Too Good To Last? Ten Clean Energy Stocks For 2019

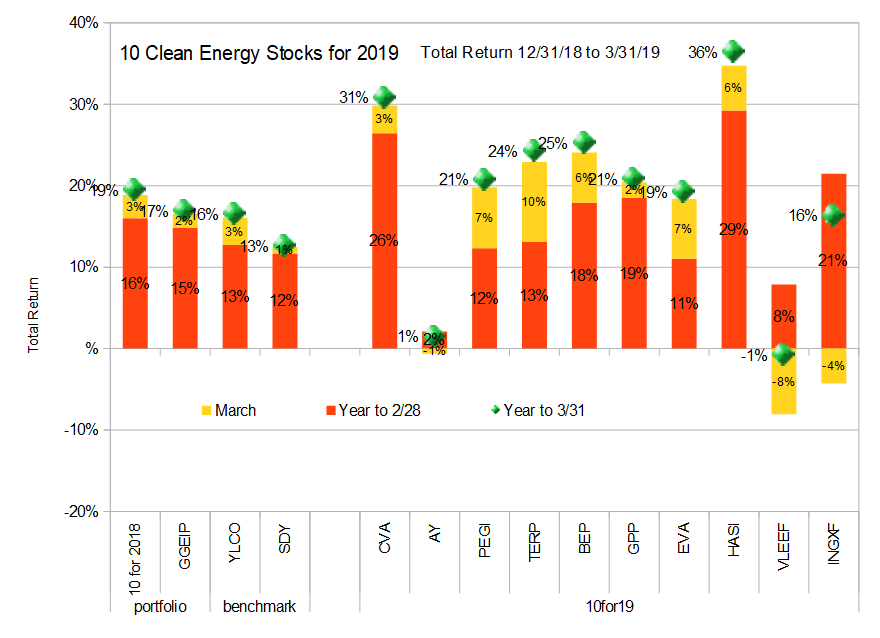

Model portfolio, real portfolio (GGEIP), and benchmarks total return, Q1 2019

The first quarter of 2019 saw the market’s largest quarterly gain in a decade, and my 10 clean energy stocks model portfolio outperformed both the broad market and the clean energy income ETF I use as a benchmark (see chart above).

Performance that strong makes me nervous, especially since the last time we saw gains like these it was the stock market rebound from the financial crisis. In this case, while the market was down in the last quarter of 2018, it had only been enough of a decline to blow a little of the foam off the top of a market that was looking very bubbly. The first quarter’s gains have shaken up the market’s champagne bottle all over again.

While this particular investor is happy to pop the cork in celebration, you can bet I’m taking pains to make sure the spray is not going to drench me or my portfolio. I’ve been selling some positions for cash, selling covered calls on others, and letting cash covered short puts expire without selling new ones. In short, I’ve been taking steps to lower my portfolio’s sensitivity to market movements in preparation for a possibly severe market decline. I’ve returned to my more customary bearish stance after my relatively aggressive (for me) buying towards the end of 2018.

Yes, I was also bearish at the end of February, and, in fact, I’m bearish most of the time, some being nervous about the market is not much of an indicator that stocks are going to fall. That said, the few times I’ve been bullish (the start of 2019, early 2009, and late 2015 (for Yieldcos after the 2015 Yieldco bust), for example, have all seen strong gains. So maybe we’re not going to see the crash I’m worried about this year, but I’m pretty confident the risks going forward outweigh the upside of a few more percentage points gain that might come from staying fully invested.

Of the ten stocks in the model portfolio, the one large position I’m holding all of is Atlantica Yield, PLC (Nasdaq: AY). It has failed to join its Yieldco brethren in the recent rally, and so its relatively attractive valuation provides some downside protection. While Valeo SA (FR.PA, VLEEF) has also been flat for the year to date, that auto parts supplier is much more sensitive to economic conditions than the other stocks in the portfolio, most of which are quite defensive in nature.I’m holding Valeo, too, but that is not a particularly large position.

Disclosure: Long PEGI, CVA, AY, TERP, BEP, EVA, GPP. INGXF, HASI, VLEEF.

Disclaimer: Past performance is not a guarantee or a reliable indicator of future results. ...

more

As always, great article. Not to be contrary at all and just for a little discussion but is this something you have thought of re Enviva?

www.theguardian.com/.../wood-pellets-biomass-environmental-impact

What about it?

Great read, very interesting.