Pound Sterling Forecast: GBP/USD Tumbled Below 1.2450 As US Dollar Strengthened

Image Source: Pexels

- The US dollar rose across the board after the release of US data.

- US bond yields and stocks rose despite weaker economic figures.

- The GBP/USD currency pair erased most of the week’s gains on Friday.

The US dollar was seen rising sharply on Friday, as it trimmed weekly losses after the release of the latest US economic data. The GBP/USD currency pair fell almost a hundred pips, as it was seen trading at around 1.2445.

The pair changed its course after reaching a fresh multi-month high at 1.2546. From the top it dropped more than a hundred pips, and it bottomed after Wall Street’s opening bell at around 1.2435.

US Dollar Shines Despite US Data

The US dollar was up across the board, ending a three-day negative streak and recovering from the lowest levels seen in months. Higher US yields were seen supporting the greenback on Friday. The US 10-year yield reached 3.50% and the 2-year was at 4.09%, up by 2.90% for the day.

Data from the US came in mixed. Retail Sales dropped by 1% in March, more than the 0.4% expected. Industrial Production expanded by 0.4%, more than the 0.2% forecast. The University of Michigan’s Consumer Sentiment Index improved in April to 63.5 from 62.

The key support to the dollar came from Fed talk. Federal Reserve Governor Christopher Waller said on Friday that the central bank has not made much progress on the inflation goal, and insisted rates need to rise further. In an interview with CNBC, Chicago Fed President Austan Goolsbee argued that a “mild recession” is definitively on the table as a possibility.

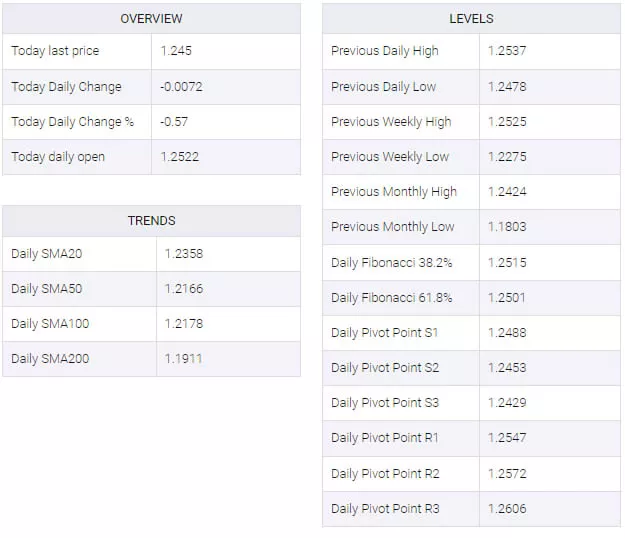

GBP/USD Technical Levels

More By This Author:

Inflation And FOMC Minutes Still Favor Further Tightening – UOBCrude Oil Futures: Outlook Is Expected To Remain Bullish

USD/JPY Struggles For A Firm Intraday Direction, Flat-lines Around Mid-132.00s

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more