U.S. Bank Deposits Suffer Biggest Weekly Decline Since 9/11 As Tax Man Cometh

Image Source: Pexels

It's that time of year again and US bank deposits sure showed it...

While money-market funds' total assets fell over $100BN, on a non-seasonally-adjusted (NSA) basis, total bank deposits crashed by a stunning $258BN as Tax-Day cometh. That is considerably more than the $152BN decline last year but less than the $336BN plunge in 2022...

Source: Bloomberg

This makes some sense though as the Treasury Cash Balance rose by around the same amount as taxpayers did their duty and paid their 'fair share'...

Source: Bloomberg

However, on a seasonally adjusted (SA) basis (i.e. adjusted by the PhDs for the fact that we get large deposit outflows at this time of year to pay taxes), total deposits dropped $133BN - the biggest weekly plunge (SA) since 9/11!

Source: Bloomberg

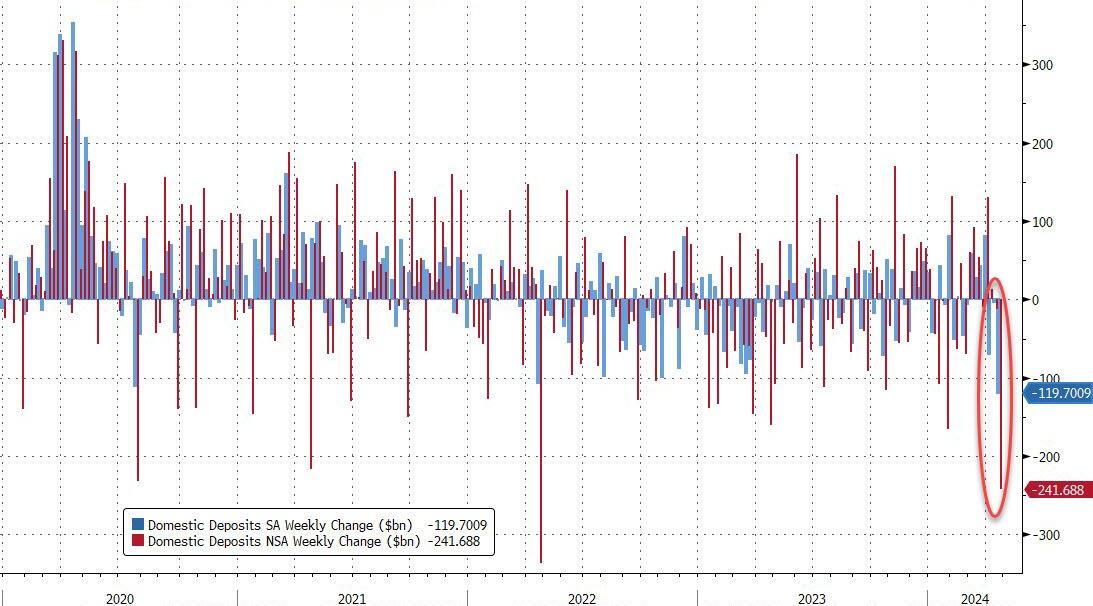

Excluding foreign deposits, domestic bank deposits plunged on both an SA (-$119BN: Large banks -$99BN, Small banks -$21BN) and NSA (-$241BN: Large banks -$188BN, Small banks -$53BN) basis...

Source: Bloomberg

For context, that is the largest weekly drop in SA deposits since 9/11 and the largest NSA deposit drop since April 2022 (Tax Day).

Interestingly, despite the deposit dump, loan volumes increased last week with large banks adding $5.8BN and small banks adding $2.5BN...

Source: Bloomberg

All of which pushed the un-bailed-out 'Small banks' back into 'crisis mode'(red line below constraint absent the $126BN still in the BTFP pot at The Fed which is slowly being unwound)...

Source: Bloomberg

And so, with rate cuts off the table - and tapering QT very much back on - we wonder just how much jockeying between Janet (Yellen) and Jerome (Powell) is going on ahead of next week's QRA and FOMC news...

More By This Author:

Fed's Favorite Inflation Indicator Prints Hotter-Than-Expected As Savings Rate PlungesMicrosoft Surges As AI-Growth Drives Across-The-Board Beat

Soggy 7Y Auction Prices On The Screws; Foreign Demand Sags Amid Surge In Directs

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more