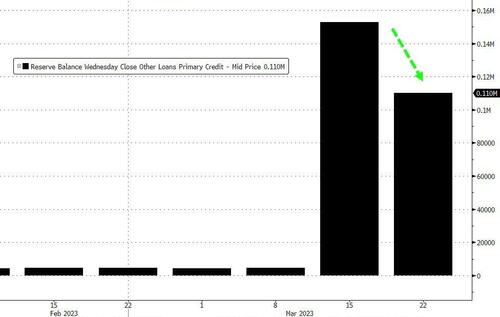

Looking at the actual reserve components that were provided by the Fed, we find that Fed backstopped facility borrowings were roughly flat around $164 billion, but the composition shifted, as usage of the Discount Window dropped by $42 billion to $110 billion...

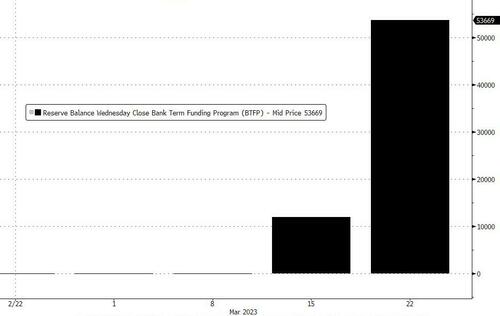

... which however was offset almost dollar for dollar by a $42.6 billion increase in usage of the Fed's brand new Bank Term Funding Program, or BTFP.

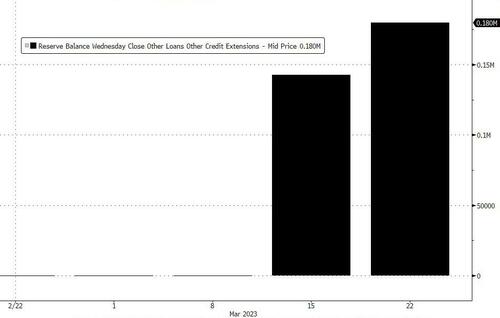

Meanwhile, other credit extensions - consisting of Fed loans to bridge banks established by the Federal Deposit Insurance Corp. to resolve SVB and Signature Bank- rose to $179.8 billion from $142.8 billion the previous week.

Of course, the above only accounted for just under $40BN in reserves, what was the delta?

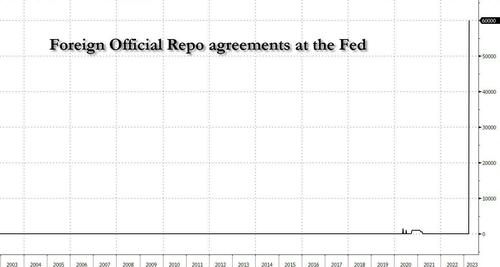

The answer: a record $60 billion in foreign official Repo (which is also the counterparty limit) under the Fed's new FIMA repo facility, which means that the offshore scramble for dollars was alive and well, and someonereally needed access to USD. That someone is likely either Credit Suisse or UBS, or some SPV of the Swiss National Bank; of course, we can't know for sure since the names of counterparties are named. confidential.

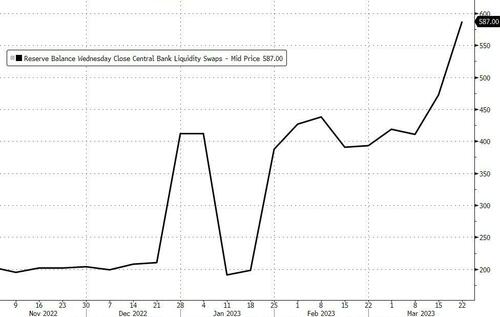

The maxing out of the foreign repo is also why the Fed's USD liquidity swaps only rose to a paltry $587 million in the past week...

... as the real number to focus on is the massive amount of foreign repo usage, which is where the foreign USD scarcity emerged this week.

Meanwhile, with QT still laughably taking place in the background, the Fed's holdings of TSYs dropped by $3.5 billion to $7.937 trillion.

The question is whether after emergency Fed facilities rose by another $100 billion - a rough proxy of how much deposit drain took place in the week - if this marks the peak for the credit crisis. And while that may have been true until yesterday, it is none other than Janet Yellen herself who sent bank stocks plunging in the past 48 hours with her amateurish comments. In any case, this means that we will need to wait one more week until the next H.4.1 statement to see if the various emergency Fed facilities are declining or if they continue to rise and will eventually be replaced with permanent reserve facilities such as QE, similar to what happened after the 2008 financial crisis.

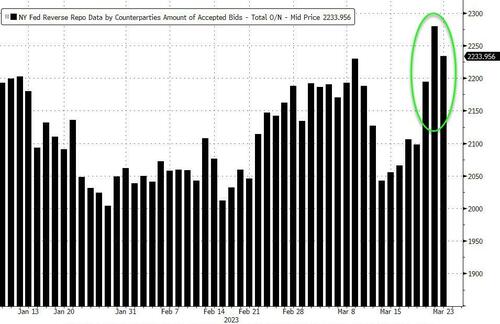

Finally, while the Fed is flooding the system with emergency reserves, those wondering where these are going should look at the Fed's reverse repo facility which has soared, as well as money market funds which have been scooping up cash recently, fueled in large part by depositors pulling their money away from US banks.

The amount of money parked at money-market funds climbed to a fresh record in the week through March 22 as banking concerns continued to rock global markets. According to data from the Investment Company Institute, about $117.4 billion poured into US money-market funds in the week through March 22, bringing total assets up to an unprecedented $5.132 trillion, versus the $5.01 trillion in the week to March 15. Inflows over the past two weeks totaled more than $238 billion.

Initially, much of that flow was driven by more attractive rates, but concern about the steadiness of some smaller lenders helped boost the trend this month.

“This is consistent with ongoing deposit flight from the banking system as depositors indirectly invest their cash into government securities via money funds and shun bank credit,” said TD Securities strategist Gennadiy Goldberg. “This answers the question of ‘where is the money going once it leaves the banking system?”’

As a result, more cash may remain parked at the Fed's reverse repurchase agreement facility amid a lack of short-end supply due to ongoing Treasury bill paydowns and Federal Home Loan Banks normalizing issuance. On Thursday, some 99 counterparties parked $2.234 trillion at the RRP, down from $2.28 trillion the prior session, but just shy of 2023 highs.

Finally, looking at our favorite chart showing total reserves vs US market cap, it shows that with reserves rising to $3.425 trillion, the highest since April 2022, US stocks are now badly lagging where the amount of reserves would have them be.

On the other hand, the bank crisis needs to stabilize first and while reserves are being furiously injected into the system, money (in the form of deposit runs) needs to stop entering the reverse repo system (effectively sterilizing reserves), because as the next chart shows, much of the increase in reserves has been offset by a surge in reverse repos.

More By This Author:

Disney Begins 7000 Job Cuts After String Of Theatrical Failures

Coinbase Tumbles After-Hours On Wells Notice Disclosure

Fed Hikes Rates 25bps, Maintains QT, Removes Hawkish Guidance

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more