Ten Clean Energy Stocks For 2019

Looking forward to 2019, I’m more optimistic than I have been since the start of 2016, in the wake of the popping of the YieldCo Bubble in late 2015.

The bear market that started in late 2018 seems like it’s far from over, but I expect in early 2019 will see it enter a less chaotic phase. After the wild declines and swings of late 2018, I expect investors will begin the new year with an eye to safety more than growth. This means that the clean energy income stocks which are my focus should outperform riskier growth stocks. The end of interest rate increases by the Federal Reserve should also help these stocks as fewer investors are drawn away by the increasing yields of bonds and other income instruments.

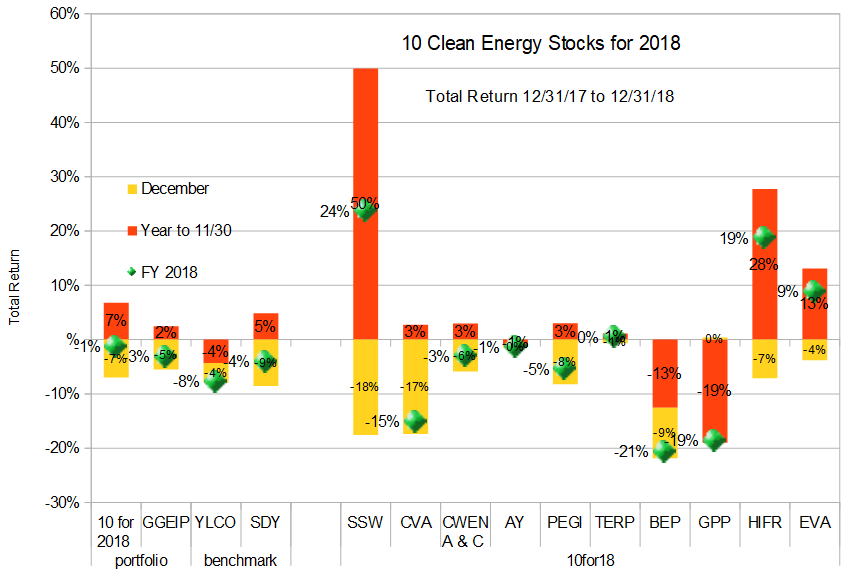

As I write on December 28th, my Ten Clean Energy Stocks for 2018 model portfolio looks like it will end the year with a small loss, but ahead of its benchmarks. You can see its returns through December 28th in the chart below, and stay tuned for a recap sometime in the next week.

Out with the old

With stock prices down and yields up, I plan to keep seven stocks from the 2018 list for 2019. The exceptions are (somewhat coincidentally), the two winners: InfraREIT (HIFR), Seaspan Worldwide (SSW), and Clearway Energy, Inc (NYSE: CWEN and CWEN/A). I’m dropping InfraREIT because the company is being bought out by Oncor in a transaction expected to close sometime in the second quarter. Seaspan is losing its slot for lack of greenery. I always considered the owner of relatively efficient container ships to be marginally green (due to the relative efficiency of its ships compared to those of its peers), and a recent purchase of an interest in liquefied natural gas transportation makes it no longer meet my standard for a green stock.

I’m dropping Clearway mostly based on relative valuation. The company is still attractive, but a little less so than some of the other Yieldcos which made this year’s list. Not only does Clearway have some fossil fuel assets, it also has a large number of power purchase agreements with PG&E (PCG). PG&E, in turn, has significant potential liability from the possible involvement of its equipment in starting some of California’s recent wildfires. Both California’s utility regulators and legislators are working to protect PG&E from bankruptcy, but what that protection might look like has yet to be seen. Given the large number of Yieldcos at very attractive valuations, I see no need to keep Clearway in my top ten picks.

In with the new

Valeo SA (FR.PA, VLEEF)

12/31/18 Price: €25.21/$28.20. Annual Dividend: €1.25. Expected 2019 dividend: €1.25. Low Target: €20. High Target: €50.

My friend and colleague Jan Schalkwijk of JPS Global Investments brought French auto parts supplier Valeo SA. Like many auto stocks, Valeo struggled in 2018 with industry oversupply and the ongoing trade war. This led the stock to fall by more than half, giving it what I consider a very attractive valuation.

Valeo follows the European model of paying a single annual dividend based on the previous year’s profits. Its 2018 dividend was €1.25, which would amount to slightly more than a 5% yield based on the current stock price of €24.55. Analysts estimate the company will earn around €3 per share in 2018, easily enough to maintain that dividend in 2019, and they still expect growth in 2019.

