Unprecedented Fear Reset: What Does It Mean For Stocks?

This Has Never Occurred Before

While reading earlier this week, the sentence below, from Bloomberg, seemed to jump off the page:

The VIX has dropped more than 10 percent in each of the past three days, the first time that’s ever happened.

Think about that…the VIX has been around for almost 25 years. The VIX has lived through the Asian financial crisis, Russian financial crisis, downfall of Long-Term Capital Management, the dot-com boom and bust, housing and mortgage boom and bust, 2008 stock market meltdown, and European financial crisis. Therefore, an unprecedented move in the VIX begs the question…what happened in the stock market the last time we saw something similar?

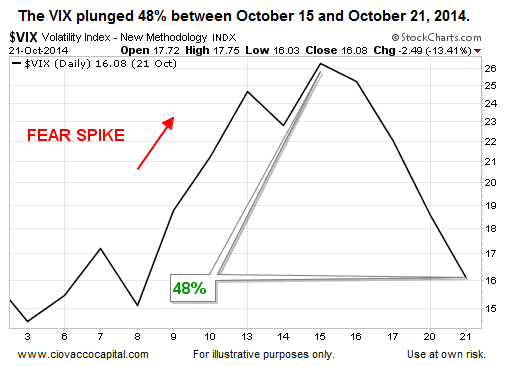

Sharpest VIX Drop Since 2009

According to Bloomberg, the VIX just experienced its sharpest drop since 2009:

After surging to a 28-month high last week, the Chicago Board Options Exchange Volatility Index (VIX) has fallen at least a point a day starting Oct. 16, reflecting a dissipation of investor concern that hasn’t occurred in five years (2009).

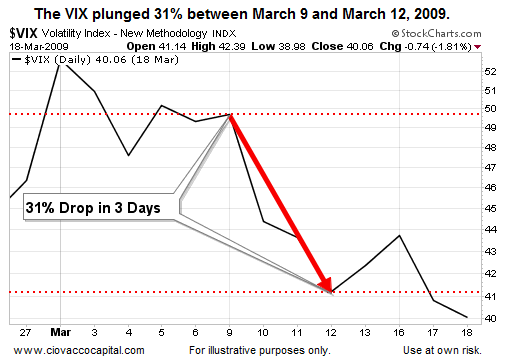

If you are unfamiliar with the VIX, in general terms it tends to go up as the “fear of bad things happening” increases. As we know, there was quite a bit of fear floating around in 2008-2009. As shown below, after a spike in fear in late February 2009, the VIX plunged 31% in three sessions, indicating a rapid reduction in investor concerns.

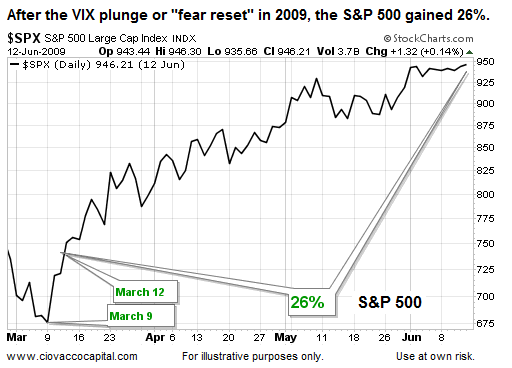

What happened after the VIX dropped rapidly in March 2009? The S&P took off like a rocket.

Recent Fear Reset Was Bigger Than 2009

The recent unprecedented plunge in investor fear (concerns about future market volatility) was even larger than the plunge in 2009 that preceded a 26% rise in the S&P 500.

If investors were concerned about the possibility of “really bad things happening” last week and now those concerns have dropped in a manner never seen before, then it stands to reason that many raised cash when fear was high and may be looking to redeploy cash now that fear has dropped, which is exactly what happened in 2009 as stocks gained 26%. This is not a prediction; it is simply an educational exercise to understand possibilities and probabilities. It may also serve to balance many of the “a new bear market has started” articles. Our approach, as always, is to see how things unfold and adjust as needed, rather than predict.

Similar Equity Pop Occurred In 2011

When the VIX plunged recently stocks also experienced a rare and extremely sharp reversal. FromReuters/Yahoo Finance:

With the session’s advance [October 22], the S&P 500 is on track for the biggest five-day rally since December 2011.

