Updated Business Cycle Indicators, Including Employment

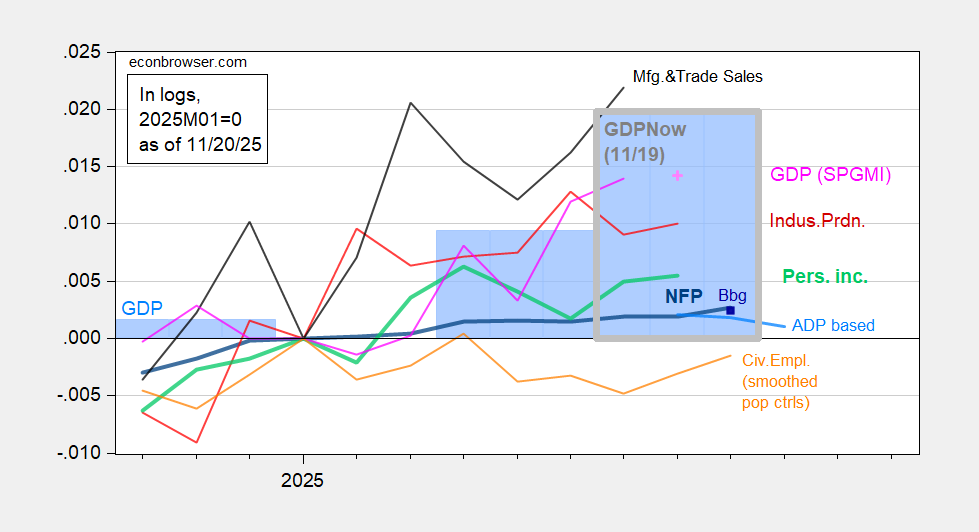

Incorporating employment (including implied benchmark NFP):

(Click on image to enlarge)

Figure 1: Implied NFP preliminary benchmark revision (bold blue), ADP based author’s estimate (light blue), Bloomberg consensus employment for implied preliminary benchmark, (blue square), civilian employment with smoothed population controls (bold orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), estimate of monthly GDP based on coincident index (pink +), GDP (blue bars), GDP from GDPNow of 11/19 (blue bar, gray outline), all log normalized to 2025M04=0. Source: BLS via FRED, Federal Reserve, BEA 2025Q2 third release, Atlanta Fed, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (9/2/2025 release), and author’s calculations.

My nowcasts using ADP to interpolate private NFP indicate a drop in employment. Goldman Sachs estimates +85K for October, which is closer to actual (+119K). However, downward revisions to the previous two months data (40K) meant the change on what was previously thought was +81.

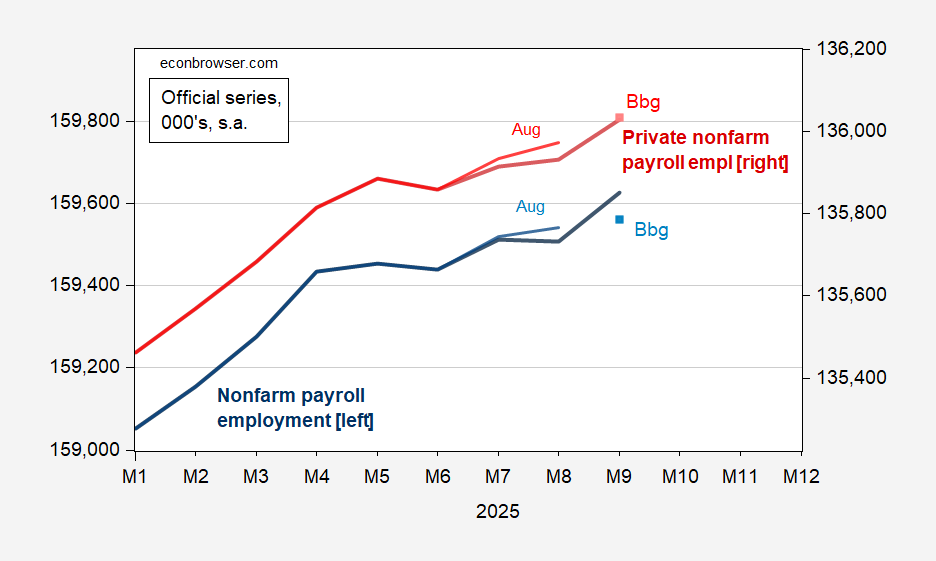

I zoom in to this August as well as September employment data, to show the impact of revisions.

(Click on image to enlarge)

Figure 2: Nonfarm payroll employment (September release official) (dark blue, left log scale), NFP employment (August release official) (blue, left log scale), Bloomberg consensus (light blue square, left log scale), private nonfarm payroll employment (September release official) (dark red, right log scale), NFP employment (August release official) (red, right log scale), Bloomberg consensus (light red square, right log scale), all in 000’s, s.a. Bloomberg levels calculated using August level and Bloomberg consensus change. Source: BLS, Bloomberg, and author’s calculations.

Consensus private NFP essentially hit the mark, while overall NFP was an undershoot. This suggests greater difficulty tracking government employment.

Note that the big change in (Federal) government employment should be incorporated into October release numbers; however, we won’t get those CES figures until the November release date. My guess on a net drop in total NFP relative to September remains.

More By This Author:

Business Cycle Indicators and NowcastsRejoinder To Comments On House Price Affordability

S&P 500 And Bitcoin: Past Peak?