Fed Hikes Rates 25bps, Maintains QT, Removes Hawkish Guidance

Image source: Wikipedia

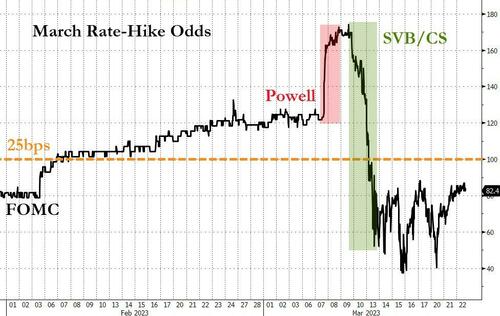

A lot has changed since The Fed last met on February 1st and decided to hike 25bps. Between Powell's hawkish hearings with Congress and the dovish-inference of a global financial system crisis, the market's expectations for The Fed's actions today have swung wildly - but ironically, are basically unchanged since the Feb 1st meeting.

At its most hawkish the market priced in a 75% chance of a 50bps hike (after Powell's hearings). That then collapsed to a 63% chance of a 'pause' by The Fed following the collapse of SVB and CS. The last week has seen expectations rise back to 80% or so of a 25bps hike...

Source: Bloomberg

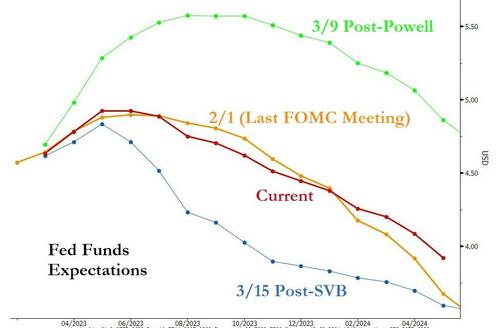

Interestingly the entire Fed Funds curve is back at very similar levels to where it stood at the last FOMC meeting - after a wild ride in between...

Source: Bloomberg

Crypto and tech stocks have soared since the last FOMC meeting (but more driven by the post-SVB fallout) while gold and the dollar have managed modest gains while bond (prices) are broadly lower...

Source: Bloomberg

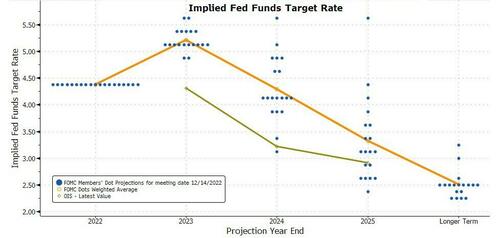

The Dot-Plot gets a makeover today with expectations for considerably larger variations (and a dovish drift) from where it stood in December...

Source: Bloomberg

And, of course, The Fed Balance Sheet exploded higher...

Source: Bloomberg

Goldman Sachs economists looked at how the Fed has set policy in the past when stresses in the financial system threatened to disrupt lending and economic activity. Excluding severe recessions, they looked at 1966, 1984, 1994-95 and 1998. The central bank eased monetary policy in two of the four cases and paused tightening in a third, they found.

They write:

“Overall, the historical record suggests that the FOMC tends to avoid tightening monetary policy in times of financial stress and prefers to wait until the extent of the problem becomes clear, unless it is confident that other policy tools will successfully contain financial stability risks.”