A 7.5 forward P/E ratio and over 5 percent dividend yield would be enough to get me to take any stock seriously, but valuation is not the only factor attracting me to the stock. The company is a leading supplier for two accelerating trends in the automotive industry: electrification and autonomous driving.

The company is a leader in 48V mild hybrid technology, which can deliver most of the fuel savings from of a full hybrid vehicle at a fraction of the cost by allowing the gas engine to turn off instead of idling while the vehicle is stopped. Beyond the technologies of today, Valeo has developed a full 48V electric powertrain system which is 20% less expensive than the high voltage systems used in most electric vehicles today. Although I expect a low voltage electric drivetrain will have lower performance than the typical high voltage system, and so be less attractive to car buyers, it could be extremely well suited to transportation services such as car-sharing services and autonomous taxis, such as the Autonom Cab, the world’s first robo-taxi, which was presented by its French designer Navya. This all-electric, driverless vehicle relies on Valeo laser scanners, and LiDAR (light detection and ranging.)

While I find it particularly difficult to predict which carmaker is likely to pull ahead in the race to make profitable electric and autonomous vehicles, I feel more confident investing in a part supplier that works with most of them.

Welcome back, Hannon Armstrong

Hannon Armstrong (NYSE: HASI )

12/31/18 Price: $19.05. Annual Dividend: $1.32. Expected 2019 dividend: $1.32. Low Target: $18. High Target: $27.

Last year, I dropped a long time favorite stock, Hannon Armstrong (NYSE: HASI) from the list because I felt the stock was temporarily overvalued. The stock ended 2017 at $24.06, and, as I write on December 28th, is currently trading at $19.54. After the company’s $1.32 annual dividend, this amounts to a 13% loss for the year, well below the average total return of the stocks that made the list.

In the current uncertain environment, I am happy to welcome this unique clean energy financier back into the list. The company arranges financing for a broad range of sustainable infrastructure projects, from renewable energy projects like solar and wind farms, to energy efficient upgrades of buildings for performance contractors and commercial property assessed clean energy loans (c-PACE). Hannon Armstrong’s broad range of clients allows it to focus on the most profitable sectors as certain clean energy technologies go in and out of favor with other financiers, and it also has the expertise to either sell the securities it creates to long-term investors like pension funds and insurers when demand is high, or to keep them on its own balance sheet when that is most profitable.

The rising interest rate environment of 2018 meant that Hannon Armstrong did more securitization than in previous years. This strategy delivers short-term profits, but does little to increase long term cash flows that can support increases in the dividend. The recent well-timed secondary offering of 5 million shares at $22.40 per share and the refinancing and extension of its secured credit facilities this month hint that the company plans to keep more of the investments it creates in 2019 on its own balance sheet. These investments should easily allow it to achieve Hannon Armstrong to achieve its target 2 percent to 6 percent growth in core earnings per share.

The expected 2 to 6 percent core earnings growth should allow the company to raise its dividend per share by at least one cent in 2019, but I am unsure if management will choose to do so, and instead retain the capital to boost future growth. The company previously had a policy of distributing 100% of core earnings over the course of the year, but said on its first-quarter earnings call, “As we grow earnings in 2019 and 2020, we will consider growing the dividend perhaps at a lower growth rate than the growth in core earnings.” Hence I expect a quarterly earnings increase of no more than 1 cent in each of 2019 and 2020. A one cent increase would amount to 3% dividend per share growth per year, towards the lower end of the company’s core earnings growth guidance range. I don’t consider a half cent or no dividend increase at all in 2019 to be out of the question, but I am confident that dividend growth will resume by 2020.

The Marriage of Two Old Friends

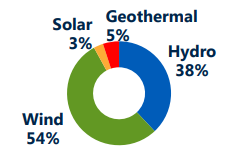

Innergex’s technology diversification. Source: November 2018 Investor Presentation

Innergex Renewable Energy (Toronto: INE, OTC: INGXF)

12/31/18 Price: C$12.54/$9.27. Annual Dividend: C$0.68. Expected 2019 dividend: C$0.70. Low Target: C$11. High Target: C$16.

Innergex has never been in the model portfolio before, but it has often been a close runner-up. It also acquired 10 Clean Energy Stocks veteran Alterra Power in early 2018. Alterra was featured here in 2012, 2013, and 2014. Like US Yieldcos, Innergex owns wind and solar farms, but also much less common run of river hydropower and geothermal assets.

Innergex also develops its own assets in house as well as acquiring them after they are operational, which is the model for most Yieldcos. While many US Yieldcos are struggling to bring down their payout ratios in order to retain some cash flow for investing, Innergex has kept its payout ratio in the 80 to 90 percent range for the last five years, making it less reliant on the whims of the capital markets to fund future growth.

