Treasuries Have Sold Off As Rates Have Been Rising

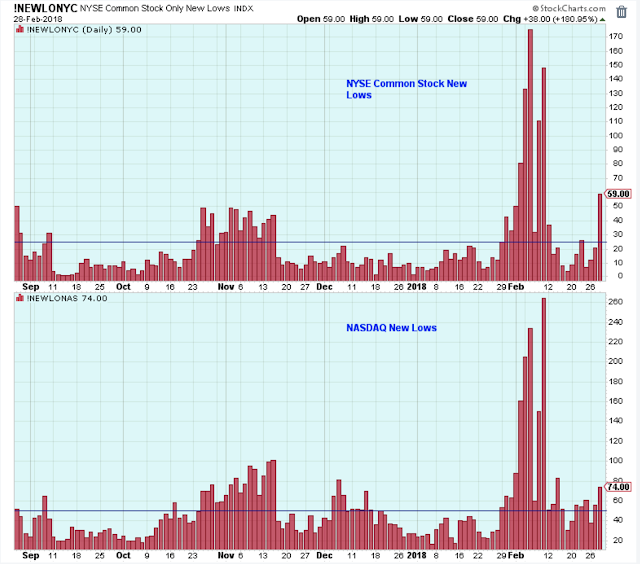

The chart below shows that selling pressure is starting to develop again based on the increase in the number of new 52-week lows.

(Click on image to enlarge)

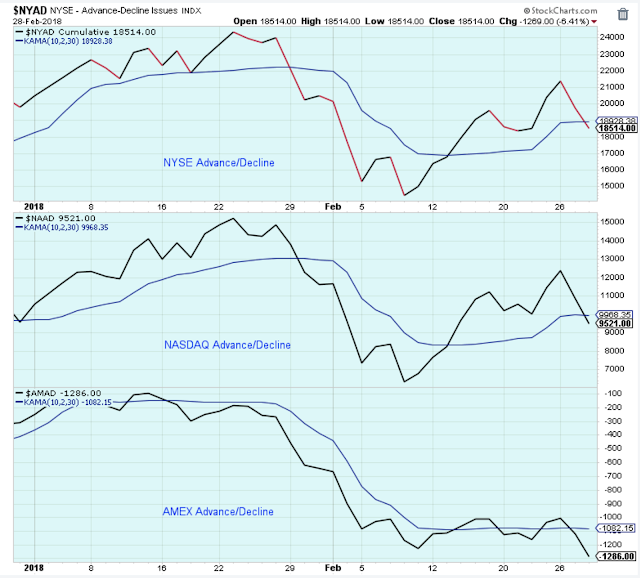

The cumulative advance/declines are pointing lower again too.

(Click on image to enlarge)

I think we all expected some back and fill. Prices will probably bounce around in this range for awhile.

(Click on image to enlarge)

Rates

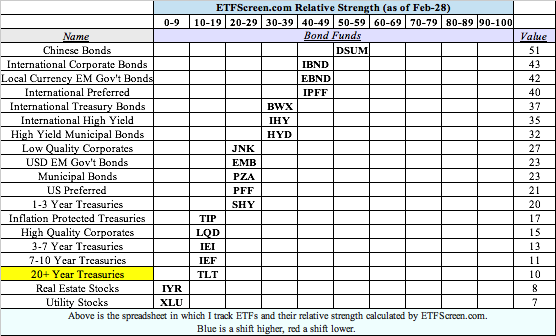

Below is my spreadsheet of the ETFs that I monitor, and their associated relative strength scores from ETFScreen.com.

These rate-averse ETFs are clearly skewed left meaning that as rates rise, these ETFs struggle. The weakness here helps confirm an environment of gradually rising rates (not that we needed much confirmation).

However, keep in mind that consensus is overwhelming negative towards fixed income, and that is often when you get surprises, at least in the short-term.

(Click on image to enlarge)

Treasuries have sold off as rates have been rising, but I think it is interesting that this ETF is still above the lows of a year ago. I think we may be ready for a short-term bounce higher for fixed income prices.

(Click on image to enlarge)

This is a very long-term chart. The 30Y Treasury Bond price is breaking down (yields up, prices down). Prices recently broke important support, and are now just below the 100-month trend. This chart is bearish towards bonds, longer-term, but it is too soon to say that the bond bull market that started in the early 1980's is over.

(Click on image to enlarge)

Outlook Summary:

Higher rates are now a headwind for US stocks. The recent tax cut, the 300 billion spending increase, and the already out-of-control federal deficit are a set up for a very dangerous spike in interest rates.

Something else to consider is the Mueller investigation. I worry that the headlines generated by the investigation may rattle the markets more than people are currently anticipating. If Mueller-related headlines get closer to the White House, then they would probably hurt stocks and help bonds.

Over the last few days, the number of new 52-week lows is starting to increase, and the number of new 52-week highs has decreased which is the opposite of what you want to happen during a short-term uptrend.

The long-term outlook is cautious.

The medium-term trend is down.

The short-term trend is up but with caution.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, ...

more

That is not surprising. Maybe a stronger statement is that treasuries are selling off and thus rates are rising. It is the bad treasury auctions that drove the last dip in stock prices, not inflation. And it is poor treasury sales that are causing treasuries to lose value not the reverse.