Thoughts For Thursday: Goblins About?

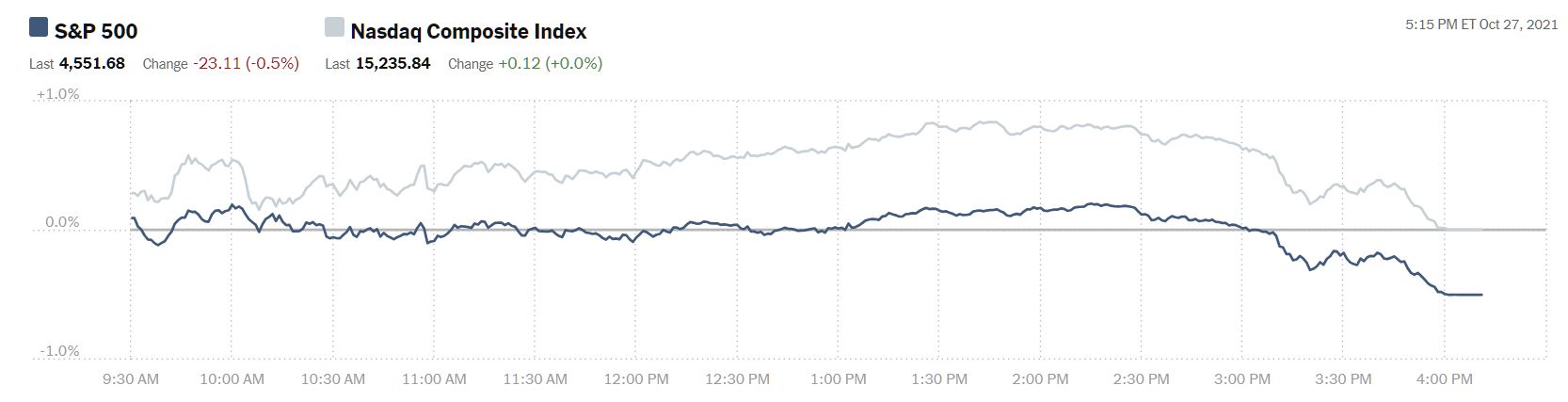

Seems goblins may have been about on Wall Street yesterday, with the major indices moving higher for most of the day, then turning down around 2:30 p.m. and finally, closing lower or unchanged.

Chart: The New York Times

The S&P 500 closed down 23 points at 4,552, but not before hitting an intra-day high of 4,585. The Dow Jones Industrial Average closed down 266 points at 35,491 despite trading as high as 35,835 early in the day. The Nasdaq Composite closed unchanged at 15, 236 though it did reach 15,365 during the day's trading session. Wednesday's top gainers were all in tech save for home improvement and building products manufacturer Masco.

Chart: The New York Times

Currently market futures are trading in the green. S&P 500 futures are up 15 points, Dow futures are up 96 points and Nasdaq 100 futures are up 95 points.

TalkMarkets contributor Michael Kramer writing in Stocks Fall Further On Wacky Wednesday finds that falling global interest rates are the culprits.

"The yield curve was utterly crushed as yields on the long-end collapsed, and bonds on the short-end rose. It started last night (Tuesday) with the 2-yr popping higher around 8:30 PM ET and ended today (Wednesday) by 6 bps to 51 bps.

The UK 10-Year Gilt fell 11 bps after the government said it would issue fewer gilts in the coming year. That sent traders scrambling to buy the bond, sending the 10-year below 1%, closing at 0.97%. Couple this with the ECB meeting tomorrow, and global rates fell sharply, including the US.

The US 10-Yr fell by 7 bps to finish at 1.54%. Meanwhile, the curve flattened by a stunning 13 bps, versus the 2-year. I have been noting that I expect the curve to continue to flatten, and if the ECB is a dovish as I expect them to be tomorrow, then yields on the long-end of the curve should continue to fall over time as the short-dated bonds rise."

"This flattening crushed the financials and small-caps, with the Financial Select Sector SPDR Fund (XLF) dropping by 1.65% and the Russell 2000 (IWM) falling by 1.9%. The more the curve flattens, the more the two sectors will fall, along with the industrials, the materials, and energy."

Looking toward today's release of Q3 GDP numbers, contributor Mish Shedlock notes that Someone Will Be Hugely Wrong On (Tomorrow's) GDP Number.