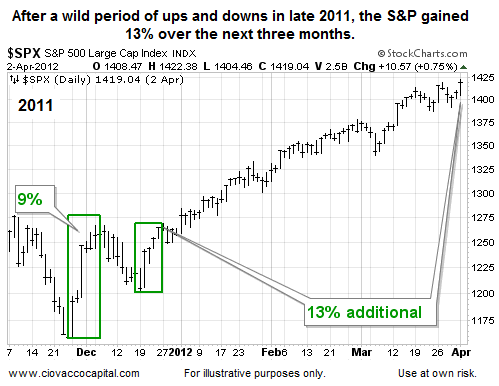

While it is true that sharp rallies in stocks can occur within the context of a correction (see flash crash period) and bear markets (2008), they can also occur at the early stages of a new and sustained rally. What happened after the two big multiple-day rallies in 2011? See below - Note: One more scare occurred between the 9% rally and 13% multiple-month rally, telling us to remain open to another scare in 2014.

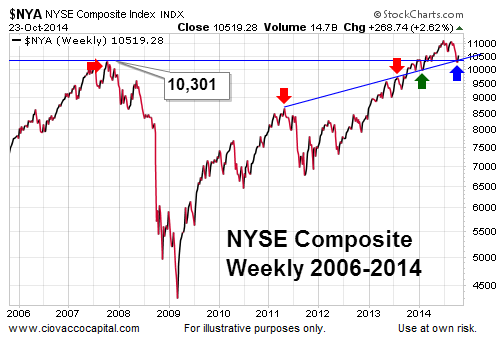

Long-Term Retest Aligns With Bullish Possibilities

Is there anything else that aligns with the “keep an open mind about gains in the weeks ahead” case? Yes, the bullish breakout and retest described on October 14 is still holding as of Thursday’s close.

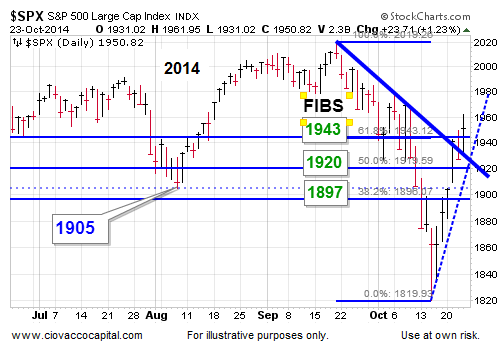

Fibonacci Also Keeps Bullish Door Open

Fibonacci was born around 1170 and used what we now call “Fibonacci numbers” as an example in the Liber Abaci. In the stock market, it is common for corrections to experience countertrend rallies that retrace 38.2%, 50.0%, or 61.8% of the recent decline and then resume the downtrend and go on to make a lower low. On October 23, the S&P 500 closed above all three major retracement levels shown below, which tells us the odds of stocks going on to make a lower low are lower today than they were a week ago. Said another way, the current move looks more like a new uptrend today than it did last week (odds-wise). Keep in mind, even under that scenario stocks could “retest” and remain above the recent low.

Investment Implications – The Weight Of The Evidence

Does all this mean stocks are out of the correction woods? No, the evidence (some anecdotal) simply tells us to keep an open mind about better than expected outcomes in the stock market over the coming weeks and months. Even under the most bullish scenario, another scare (decline) is well within historical and market norms. Our market model has called for two incremental adds to the equity side (SPY) of our portfolios in recent sessions, based on the improvement in the hard and observable evidence. The market’s mixed profile still warrants our cash and bond holdings as risk offsets.

How Does All This Impact The Model?

The direct impact inside the model is minimal. How will we use it? If (emphasis on IF) the markets continue to improve over the coming days and weeks, the recent unprecedented move in the VIX, clearing of the FIBS, and successful retest of the long-term NYSE breakout (if it holds), will allow us to consider continuing to ratchet up our equity exposure at the maximum rate allowable based on the rules and hard data. The model, evidence, and rules always and still will govern our decisions, but external evidence can assist with intraweek moves and moves within the model’s allowable bounds.

Bearish Outcomes Remain On Scenario Table

Under the lower low, failed breakout, “give back the FIBS” scenario, the rules/model/evidence will guide us just as they did during the recent correction. We will enter Friday’s session with an unbiased, flexible, and open mind.

Disclosure: None.

Agreed.

This looks like some coordinated move more than a broad relief signal. After all, what changed so dramatically? Did the Fed tell a select few they would start a new round of QE? Did Putin get a heart attack? Did ISIS go back to the dark ages where their philosophies fit with that part of the world? In reality dramatic changes with no clear rationality need to be taken with a chunk of salt and a lot of research before relying on them.