Two Pictures From The Financial Markets

Usually, the Friday after Thanksgiving holiday is a quiet trading day. This Friday, there was lots of news to react to.

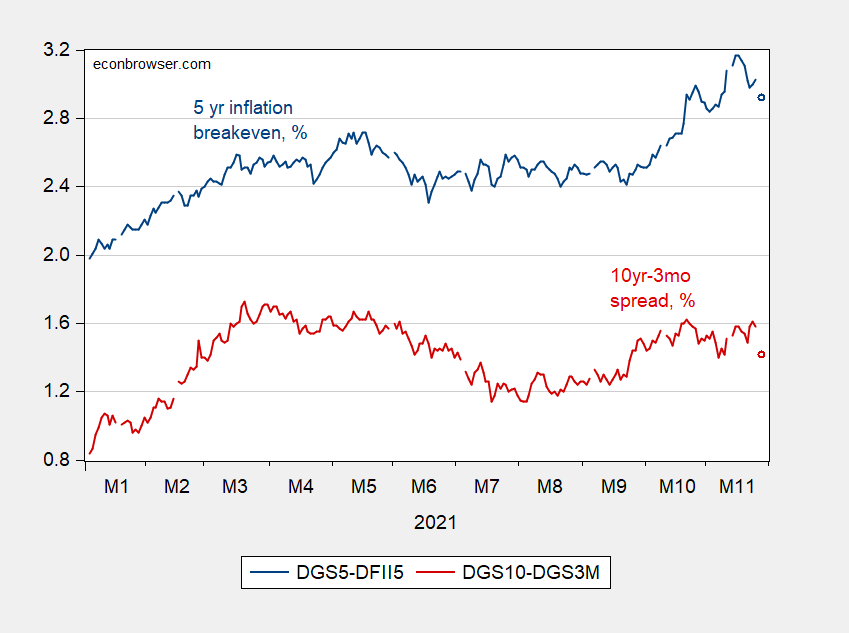

Figure 1: Five year inflation breakeven, calculated as 5 year Treasury yield minus 5 year TIPS (blue), and ten year – three month Treasury spread (red). Source: Treasury via FRED, author’s calculations.

The inflation breakeven (5 year) has fallen (although this spread is not adjusted for risk and liquidity premia), while the yield curve has flattened, suggesting slowing growth.

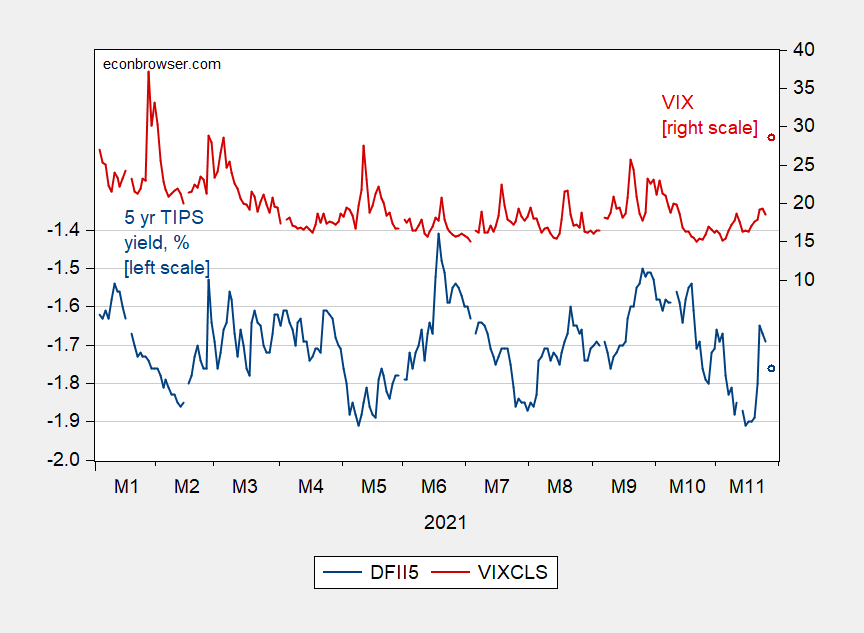

Consistent with downwardly revised growth prospects — for now — real rates have fallen, while implied uncertainty has risen.

Figure 2: Five year TIPS yield (blue, left scale), and VIX (red, right scale). Source: Treasury, CBOE both via FRED.

Disclosure: None.