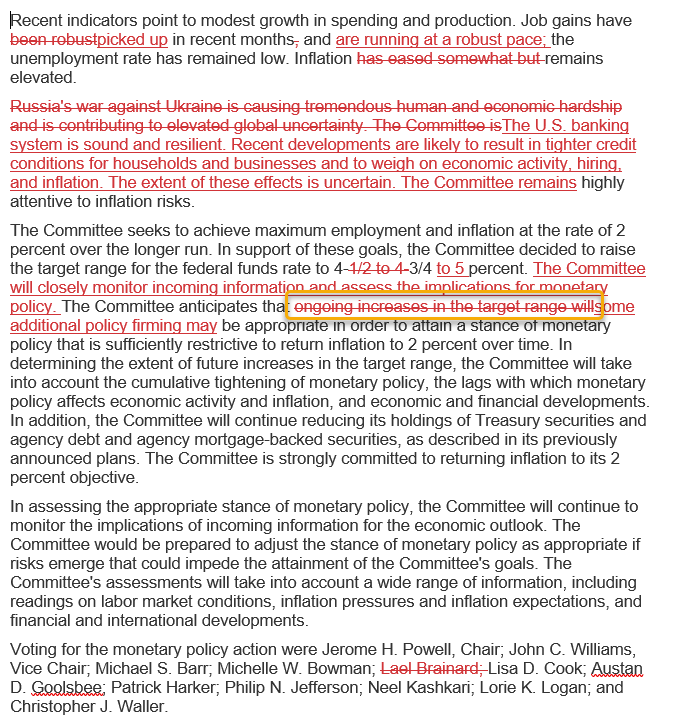

So, here's what The Fed said...

Fed hiked 25bps as expected...

*FED RAISES BENCHMARK RATE 25 BPS TO 4.75%-5% TARGET RANGE

Fed will keep QT going as expected...

*FED WILL CONTINUE SAME PACE OF REDUCING TREASURY, MBS HOLDINGS

Fed offers some dovish guidance...

...language about "ongoing increases in the target range" will be appropriate removed and replaced with "some additional policy firming may be appropriate"

Fed gives a nod to the banking system in a new addition to the statement...

The U.S. banking system is sound and resilient. Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain.

The Fed also added this new line, perhaps in a nod to their own impact on bank balance sheets (and how much more data dependent they may become):

"The Committee will closely monitor incoming information and assess the implications for monetary policy"

And as far as the new 'dots' go, the terminal rate is unchanged from the December dots...

(Click on image to enlarge)

Additionally, unemployment decreases a little, inflation up. Doesn’t seem like the last two weeks has changed the view of the FOMC.

(Click on image to enlarge)

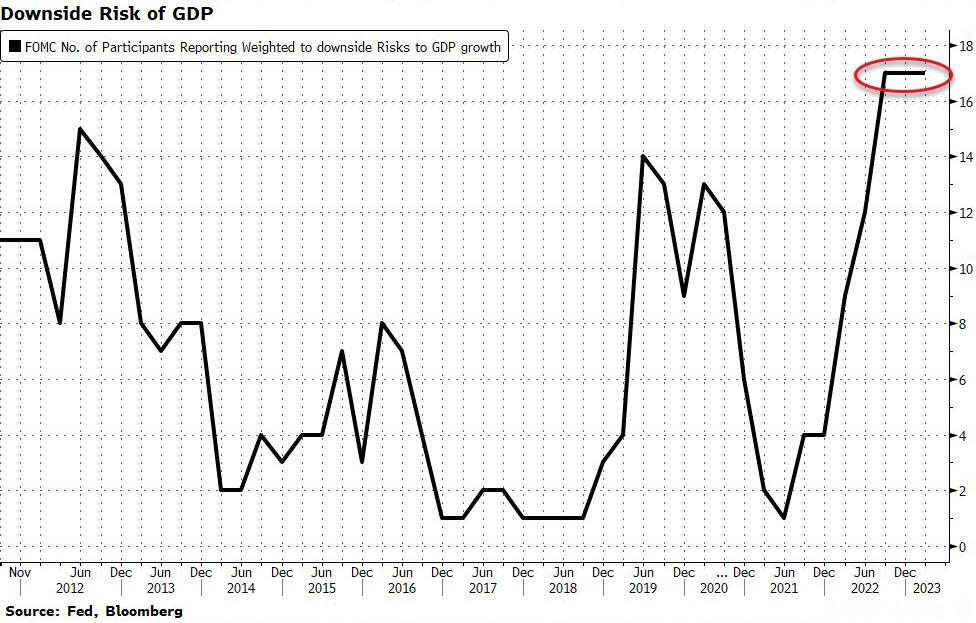

In contrast with less concern about inflation, the number of policymakers who think the risk to the economy is on the downside remains at a record high.

(Click on image to enlarge)

See the full redline below...

More By This Author:

Futures Flat Ahead Of "Most Important Fed Decision Of 2023"Auto-Loan Denials Hit Six-Year High As Distress Cycle Shifts Into Gear

20Y Auction Sees Solid Demand Despite Jarring Treasury Volatility

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more