Tracking Data Center Debt

Image Source: Pexels

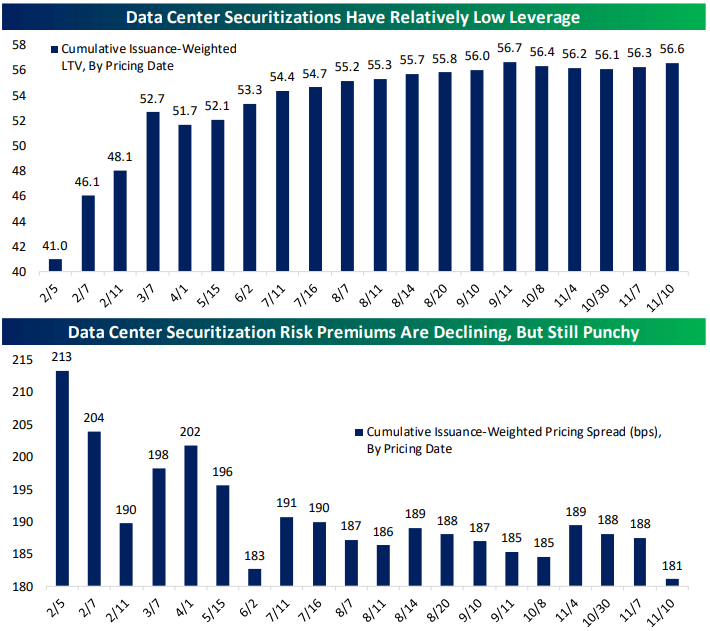

One common way that data centers borrow is via the asset-backed securities market. 26 of these deals have priced this year, but they’re relatively small in the grand scheme of things: just $17.5bn of face value. That's two orders of magnitude smaller than investment grade corporate bond issuance. It’s also noteworthy that they’re relatively low leverage, with an LTV only slightly above 50 on a weighted average basis. The combination of ample current cashflows and modest leverage means this debt can absorb a lot of decline in data center demand without leading to defaults. To be sure, risk premiums aren’t huge, but these deals all priced at spreads significantly wider than, for instance, where Oracle (ORCL) spreads sit. In other words, this securitization is much smaller and priced more conservatively than subprime MBS ever were.

To be clear, there are absolutely credit risks swirling in the data center and AI infrastructure universe. The extreme complexity of the Beignet transaction is a good example. Meta (META) is forming a joint venture with funds controlled by Blue Owl (OWL) that also receive debt funding from PIMCO funds (via the RPLDCI 6.581 05/30/49 bond which is the single largest-ever corporate bond issue). That bond amortizes over time based on cash flows from META itself, which serves as a development partner, cross-guarantor, and tenant of the completed data center. That allows what amounts to debt financing (with some de-risking via the JV with OWL funds) without an impact on the META parent credit rating. These sorts of complex transactions aren’t necessarily a sign of bad things to come, but they do indicate risk.

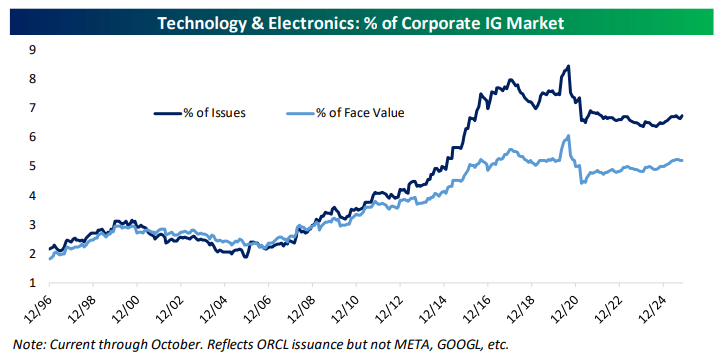

Looking at the IG bond market, we just haven’t seen the sort of sustained debt binge that is the hallmark of historical, financial system-threatening blow-ups like the subprime mortgage debacle was. That’s evidenced by relatively low Tech share of IG credit outstanding, or the relatively modest size of data centers in securitized transactions. If the AI trade does melt away and leave an investment bust, a debt crisis looks relatively unlikely without years more extreme investment rates funded by debt.

(Click on image to enlarge)

More By This Author:

Stuck In A Downtrend, But Getting OversoldEmpire Fed Rising

Short Interest Update

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more