Thrilling Thursday – Shorting Oil At $53 – Again

Thank you sir, may I have another.

How many Thursdays in a row are they going to ramp oil prices up despite a poor inventory report and set it up for a nice short? You can go back all the way to December and all the way to last summer, for that matter to see how many times we were able to short oil between $53 and $54 and make $250,$500, $1,000 per contract on our oil shorts. At some point you would think this is an expensive habit for the pumpers who jack up the price – as they have to take some sort of loss on their bogus orders (none are ever actually delivered).

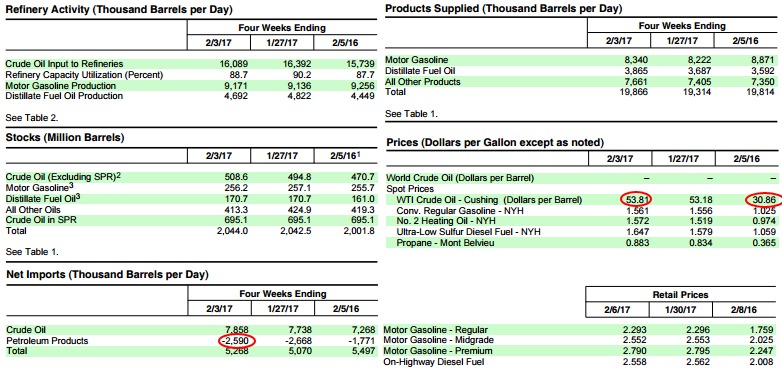

But, of course, the real game isn't to beat PSW Members out of a few Thousand Dollars, the game is to beat consumers out of a few Billion Dollars by jacking up the prices you pay at the pump or for products that use petroleum as a base. Now $53 isn't the best short but it may be all we get after yesterday's MASSSIVE 13.8Bn barrel build in crude inventories – that's 2 full days of imports we didn't need at all!

This is happening despite the fact that we are now EXPORTING 2.6M barrels of refined products PER DAY (18.2Mb/week) - now making the US one of the largest petroleum exporters in the World. We are swimming in oil and there is no sign of increasing demand and OPEC already cut the supply – this is a very poorly-balanced market.

By sending 18.2 Million barrels of refined product out of the country each week "THEY" fake US demand for oil and keep the prices high, $23 per barrel higher than they were last year and we use 16.1M barrels per day so this shell game they are playing is costing the American consumer an extra $370M/day or $2.6 BILLION per week or $135Bn a year – "THEY" just reach into your pocket and steal that money to the tune of $1,000 per working American over the course of a year.

And, of course, this is just another disproportionate "tax" on the poor that transfers their income back to the Top 1% and that is why "THEY" can afford to loss millions of Dollars to us every month as we short their little oil scam – it's nothing compared to the Billions they are stealing from the Bottom 99%, who have no idea how badly they are being screwed by these games.

Higher oil prices are certainly no reason to rally the markets so my note to our Members this morning was:

Our Futures are up 0.25% at the moment on a huge 6am move. I like /ES short at 2,295 and /NQ short at 5,200 and oil is a gift of a short at $54 – same pattern every week!

As you can see, we nailed the turn and the Egg McMuffins are already paid for and now we'll see what sticks in today's cross-currents. The Northeast is being hit by a winter storm that looks to drop a foot of snow today so that's not good for oil demand (grounded planes, less driving) or Retail Stocks and it really sucks to lose a day in the shortest month of the year.

It is good for our Natural Gas (/NG) longs and we told you about those on Tuesday and AGAIN in yesterday's Morning PSW Report, so don't complain to us if you didn't pick up yesterday's $1,000 per contract gains – something I reiterated to our our Members in yesterday morning's Live Chat Room, saying:

Asia was up half a point, Europe is mixed, oil trying to take back $52, /NG coming back to $3.05 maybe (and winter is coming on Thursday, so it's a good long).

Meanwhile, earnings are getting weaker and weaker as we move into the last 1/3 of the reports (2 more weeks to go) and it's up to the Small Caps to prove they have what it takes but, as you can see from this chart, gains in Small Caps have outpaced the S&P by a wide margin since the election in anticipation of America getting all great and stuff.

As we have noted for you in previous Reports, the Russell Ultra-Short (TZA) is a primary hedge in both our Short-Term Portfolio and our Options Opportunity Portfolio and we just put out alerts to press those shorts at Tuesday's close and we got great prices on yesterday morning's silly spike up and then we were immediately rewarded as the Russell led us to the downside in yesterday's action – PERFECT TIMING!

Our other major hedge is against the Nasdaq (SQQQ) and I know that sounds like blasphemy but we have a lot of Nasdaq longs in our Long-Term Portfolio with Apple (AAPL) one of major holding and it isn't called the AppleDaq for nothing as AAPL is about 17% of the index. We are certainly not betting against Apple but, if the index pulls back, Apple is not likely to save it from a correction.

Twitter (TWTR) gave horrific guidance this morning but DNKN, KO, SEE, SON, TRI and WFM did as well and it's not just that more companies are guiding down than up buy why are ANY major companies guiding down when the market is trading at all-time highs in expectations of an economic boom?

Disclosure: Our teaching theme at Phil's Stock World is "Be the House, NOT the Gambler." Please see " more

thanks for sharing