U.S. Major Indices Fail To Hold Onto Gains In 2018 Q1

Each candle on the following charts of the Dow 30, S&P 500, Nasdaq 100 and Russell 2000 Indices represents a period of one quarter of one year.

Buyers tested the waters above the highs of 2017, but were not able to hold those gains as they received little to no support to advance any further, and even gave up most of them, by the close of Q1 of 2018, with the exception of the NDX (which held above last year's close).

(Click on image to enlarge)

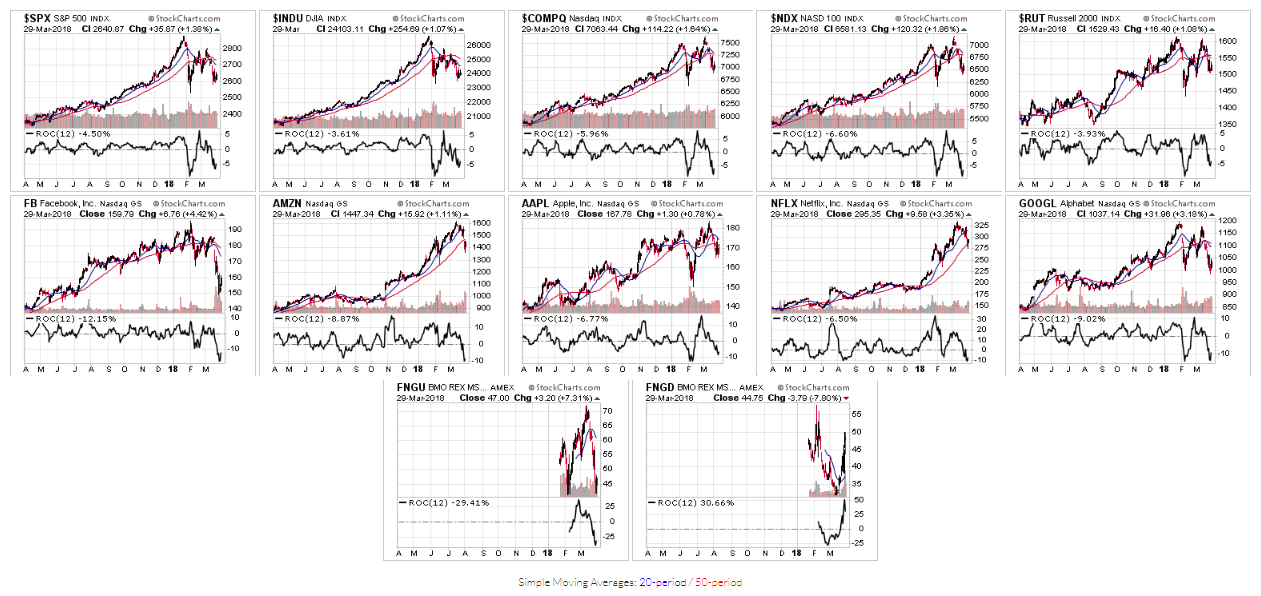

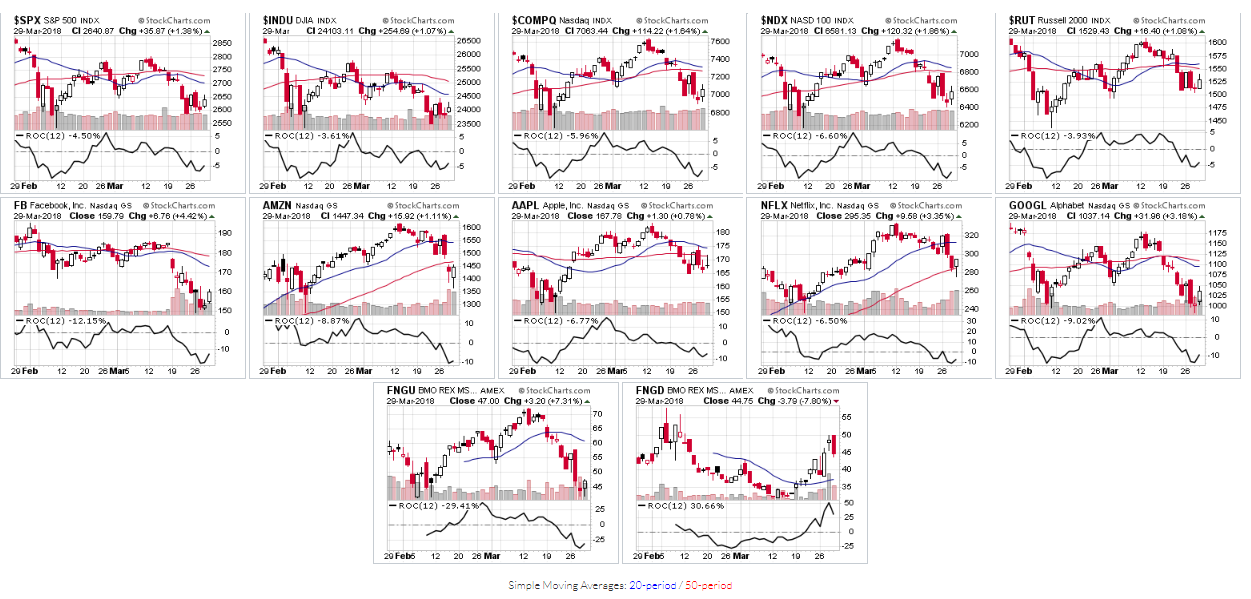

The following 1-year daily and 2-month charts of the SPX, DJI, COMP, NDX, RUT, 5 FAANGs, FNGU & FNGD show their price relative to their 50-day MA (red), as well as the Rate-of-change technical indicator.

