Thoughts For Thursday: Bear Rally, Bull Drop

With St. Louis Fed President, James Bullard suggesting that Fed rates could hit 3.5% and JP Morgan CEO, Jamie Dimon saying people should prepare for an economic hurricane, it is no wonder that the market closed down yesterday.

The S&P 500 closed at 4,101, down 31 points, the Dow Jones Industrial Average closed at 32,813, down 177 points and the Nasdaq closed at 11,994, down 87 points.

Going against market winds Energy issues were among the top gainers, along with Tech standouts for the day, Salesforce (CRM) and HP Inc. (HP).

Chart: The New York Times

Currently market futures are trading in the green: S&P 500 market futures are trading up 17 points, S&P 500 market futures are trading up 108 points and Nasdaq 100 market futures are trading up 69 points.

In a TM Editor's Choice column, TalkMarkets contributor Wade Slome has a question for Jamie Dimon and others, Bad Weather Coming: Hurricane Or Drizzle?

"Like weather forecasters, economists are perpetually unreliable. While some doomsday-er economists are expecting a deeply destructive hurricane (deep recession), others are only seeing a mild drizzle (soft landing) developing. The truth is, nobody knows for certain at this point, but what we do know is that the correction in stock prices this year (-13% now and -20% two weeks ago) has already significantly discounted (factored in) a mild recession. In other words, even if a mild recession were to occur in the coming months or quarters, there may be very little reaction or negative consequences for investors. Similarly, if inflation begins to be peaking as it appears to be doing (see chart below), and the Fed can orchestrate a soft landing (i.e., raise interest rates and reduce balance sheet debt without crippling the economy), then substantial rewards could accrue to stock market investors. On the flip side, if the economy were to go into a deep recession, history would suggest this stormy forecast might result in another -10% to -15% of chilliness."

Here are the charts as Slome has included to help us with the forecasting:

US Unemployment Rate (1997 – 2022)

Source: TradingEconomics.com

"...the economy is currently very strong (i.e., record corporate profits and a generationally low unemployment rate of 3.6%)"

US Inflation Rate%

Source: TradingEconomics.com

"The world’s greatest investor of all time thinks that all this gloomy recession talk is creating lots of stock market bargains, which explains why Buffett has invested $51 billion of his cash at Berkshire Hathaway as the stock market has gotten a lot more inexpensive this year. So, while the economy will likely face a number of headwinds going into 2023, it doesn’t mean a hurricane is coming and you need to hide in a bunker."

Maybe yes, maybe no.

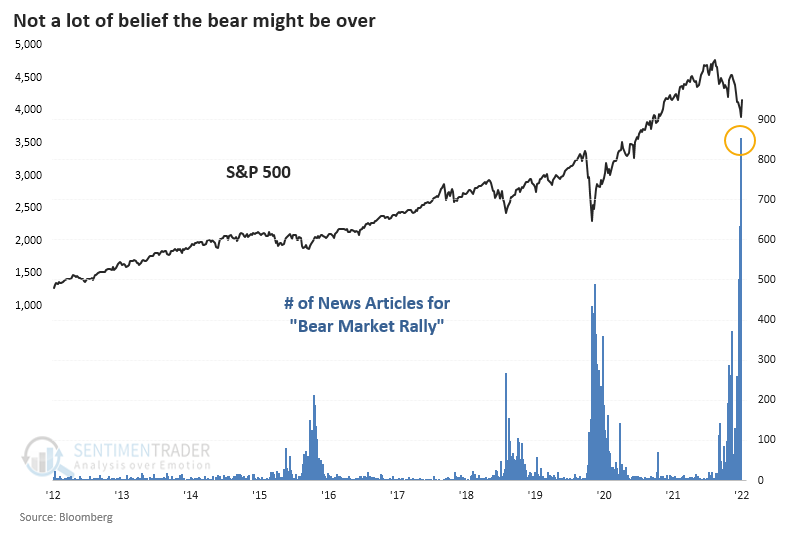

Contributor Greg Feirman opines that Everybody Thinks It’s A Bear Market Rally.