Updates on Stocks Retained from 2018

Covanta Holding Corp. (NYSE: CVA)

12/31/18 Price: $13.42. Annual Dividend: $1.00. Expected 2019 dividend: $1.00. Low Target: $13. High Target: $25.

Leading waste-to-energy operator Covanta’s stock cratered in December, but only in sympathy with broader market declines. News from Covanta was limited to the expected:breaking ground on a new waste-to-energy combined heat and power in Scotland.

I’m very enthusiastic about the value of Covanta’s stock at the start of 2019. The company shored up its balance sheet and found a source of future funding for growth capital in its partnership with Green Investment Group, but the market has not rewarded the stock. The 7.5 percent current yield is more reflective of a company in financial distress than a company on an (albeit slow) growth trajectory.

Atlantica Yield, PLC (NASD: AY)

12/31/18 Price: $19.60. Annual Dividend: $1.44(%). Expected 2018 dividend: $1.52 (%). Low Target: $18. High Target: $30.

Atlantica was the former Yieldco of Spanish developer Abengoa before its bankruptcy. Its new parent, Algonquin Power and Utilities (AQN), has gotten it back on track to growth fater a couple tough years as Atlantica dealt with the fallout from its former sponsor’s bankruptcy. During those two years, Atlantica kept its dividend low and reduced debt to strengthen its balance sheet. It has now reached its long term target of an 85% payout ratio, and is growing its portfolio with the recent acquisition of a wind farm in Uruguay.

The location of the recent acquisition in Uruguay is not an aberration. Atlantica has one of the most geographically diverse portfolios of all Yieldcos, a legacy of its former Spanish sponsor. It has assets not only in the US and Spain, but also in several other countries in South and Central America and Africa. It also adds diversification with significant electrical transmission and water infrastructure.

Pattern Energy Group (NASD:PEGI)

12/31/18 Price: $18.62. Annual Dividend: $1.688(%). Expected 2018 dividend: $1.688(%). Low Target: $18. High Target: $30.

Wind energy Yieldco Pattern’s stock price continues to trade as if investors expect a dividend cut. I am not one of those investors, and I am happy to collect the current over 9 percent yield while management continues the slow improvement of cash flow that began in 2018 to bring its payout ratio down to its target payout ratio of 80%. I expect the payout ratio to decline only slowly, and likely end 2019 near 90 percent.

A dividend increase this year is extremely unlikely, but the yield plus any capital gains as investors gain confidence in the stability of the current dividend will be more than adequate reward for holding the stock.

Terraform Power (NASD: TERP)

12/31/18 Price: $11.22. Annual Dividend: $0.56 Expected 2018 dividend: $0.60 (%) Low Target: $10. High Target: $16.

Compared to other Yieldcos, Terraform’s stock was fairly resilient in 2018, meaning that it is less of a bargain than several others in this list. Solely on the basis of valuation, I was torn between Terraform and Clearway. While Clearway is trading at a higher yield and both stocks are on similar dividend growth trajectories, Clearway has more underlying risks that compensate for its higher yield (see above.) I chose to retain Terraform in the list out of environmental preference... I have never been completely comfortable with Clearway’s fossil fuel assets.

Brookfield Renewable Partners, LP (NYSE: BEP)

12/31/18 Price: $25.90. Annual Dividend: $1.96 (%). Expected 2018 dividend: $2.08(%). Low Target: $27. High Target: $40.

The end of 2018 brings the chance to buy what I consider the highest quality Yieldco at a greatly reduced price. Brookfield stands out from other Yieldcos because of its larger size ($8 billion market cap, compared to $3 billion for the next largest, Clearway) which allows it access to low cost debt financing. Its sponsor, Brookfield Asset Management (BAM), which is also Terrafom’s sponsor, also gives it access to flexible financing which has historically allowed it to purchase distressed renewable energy assets at very attractive prices. BAM’s position as a manager of a broad range of leading infrastructure funds like BEP and TERP means that it takes the long view, and its Yieldcos pursue acquisitions when valuations are good rather than getting into bidding wars with other acquirers in the pursuit of growth at any cost.

Brookfield’s managers seem to agree that the partnership became significantly undervalued at the end of 2018. Over the last year, BEP repurchased 1.8 million units on the open market at an average price of $27.72 per share. In contrast, the partnership did not purchase any of its units over the course of 2017, when the share price traded consistently above $30. In fact, it sold 8.3 million units at C$42.15 (US$32.45) each in a secondary offering that year.

One rule of thumb I follow with Yieldcos is that you are likely getting a good value if you can buy the shares at a price below the most recent secondary offering.

