Too Much Fear

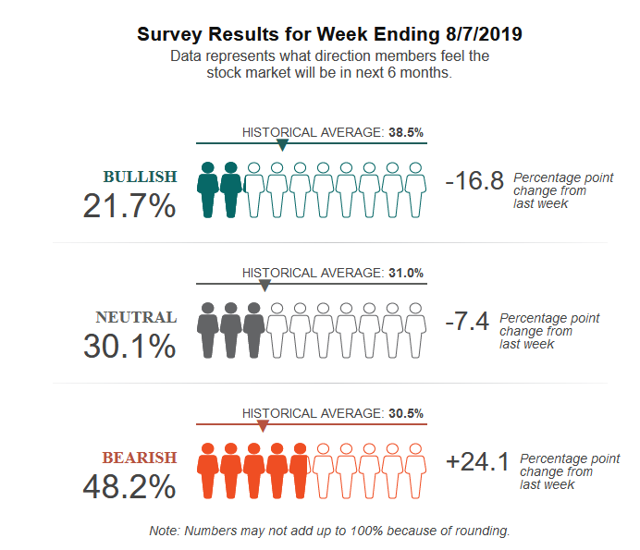

Wow! Talk about a panic! Look at the shift from bullish to bearish sentiment that happened in this week's survey (chart below). 78% of independent investors can't even imagine that the market will be higher in six months time.

The bear-minus-bull differential has spiked down to -26.5%, a level that corresponds to SPX lows (blue pointer on the chart).

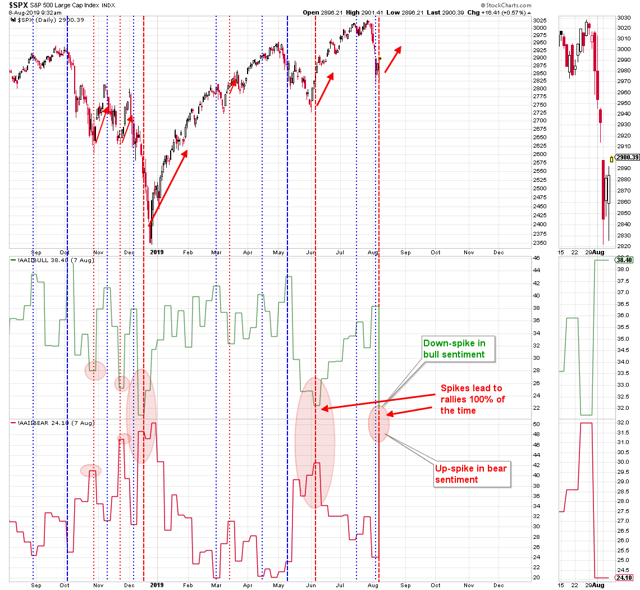

Down-spikes in bull sentiment and up-spikes in bear sentiment have led to rallies five out of the last five times (char below).

The counter-trend, that we pointed out a couple of weeks ago, did predict a pullback within the on-going normal rally pattern (chart below).

There is too much fear for this to be a top in the market.

Interested survey. But what's your take. Where do you think the market will be in 6 months time?

Closer to the end of the year, we think the market is going to breakout of the trading-range that it has been in since Jan 2018, and enter a new major up-leg that few see coming.

I feel there is too much uncertainty to know where we will be in 6 months. And uncertainty is never good. With most presidents, we have a sense of stability. With #Trump, anything could happen. In particular with talks with China and North Korea.

What you say is true. However, since we NEVER know where we will be in the future, we have to use correlations that existed in the past in order to establish what is likely to happen down the road. There are only two constants in the stock market---fear, and Treasury money flows---and both are saying that the market is likely to be higher in the medium and long-term future.