For the most part, the FAANGs have been the powerhouse of the Technology group and have kept the NDX in positive territory for the year, so far. However, those have been weakening considerably, especially FB and GOOG.

I first wrote about FNGU and FNGD here (two recent 3x leveraged ETNs comprised of the FAANGs + BABA, BIDU, NVDA, TSLA & TWTR). Although they have yet to make a new all-time low (in the case of FNGU) or high (FNGD), their respective Rate-of-change indicators have...suggesting that we'll see further volatility, wild price swings and weakness ahead for some or all of these stocks.

Further recent comments regarding FB, AMZN, NFLX, TSLA and TWTR can be read at this link to my recent articles on all of them.

(Click on image to enlarge)

(Click on image to enlarge)

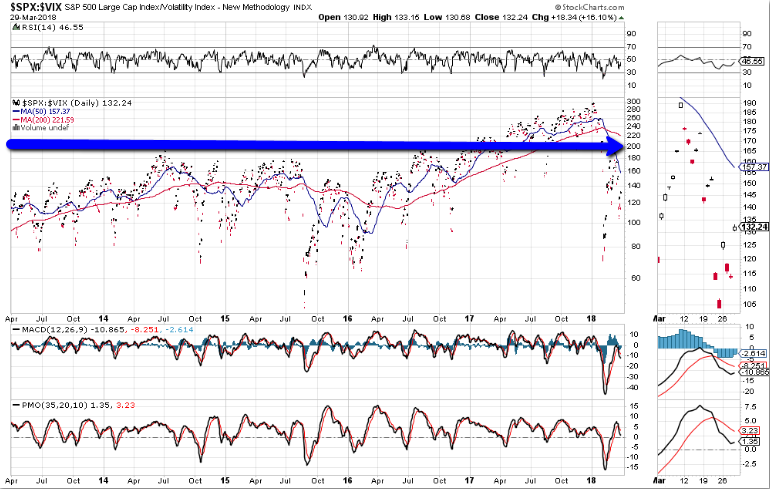

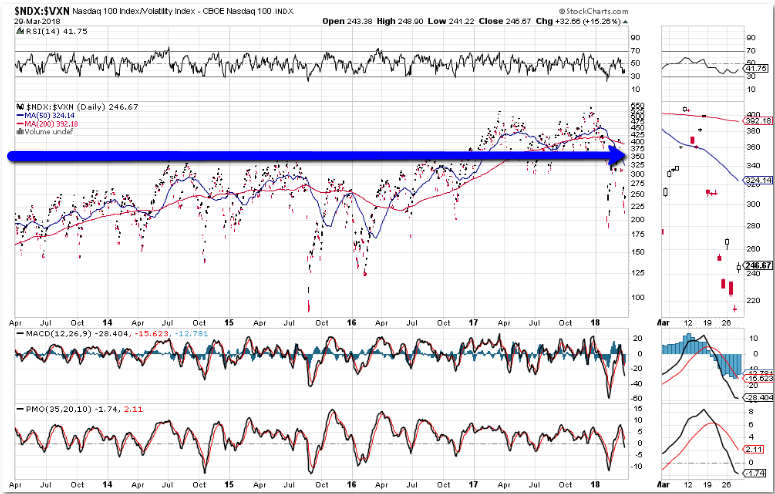

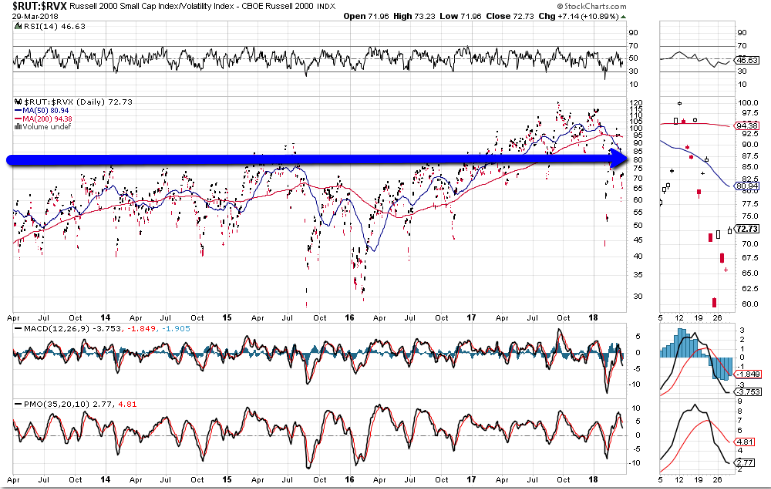

The following three daily charts of the SPX:VIX, NDX:VXN and RUT:RVX ratios show that all of them are still trading beneath their respective major resistance levels (200, 350 and 80), and are still trading under the bearish influences of their respective moving average Death Cross formations, as well as "SELL" signals on their RSI, MACD and PMO technical indicators.

We'll continue to see some wild swings made in the coming weeks and volatility will remain elevated until:

- all three ratios, not only climb back above, but also hold above these resistance levels,

- all three technical indicators reverse and form new "BUY" signals, and

- the bearish Death Cross is reversed to a bullish Golden Cross.

In summary, volatility is still very much alive. Watch the Technology sector and these three ratios as leading indicators as to whether or not, and to what extent, they may influence the overall equity market sentiment and direction for Q2.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

I'm actually a bit surprised by the weakness seen in $GOOG as their fundamentals are still in place and going strong. They are also developing a lucrative range of investments ranging from self driving tech to robotics, This differs significantly from $FB despite the fact that both companies are in the business of customer data.

Could be that the perception of its ties to customer data is weighing more negatively, at the moment, than on its other business pursuits...we'll see if that escalates or abates...either way, I think volatility will remain for awhile.