US Dollar Index: Could A Double Bottom On The Weekly Chart Drive The DXY To 111.000?

Image Source: Pixabay

- The US Dollar Index found bids near the year-to-date lows at 100.788.

- US dollar bulls must retake the 104.000 level to challenge the year-to-date high at 105.883 and maintain a double-bottom approach.

- Contrarily, US dollar bears must reclaim the 100.788 level to test the 200-week EMA at around 99.117.

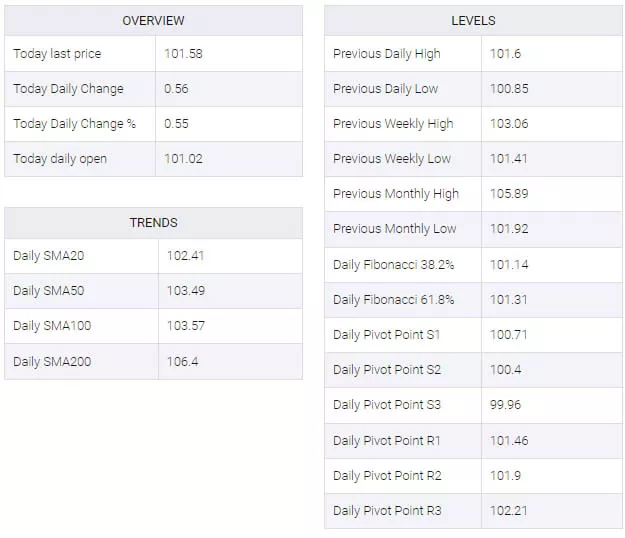

The US Dollar Index (DXY), a basket of six currencies against a basket of peers, snapped three days of straight losses and climbed 0.56% as the New York session ended on Friday. The DXY exchanged hands at around 101.570 as a bullish engulfing candle pattern emerged in the daily chart.

US Dollar Index Price Action

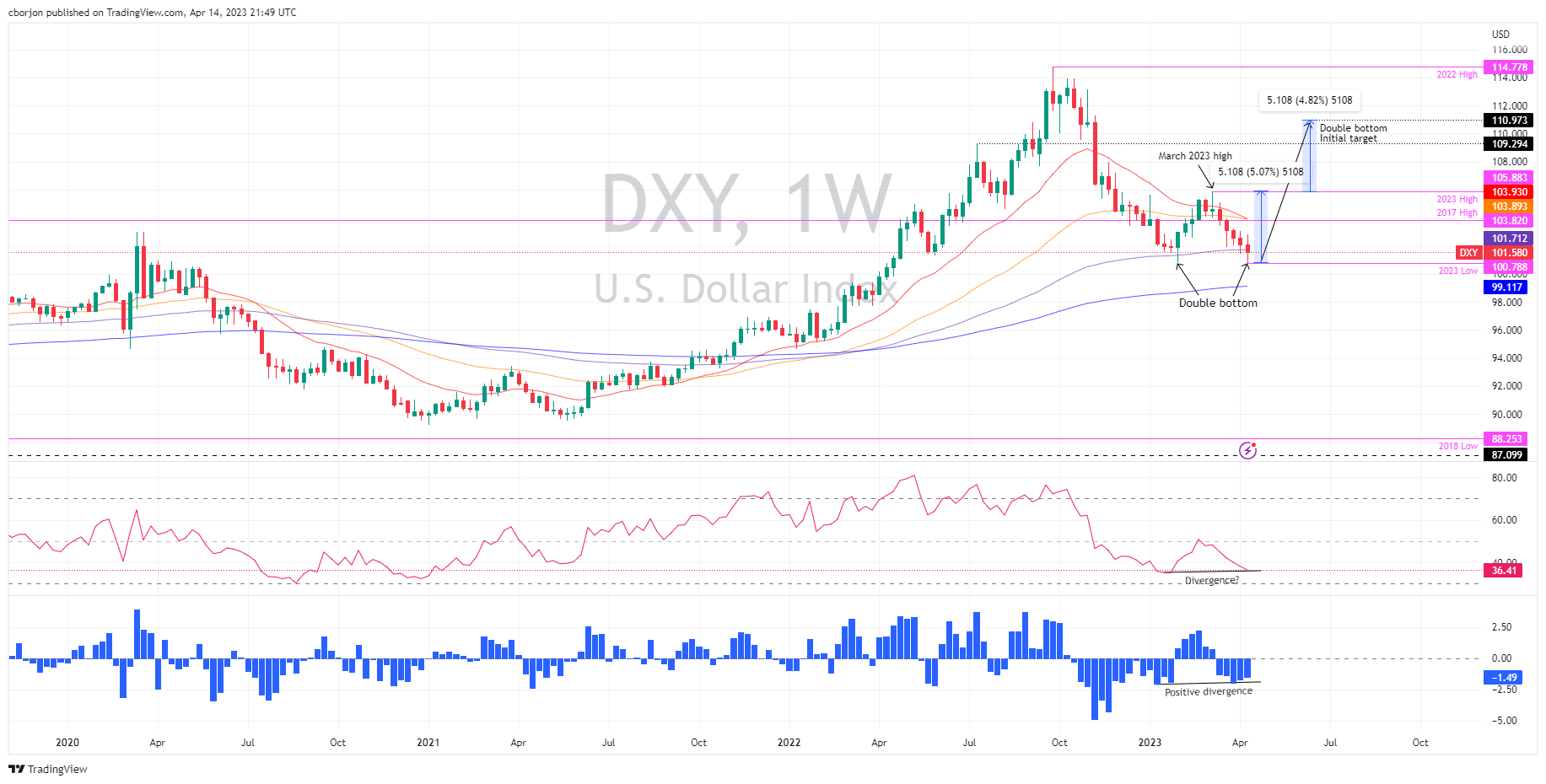

From a weekly chart perspective, the US Dollar Index held an upward bias over the week. The DXY’s fall from the September 2022 highs at 114.728 towards the 2023 lows of 100.788 bottomed around the latter, depicting a double bottom formation.

Furthermore, the 200-week Exponential Moving Average (EMA) was seen sitting comfortably at around 99.117. The Relative Strength Index (RSI) has been resting in bearish territory, yet it was bottoming higher during the recent dip. The Rate of Change (RoC) also displays that selling pressure has been waning, which could pave the way for further upside.

Upside risks in the DXY lie at the confluence of the 50- and 20-week EMAs, around 103.893-103.930. A break above would expose the 2023 high at 105.883, the last peak, before clearing the way toward 111.000, the double-bottom initial target.

Conversely, the US Dollar Index’s first support would be seen at 100.788. A dip below that point could clear the way toward the 200-week EMA at 99.117.

US Dollar Index Weekly Chart

US Dollar Index Technical Levels

More By This Author:

Pound Sterling Forecast: GBP/USD Tumbled Below 1.2450 As US Dollar Strengthened

Inflation And FOMC Minutes Still Favor Further Tightening – UOB

Crude Oil Futures: Outlook Is Expected To Remain Bullish

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more