"Sentimentrader had a fascinating chart out today showing that the number of articles mentioning “bear market rally” is double the number during the March 2020 COVID Crash. I’m noticing that even bulls think this is only a bear market rally. A poker dealer at Casino M8trix in San Jose, CA who trades on the side told me on Monday that he expected the rally to roll over imminently. And so the minor selling we’ve seen Tuesday and Wednesday is being almost universally interpreted as the end of the bear market rally and the beginning of the next leg lower. What does it mean? Well, it IS in fact a bear market rally – but until the crowd starts to think it might not be, we’re going higher. See you at the 50-day moving average (DMA). "

Contributor Ironman takes note of strong dividend payouts in Dividends By The Numbers In May 2022.

"Dividend-paying firms in the U.S. showed unexpected strength in May 2022. More dividend-paying firms either increased their dividends or paid extra dividends than in previous months, while fewer firms announced dividend cuts. It's the kind of combination that typically produces good outcomes for the owners of dividend-paying stocks.

- 4,041 firms declared dividends during May 2022, a decrease of 453 over April 2022's count and 2,188 more than did a year earlier in May 2021.

- May 2022 also recorded 85 firms that announced special (or extra) dividends. That's 32 more than in April 2022 and 38 more than in May 2021.

- There were 156 companies that announced dividend rises during the month, an increase of 29 above April 2022's figure and 8 more than May 2021.

- The number of companies announcing dividend cuts dropped to 9 in May 2022, 17 fewer than April 2022's total, but 3 more than May 2021's recorded value.

- For the eleventh consecutive month, zero firms omitted to pay dividends."

TM contributor Mish Shedlock raises the concern that Russian oil sanctions will have limited effect and notes that, Russia Uses Chinese Ships And Indian Refiners To Stay Ahead Of Oil Sanctions.

"Why will these (new E.U.) sanctions work any better than any other set of sanctions. Shippers and refiners have been very skilled at hiding origin of Russian oil...

To avoid large insurance costs, the ships turn off their GPS systems to go dark, then transfer oil to large megatankers such as the Lauren II, a giant Chinese crude carrier that can hold about 2 million barrels of oil.

As long as India and China are willing to bypass sanctions, the oil will get through. However, these added costs impact prices globally.

More ships are using hauling oil from Russia to India and China instead of Russia to the EU. In turn the EU gets oil from Saudi Arabia instead of Russia.

Sanctions drive up the price soo much that Russia is getting more money even though Russia has to discount its price significantly to find takers.

The asininity of this setup is staggering.

The desire to "do something" is so politically powerful that politicians would rather inadvertently aid Russia than do nothing at all. "

