US Job Market

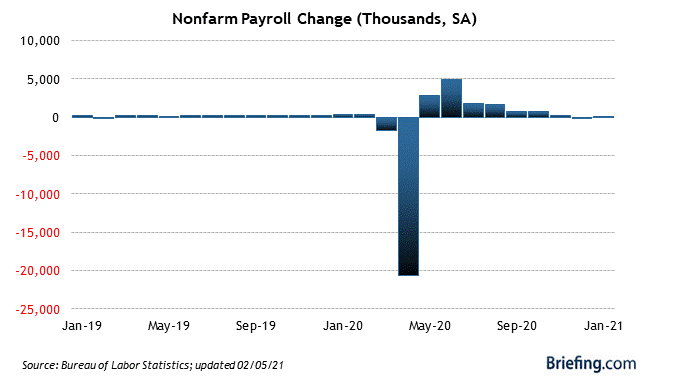

“The magnitude of job loss in March and April 2020 had no precedent since the end of World War II. Early in the crisis, many expressed hope that, with government support, employers and employees could quickly return to pre-pandemic employment arrangements. However, as the COVID-19 crisis continues, more employer–employee bonds break, amplifying the economic and societal damage.” (BLS, Employment recovery in the wake of the COVID-19 pandemic, Dec. 2020)

“At the beginning of this recession, unlike earlier recessions, a large majority of unemployed workers expected to be recalled to their jobs, and many were. Such recalls powered a rapid but partial recovery from May through the summer. However, the recovery has now slowed, and many temporary layoffs have become permanent. As the pandemic has continued, employment bonds between employers and their furloughed workers have weakened. The process of matching unemployed workers to new employers is much slower than recalling them to their old jobs. These factors suggest future employment recovery might be slow.” (BLS, Employment recovery in the wake of the COVID-19 pandemic, Dec. 2020)

Even though the US job market outlook is looking a bit brighter because of the expanding vaccine rollout, the fact that there is so much ground to be made up suggests that the case for a strong fiscal stimulus remains quite compelling.

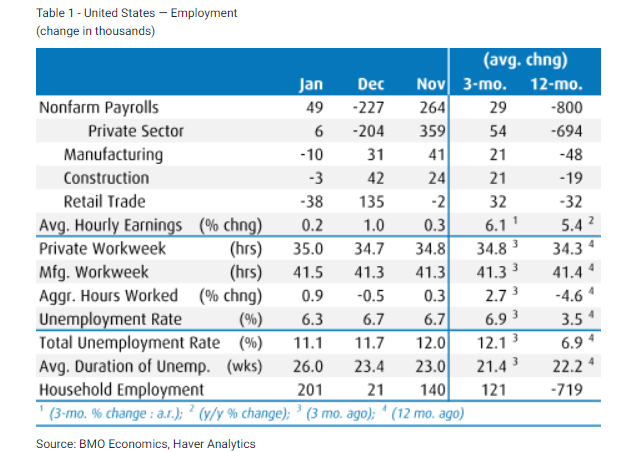

Since the peak of the job market last February, total payroll employment in the US has declined by 9.9 million workers or 6.5%, with 3.9 million, or almost 40%, of the losses centered in the leisure and hospitality sectors. As well, the number of permanent job losers remains at an alarmingly high of 3.5 million, compared with the 2.2 million back in February of 2019.

The US experienced some large-scale job cuts towards the end of last year, and even though the January payroll gain in January was quite modest, nonetheless it could be foreshadowing a stronger job market ahead since the vaccine rollout is quickening.

It is also interesting to note that the somewhat more volatile survey of households has recorded five consecutive months of employment gains, with a gain of 201,000 recorded in January.

In contrast, the payroll survey recorded a slim 49,000 new jobs in January reflecting both an increase in the number of employed and a reduction in the labor force participation rate. The unemployment rate in January fell slightly to 6.3% versus 6.7% in December.

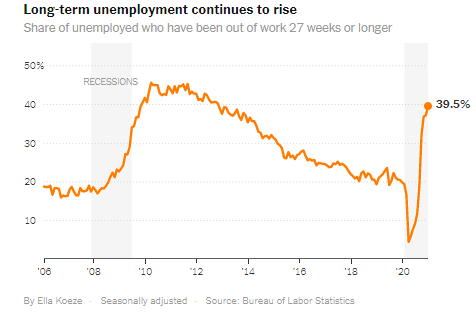

Nonetheless, long-term unemployed workers continue to account for an increasingly larger share of total unemployment (39.5%), underscoring the fact that there will be some longer-term negatives facing American workers once the pandemic is over.

The experience of past recessions, and even the deep Great recession of 2008-09, is that it is harder to re-employ workers than it is to lay them off.

In closing, the pandemic recession is likely to leave some permanent scars on the American job market. Accordingly, the weak employment figures in January strengthen the case for another sizeable pandemic relief package.

President Biden has proposed a $1.9 trillion package, but his critics claim that the package is too large, and many Republicans argue that the government should hold off with more assistance and wait until the December $900 billion aid package filters through the economy. Yikes!.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

The indiscriminate and random flinging of huge amounts of cash is seldom a wise choice, but typical of the liberal mindset. The results in the past have always been the same, with a huge burden of debt placed on the backs of those not yet born, and rampant inflation devouring the assets of the many who are unable to magicly increase their incomes. The painful reality is that inflation damages a whole lot of people quite a lot, while profiting those who least need the benefit.

Unfortunately none of the included images appear in my copy of this post, nor the captions.

But thanks for some interesting data.