Two Forces That Could Send The Stock Market Spiraling Down

Image Source: Pixabay

The spike in the volume (supply) and the volatility last week due to Powell testifying in congress and the collapse of the banks negated the bullish sentiment. Watch the video below to find out how these two forces could threaten to sink the S&P 500 and the key levels for short-term swing trading opportunities.

Video Length: 00:10:53

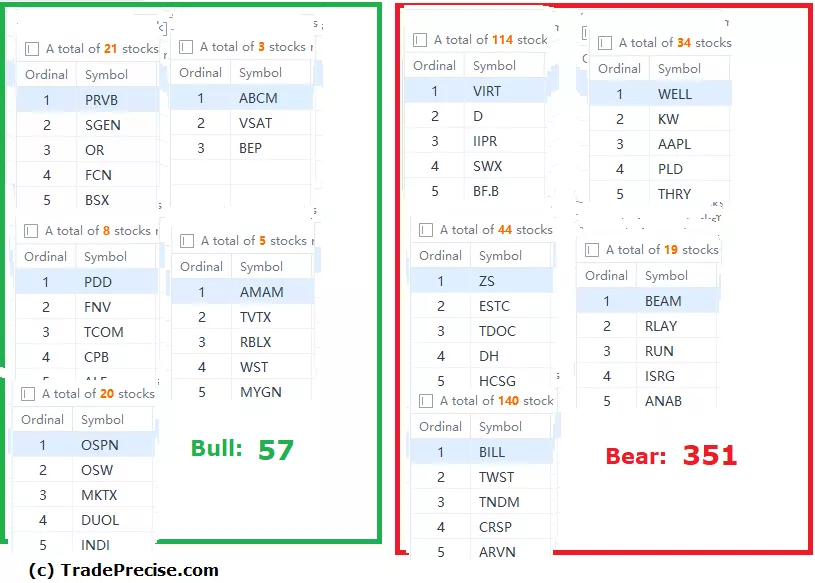

The bullish setup vs. the bearish setup is 57 to 351 from the screenshot of my stock screener below pointing to a flip in the market sentiment to bearish.

The damage to the stock market breadth will take time to recover. Should the market sentiment improves, be patient to wait for the trade entry setup. The resume of the increasing supply with excessive volatility using the analog as discussed in the video above could see more weakness ahead in S&P 500. The video above is part of the latest Weekly Live Group Coaching Session (1.5 hours) on 14 Mar 2023.

More By This Author:

Healthy Market Pullback? The Critical Levels That Will Make Or Break

Is KE Holdings Heading For A Massive Breakthrough Or A Sudden Drop?

Hershey's: Breaking Records During A Recession?

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.