Healthy Market Pullback? The Critical Levels That Will Make Or Break

Image Source: Unsplash

After the strong impulsive upswing, a pullback is anticipated as hinted by the rejection of the supply zone in S&P 500.

Watch the video below to find out the key levels to watch out for a healthy pullback in S&P 500 using the Wyckoff method and when you should raise a red flag as an early warning.

Video Length: 00:10:04

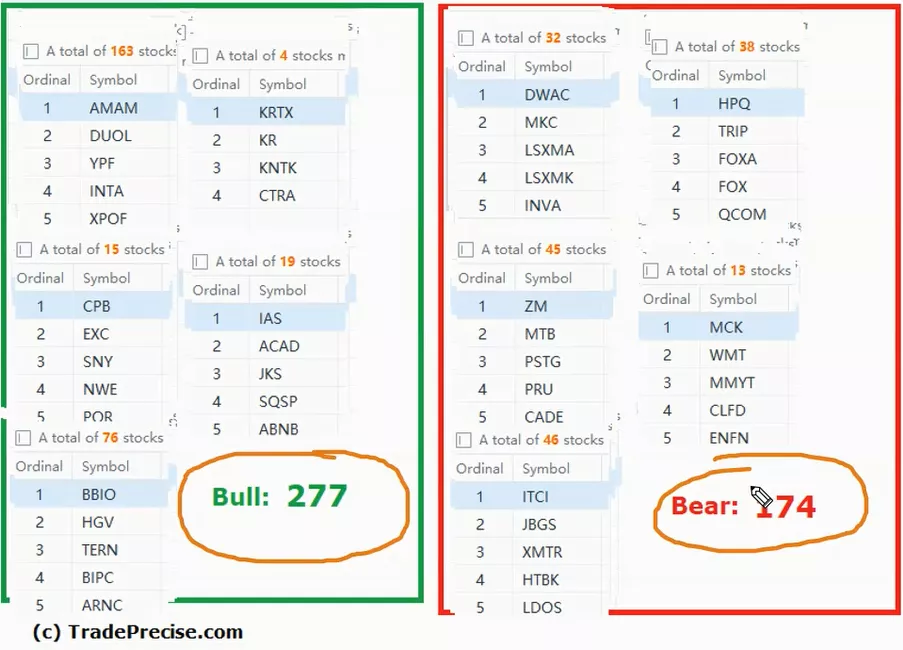

The bullish setup vs. the bearish setup is 277 to 174 from the screenshot of my stock screener below suggesting still a positive market environment. However should the market experience a pullback, it is essential to pay attention to the failure of the entry setup.

Pay attention to the critical levels that S&P 500 needs to hold as discussed in the video above before raising the red flag as an early warning. The video above is part of the latest Weekly Live Group Coaching Session (1.5 hours) on 7 Mar 2023.

More By This Author:

Is KE Holdings Heading For A Massive Breakthrough Or A Sudden Drop?

Hershey's: Breaking Records During A Recession?

Bounce Back Alert: Is The S&P 500 Ready To Make A Comeback On Exhaustion Of Selling Momentum?

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.