Green Plains Partners, LP (NASD: GPP)

12/31/18 Price: $. Annual Dividend: $1.90(%). Expected 2018 dividend: $1.90(%). Low Target: $13. High Target: $27.

Ethanol MLP and Yieldco Green Plains Partners remains the riskiest stock in the model portfolio. The ethanol market is suffering from the Trump EPA’s continued undermining of the Renewable Fuel Standard with “hardship” waivers to large, highly profitable refiners. The price of ethanol’s main competitor, gasoline is low. Retaliatory tariffs on ethanol exports further undermine the market.

GPP’s stock price reflects this distress. GPP’s parent, Green Plains Inc. (GPRE) has fallen as well and racked up significant losses this year. Nevertheless, analysts expect GPRE’s red ink to stop in 2019. That means that investors can be confident the minimum revenue guarantees that GPRE has given GPP remain safe. Those guarantees should allow GPP to limp along, maintaining its current dividend through the weak ethanol market.

When the ethanol market recovers, the pressure on GPP’s stock price should ease, leading to capital gains for investors who buy at the current price. The ethanol market is in such dire straits that a recovery could be triggered by a number of factors: rising gasoline prices, falling corn prices (perhaps as a result of the continued trade war), a change EPA policy (something advocated by powerful Republicans in the Senate), or the closure of excess ethanol facilities (a process which has already begun.)

While Green Plains Partners is undeniably a risky stock, the current 14 percent dividend is extremely attractive and any recovery in the ethanol market, if it happens, should lead to a dramatic gain in the stock price.

Enviva Partners, LP. (NYSE: EVA)

12/31/18 Price: $27.75. Annual Dividend: $2.54. Expected 2018 dividend: $2.58. Low Target: $24. High Target: $40.

Wood pellet Yieldco and Master Limited Partnership Enviva continued its growth through regular drop-down acquisition from its sponsor through 2018, increasing its distribution by a regular 0.5 cents per quarter. With a payout ratio in the high 80 percentile range and a new, lower interest rate credit facility in place, I expect this growth to continue unabated in 2018.

At a 9 percent yield with continued growth of at least three percent per year, the partnership seems likely to produce a solid return while providing good technology diversification.

Final Thoughts

During bear markets, most investors reassess their willingness to take risk. Some sell all their stocks, while others reallocate their investments to less risky stocks. These ten stocks are chosen to benefit from the latter trend. For the most part, they produce steady income streams that are largely independent of economic conditions.

The first stage of the bear market, which we experienced in late 2018, has been mostly composed of indiscriminate selling by investors once again reawakening to the fact that stocks do not always go up. I expect the next stages to be characterized by more discriminate selling, and investors begin to differentiate between stocks that may not do as well in a slowing economy crippled by political uncertainty and trade wars, while holding on to those investments that are less dependent on economic conditions.

The final stage of a bear market is capitulation. In this stage, the optimistic investors who had been holding on to their losers in the hope that the bear market was just a temporary dip give up. The only buyers at that point are deep value investors, who buy based solely on the future cash flows of a company, regardless of any hope of future appreciation. Those deep value investors will put a floor under the stock prices of these ten stocks.

I could also be wrong about the future course of this market. Although it seems unlikely to me, I have a history of underestimating the optimism of investors. Perhaps the current bear market will be short-lived, and the Dow will be hitting new highs by the end of 2019. If that happens, I expect that this model portfolio will produce gains as well, although it will likely lag the gains seen by the broad market of less conservative picks.

If this model portfolio makes modest gains in a mild bear market, makes less than spectacular gains in a recovery, or takes modest losses in a continued severe bear market, it will have accomplished my long term goal. That goal is not taking the big loss, while staying open to the opportunity for gains. As long as you are in the market, every now and then the stars will align, and you will make some great gains, as this model portfolio did in 2016 and 2017. The trick is not to have all those gains disappear in the bad years.

2018 was a bad year, but it’s pretty easy to live with the model portfolio’s 1.3% loss. A severe bear market could lead to another modest loss in 2019. On the other hand, a recovery in the later part of the year could bring significant gains. I’m looking forward to seeing how that wager plays out in 2019.

Disclosure: Long PEGI, CWEN/A, CVA, AY, SSW, TERP, BEP, EVA, HIFR, GPP. INGXF, HASI, VLEEF, AQN. Tom Konrad earns consulting fees from JPS Global Investments for consulting on its Green Economy ...

more

After the first few days of trading in 2019 it definitely looks like you made the right call on $CWEN. Thank you again, love your insights

I agree on $CWEN. @[Tom Konrad](user:5273) is definitely at the top of his game.