Unemployment Insurance Claims, Layoffs, Recession

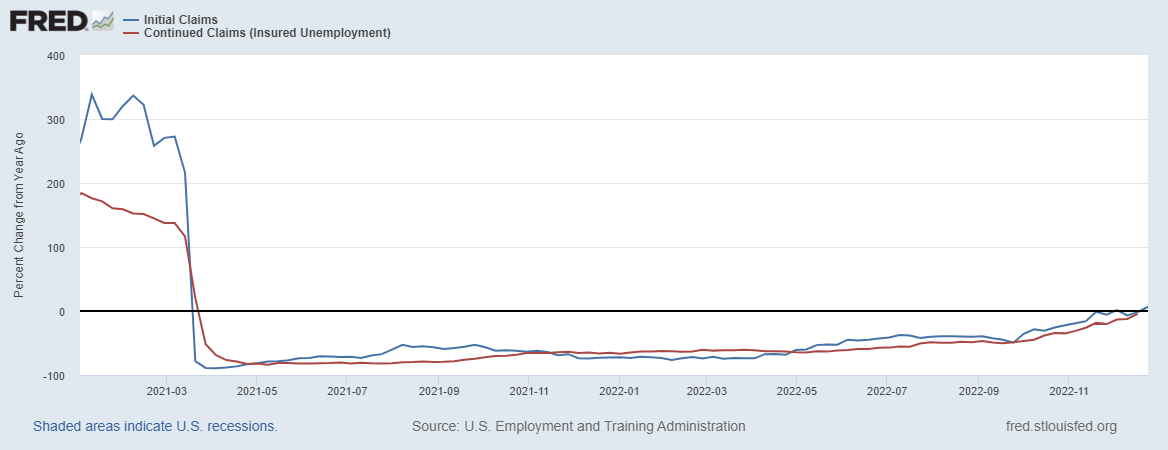

Initial claims hit expectations while continuing claims surprise on the upside (1710K vs 1686K consensus).

I was recently asked — in light of these numbers — what the high profile layoff announcements meant for the economy, now and going forward. My answers — not much in terms of the short term horizon, and secondly, expect more layoffs as the economy slows further.

Here’s my reasoning. First, initial claims might be taken as an indicator of layoffs — but if so, they are stil remarkably small relatively speaking (1.7 million vs. a nonfarm payroll employment level of about 153 million, or about 0.6 percent), and one has to take into account the flows going both ways, most importantly hires. Second, many of these high profile announcements are in the information and finance sector. For information, it’s important to recognize there has been an unprecedented boom in IT-related hiring, so some re-trenchment for specific firms is unsurprising (see discussion from GS). In fact, information sector hiring continued to rise through November according to the last employment situation release (up 5.6% over pre-pandemic peak).

There is another issue of whether initial claims correlates well with layoffs (this will change with coverage, which has changed over the course of the pandemic and afterward). With respect to initial claims and layoffs as measured by JOLTS, one can see there’s a substantial difference between the series.

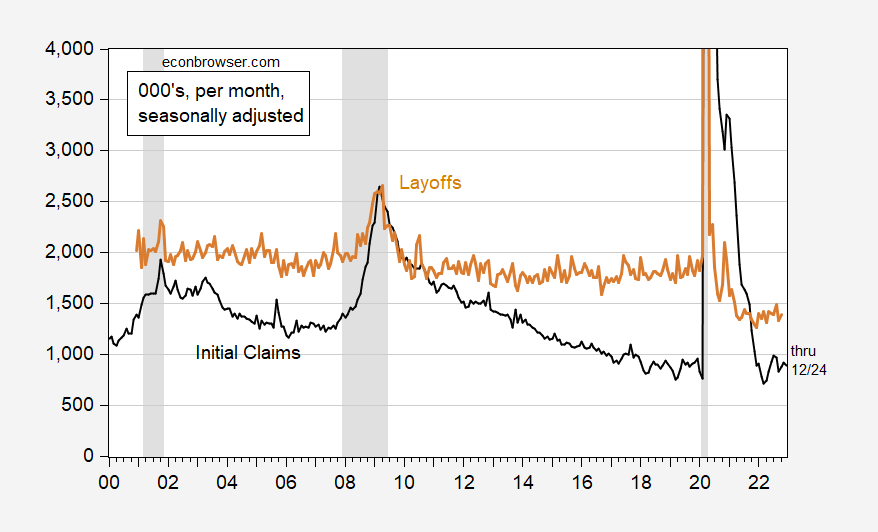

Figure 1: Initial claims, average of weekly series adjusted to monthly rate (black), and layoffs and discharges from JOLTS (tan), both in 000’s, seasonally adjusted. December 2022 observation for Initial Claims is for December ending 12/24. NBER defined peak-to-trough recession dates shaded gray. Source: DoL via FRED, BLS, NBER and author’s calculations.

While the two series had a high correlation pre-pandemic, they have not had a particularly high correlation post-pandemic. Hence, one should be careful about making inferences regarding layoffs using the initial claims data.

Both initial claims and layoffs (through October) are near record low levels. For a recession, we want to see hirings down and layoffs up. Typically hirings decline months, perhaps a year or more, before the recession (as dated by the NBER BCDC) begins. Here is the picture from JOLTS.

