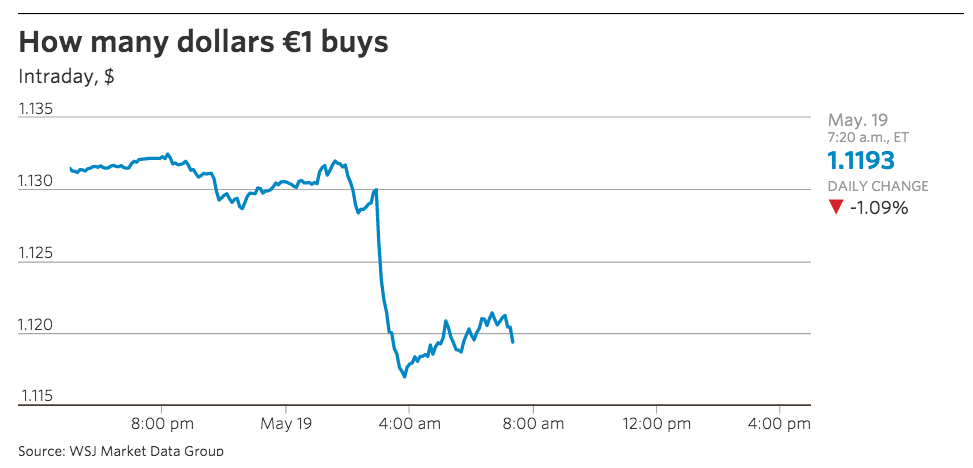

Tuesday: Euro Drops 1.5% As ECB Promises More Free Money

Bad news is great news!

The Greek talks have stalled, England's CPI is deflating, German GDP slipped to 0.3% in Q1 and German Investor Sentiment (ZEW) dove to a 5-month low, dropping over 20% in one month to 41.9. That and collapsing bond prices were the last straw for the ECB, who announced this morning they would "front-load" their $75Bn monthly bond-buying into May and June, to avoid having to bother over the holidays.

This is a fun way the ECB can double up on stimulus without SAYING they are doubling up on stimulus:

“Even though this is just front-loading, it is effectively an increase in the size of quantitative easing, even if just for a short period of time,” said Simon Derrick, a currency strategist at BNY Mellon. “It shows that within the existing framework, the ECB is willing and able to be incredibly flexible,” Mr. Derrick said.

Separately on Tuesday, Christian Noyer, the head of France’s central bank and a member of the ECB governing council, said the ECB was ready to go further if needed to meet its inflation target. “The purchase program will continue until the end of September 2016 and beyond if we do not see a sustained adjustment in the path of inflation,” he said.

Does anyone besides me think it's strange to announce more QE WHILE the markets are making record highs? Anyone???

We have indeed fully embraced the worst kind of Voodoo Economics, with the World's Central Banks creating endless supplies of money out of thin air by simply writing checks to buy bonds which enable the Sovereign nations to go endlessly into debt. There have been, so far, no consequences for this behavior and even countries like Greece, who have no possibility whatsoever of being able to pay off their debts, are lent more and more money.

As you can see from the chart, household debt and Government debt have climbed substantially in the past few years and Corporate debt is on the rise as well with Trillions of Dollars in additional debt accounting for about 250% of our GDP growth over the past 7 years. That's in-line with our over 300% Debt to GDP ratio and you can, indeed live high on the hog while maxing out your credit cards – it's one big party as long as you can keep making those minimum payments (and as long as they keep expanding your credit line).

That's what we're doing folks, we (the entire Planet Earth) are going further and further into debt and our Banker, the Central Banksters, are very happy to keep lending us money. Not only that, but they are lending it to us at the "teaser" rates of 2% or less, which makes those debts seem like a no-brainer, don't they? Every week it's like getting another credit card offer in the mail when another Central Bank says they will increase or extend their QE offers – if you act now!

Meanwhile, the Fundamentals remain in free-fall:

If this doesn't bother you (how can this not bother you?), then go ahead and buy equities. We came up with a lovely play on the S&P ETF(SPY) in yesterday morning's Live Member Chat Room which will double your money if the S&P climbs 50% higher, to 3,000 by Jan, 2017.

As I mentioned last week, we got a bit too bearish in our agnostic Short-Term Portfolio so we looked to add more longs to our bullish Long-Term Portfolio to balance things out. It's a very sensible way to play the markets! If the Central Banksters are going to insist on pouring money onto us, we'll stand outside with buckets and collect the cash. The difference is we're quick to convert our ill-gotten gains back to cash because we KNOW they are ill-gotten and we KNOW there will, one day, be a hell of bill to pay.

Last Wednesday I told you:

By next week, at least 80% of those remaining 210,617 FAKE June orders will be rolled along to fake the next month – all in order to create a false sense of demand to drive up the prices you pay for energy – sucker! That's right, you are a sucker. You are a sucker because you don't get mad about this, you don't take action and you keep electing people who are in the pockets of the oil companies and let this happen.

Here's what the NYMEX strip looks like as of yesterday's close:

As you can see, 178,912 contracts (84.9%), representing 178,912,000 barrels of oil that were scheduled to be delivered to the United States, have been CANCELLED for June delivery. This helps to create an artificial shortage of oil that drives the price you pay at the pump higher than it should be. At the same time, 445 Million barrels of fake, Fake, FAKE!!! orders have been created in July, also to drive up the prices by creating a false sense of demand.

Meanwhile, we're happy to make our money off the scammers. Those June oil Futures we suggested you short at $61.50 (/CLM5) last Wednesday are failing $58.50 this morning for a gain of $3,000 per contract while (JO), the Coffee ETF we suggested you go long on at $22.25 is now $24.69 – up a quick 10.9% for the week (you're welcome).

From a trading standpoint, we don't care IF a game is rigged as long as we know HOW the game is rigged and are able to play along but, from a moral standpoint – we're outraged!

more

Only after their criminal act of releasing the inside info early to a select few.