"Following a string of bad economic numbers, the final GDPNow Forecast for third-quarter GDP is 0.2%. However, a full two percentage points of that number is an inventory build. Since inventories net to zero over time, GDPNow's true bottom line estimate is -1.8%. In contrast, the Bloomberg Econoday consensus is a much higher 2.7% in a range of 1.6% to 4.8%. Econoday does not net out real final sales. Someone is going to be hugely wrong, and possibly everyone if we see a number like 1.4%."

Shedlock also adds these further comments:

"Earlier I noted that the Goods Trade Deficit Expands a Shocking 9.2% as Exports Plunge. The GDPNow estimate makes more sense to me, and seemingly to the bond market as well as yields plunged across the board but especially on the long end. I will cover bonds in a separate post, but the bond market reaction is as if the GDPNow estimate is correct. This is due to the fact that exports add to GDP while imports subtract.

Inflation also subtracts from real GDP and inflation has been running hot...If the GDPNow model has the trade impact correct, and I believe it does, then look for GDPNow to be much closer than the Econoday consensus."

As the post-pandemic recovery continues it has been noted that one of the factors hobbling the recovery is the demand for higher wages. Contributor John Rubino in his article Another Effect Of Higher Wages looks at what the (perhaps hidden in plain sight) implications of higher wages mean further down the road.

"After decades of stagnation, wages are finally rising. McDonald’s, believe it or not, has made the whole $15 minimum wage movement obsolete by starting its burger flippers at $21 an hour.

This is a good thing, but also a complicated one. In Remember Strikes? we covered some of the ways rising wages will change the world going forward. But we left out a big one, which is accelerated automation...

...When McDonald’s (MCD) – or Walmart (WMT) or Amazon (AMZN) – talk about “substantial benefits to customers and employees” they’re of course actually saying “fewer human employees.” So the near-term gains in wages might produce a longer-term decrease in entry-level jobs. This was always going to happen, as AI-driven robots become increasingly able to do repetitive work. But labor shortages and rising wages (and more frequent strikes) are turbo-charging the process. No real point here, just noting how multifaceted and complex big societal trends can be."

Halloween is a time when the scary and spooky are celebrated and strange spirits can be found lurking about. In that vein I present Stonks: The Canary In The Stock Market Coal Mine brought to readers by contributor Jesse Felder.

"After a fascinating conversation with Investech founder Jim Stack a few months ago, I was inspired to put together an indicator for tracking broader speculative activity in the stock market. As Jim noted during our chat, the action in so-called “stonks,” or popular meme-driven equities, can be a great indication of the broader “animal spirits” driving the bull market. For this reason alone, they are probably worth keeping a close eye on."

"...they (Stonks) have grown in number over the past year and so plotting them individually on a single chart (indexed to 1,000 as of 1/1/17) has gotten pretty noisy. Combining them into a single index cleans up the picture a bit. And the immediate takeaway is that “animal spirits,” at least as measured by this group, potentially peaked back in the spring with the GameStop (GME) blowoff and have put in a pattern of lower highs ever since (although we don’t yet have a lower low)."

"...While intelligent investors can argue whether the broad stock market is overvalued or not, there simply is no debate when it comes to stonk market. These things have become undeniably obscene."

"...considering they could represent the canary in the bull market coal mine, a bear market in stonks could have important implications for stocks in a broader sense."

Halloween is a holiday for having fun and spending time with our families, taking the kids around for trick or treat, but it is also a time for teaching kids about responsibility, education, togetherness and freedom from want. When I was in fifth grade my classmates and I stopped knocking on doors to collect candy and instead of plastic jack o' lanterns to hold our "loot", we carried orange and black boxes in which to collect coins for UNICEF, the United Nations Children's Fund. UNICEF is celebrating it's 75th birthday this year.

Closing out the column for today and further emphasizing the importance of education TM contributor Jill Mislinski takes a deep dive into recently released data by the Census Bureau regarding Household Incomes 2020: The Value Of Higher Education. I have excerpted two of the charts from her article below, but highly recommend that you read the full article and share the data with your own high-schoolers.

"...The median income for all households with a householder age 25 and older was $67,521. The chart below shows the median annual household income for nine cohorts by educational attainment. We've rounded the data points to the nearest $100, e.g. $69.2K for all households age 25 and older."

The importance of a good education is paramount as can be seen from the chart. Unfortunately, the cost of that education has soared more than any other item as illustrated below.

Have a happy and safe Halloween. I'll see you next week.