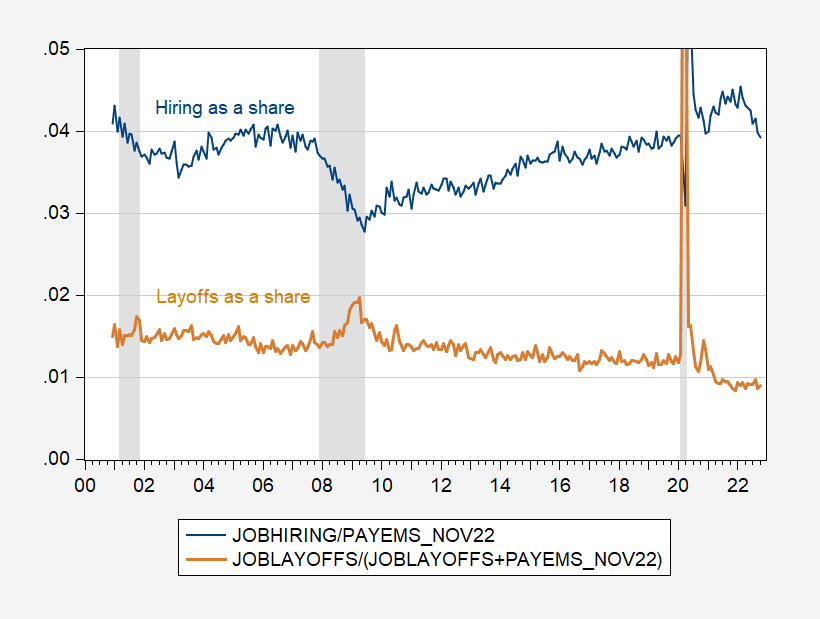

Figure 2: Hiring as a share of nonfarm payroll employment (blue), and layoffs as a share of layoffs plus nonfarm payroll employment (tan), all seasonally adjusted. NBER defined peak-to-trough recession dates shaded gray. Source: DoL via FRED, BLS, NBER and author’s calculations.

While hiring is declining, this is from a spectacular peak. As noted in Breyers et al. (2011), in the pre-pandemic era, employment growth slows because of hiring declines, much before layoffs.

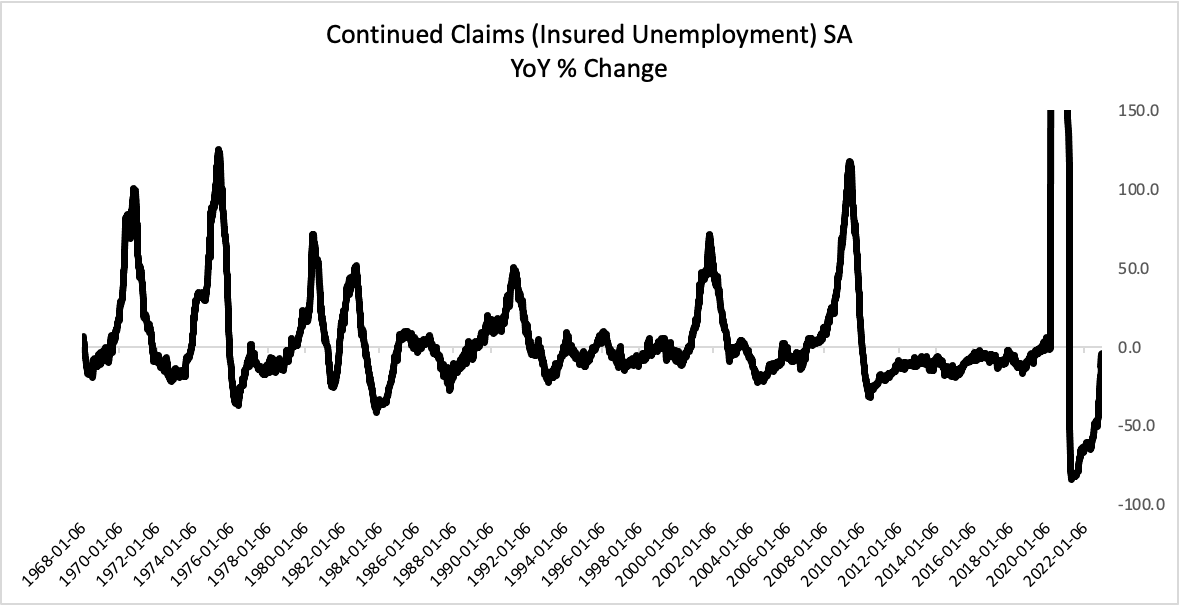

What’s this mean for recession? My coauthor Rashad Ahmed points out to me that each time continuing claims y/y growth bumps up (eyeballing, around 10%), in a recession. We’re just hitting -4.6% — essentially zero based on the variance — as of week ending 12/17.

Here’s a picture he provided.

Source: Rashad Ahmed, communication, 12/29/2022.

And here’s a detail on initial claims and continuing claims (tan line).

(Click on image to enlarge)

More By This Author:

“Foreign Direct Investment Under Uncertainty” Up To 2019China Saber-Rattles (Again)

Goods Trade Balance Improves In November