Trump Stimulus And Global Economic Data In Focus

The first full week of October saw traders digest a huge amount of economic and political news, causing some major swings in the market. US President Donald Trump's decision to halt stimulus negotiations surprised many on Wall Street, as well as some in his own camp. While indices initially fell, they recovered well after Trump announced he went ahead anyway to approve a revised stimulus package.

For now, markets are likely to continue to move based on the narrative from the US, especially so near to the presidential election. Institutional investors are more likely to take stock of the big picture after the election where the four-year election cycle typically shows a tendency for a bullish year.

Other risk-assets, such as the Australian dollar (FXA), New Zealand dollar and Canadian dollar (FXC) also received a boost from the news and traders may look for continuation in some of those moves this week.

All eyes may also be on the Chinese Yuan (CYB) which has just recorded its best quarter in 12 years. China's strong domestic recovery and high yields have helped lift its currency on both domestic and international demand. Many analysts are predicting the potential for more upside - especially if Joe Biden wins the presidency in November.

- Stock market volatility remains elevated on the hope of a new round of stimulus from the White House

- Investors have so far dumped safe-haven currencies such as the Japanese Yen and Swiss Franc

- The US dollar has continued to remain the weakest G7 currency

- The Chinese Yuan recorded its biggest rally in more than 12 years on a domestic recovery

- British pound in focus after UK Prime Minister Boris Johnson tells French President Emmanuel Macron that the UK is open to all avenues for a deal, but not at 'any cost'

Source: Forex Calendar provided by Admiral Markets UK Ltd.

This week, there are core economic announcements due from a variety of countries which could impact volatility levels in the currency market.

Key economic reports and markets to watch

US Inflation & Retail Sales

It's a big week for the US dollar with a calendar full of possible major and minor impact economic news announcements and the continued uncertainty on when - and maybe 'if' - the next presidential election debate will be. These are some of the key announcements we know about for the week:

- Tuesday 13 October:

- USD Inflation Rate YoY - 1.4% expected, 1.3% previous

- Friday 16 October:

- USD Retail Sales MoM - 0.6% expected, 0.6% previous

The US Federal Reserve has been notable in their determination to push inflation higher from its current lows which it considers to be dangerously low. However, with the Fed planning to keep rates at record lows near zero, it has skewed the yield curve for bond traders. Even more challenging has been the decision in 2018 to review its policy-making which has brought inflation expectations front and centre.

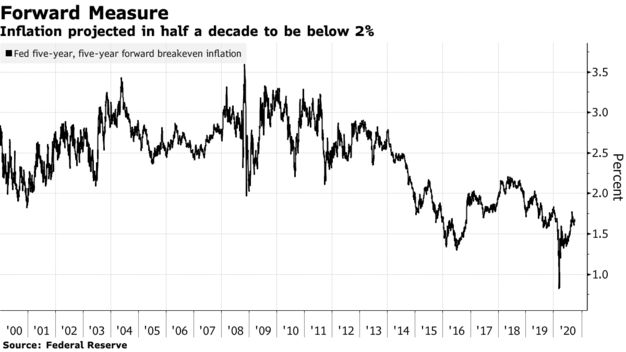

To measure inflation expectations, the Fed traditionally has used the forward markets and looked at the five-year forward breakeven rate which is traders' projections for rates in half a decade, as shown below:

Source: Federal Reserve via Bloomberg

It makes this week's inflation numbers hugely important. Although, in this unique period traders may well focus on the election outcome and possible stimulus plan more. What will be interesting this week are comments from different central bank officials and how they view the data coming out - making it an interesting week for the US dollar.

In the long-term chart of the US dollar index below, price action has been contained in a long-term range between the $103 and $89 price level. Currently, the price sits in the middle of this range with current weakness driving the price back down to the lower support line around the $89 price level. However, the price is stalling around intermediate support around the $93 price level.

Source: Admiral Markets MetaTrader 5 Web, USDX, Monthly - Data range: from Nov 1, 2004, to Oct 12, 2020, performed on Oct 12, 2020, at 6.00 am BST. Please note: Past performance is not a reliable indicator of future results.

Last five-year performance of the S&P 500 circa: 2019 = +29.09%, 2018 = -5.96%, 2017 = +19.08%, 2016 = +8.80%, 2015 = -0.82%, 2014 = +12.32%

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter "Analysis") ...

more

It now appears apparent that Trump can not even convince his own party's senators to support his stimulus plan. Don't expect anything just like his promise to give drug money cards to seniors. Rather look to Asia to potentially support the market this week.