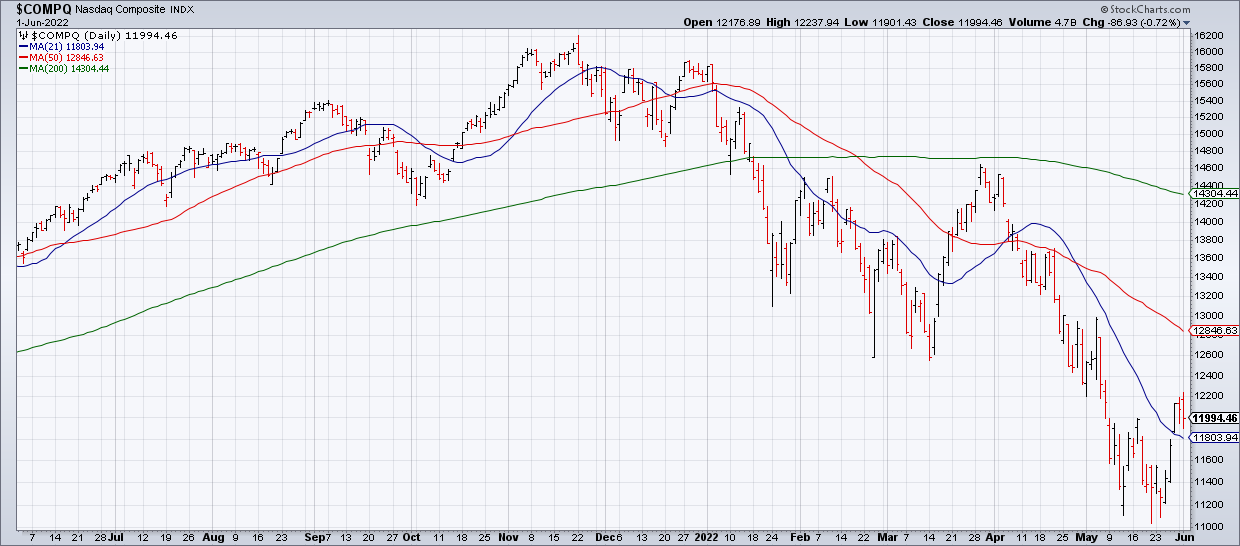

TalkMarkets contributor Alex Barrow in TM Editor's Choice column, explains why it is time to get back in the game. As he writes, Again, Buy ‘Em.

Here is Barrow by (some of) the charts:

"Coupled with a major bullish thrust in the McClellan Oscillator index while the Summation is coming off deeply oversold lows. Time will tell but this is looking a lot like the last three major market bottoms.

And we saw a round of positive confirming breadth thrusts last week (something we’ve been patiently waiting for). We got three consecutive 80%+ up volume days, > 90% of stocks above their 10dma via NDR (@EdClissold), and we were two days shy from seeing an official Zweig Breadth Thrust fire as well."

Contributor James Knightley takes us out on a bright note finding More Evidence For A 2Q US Growth Rebound.

"After the surprise contraction in the first quarter, there is growing evidence to suggest the economy will rebound strongly in the second with 4%+ GDP growth on the cards. The labor market is strong, consumers are spending and there is now evidence that manufacturing isn't struggling as much as feared while construction output continues grinding higher.

The Job Opening and Labor Turnover statistics (JOLTs) reinforce the message that any weakness in Friday’s employment report is down to a lack of workers willing and able to do the job rather than any softening demand. Job openings fell to 11.4mn from an upwardly revised 11.855mn (consensus 11.35mn), but this means there are still nearly two job vacancies for every unemployed American. To put this in context, in the UK there is one vacancy for every unemployed Briton and in Germany, there are just 0.4 vacancies for every unemployed German."

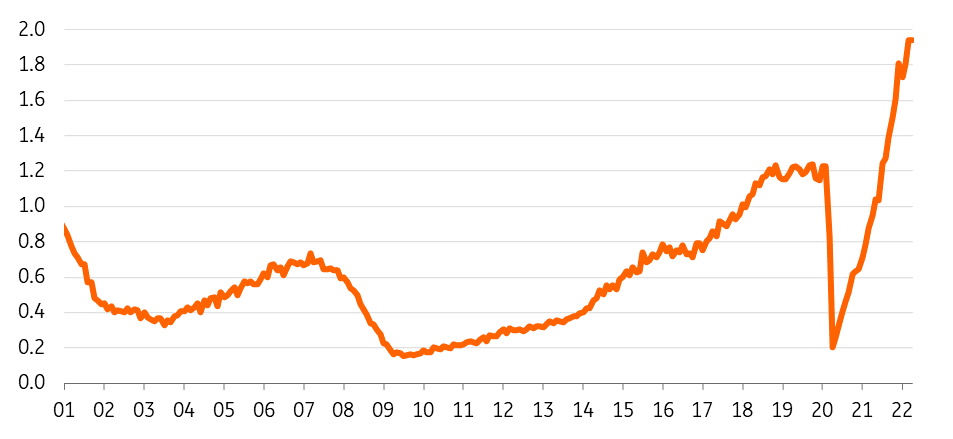

Number of US job openings for every unemployed American

Source: Macrobond, ING

"A tighter jobs market means more upward pressure on wages, which is likely to keep inflation stickier in the US than in other developed markets. In turn, this supports our view that the Federal Reserve will continue to be more aggressive in raising interest rates than the European central banks, which will help keep the dollar supported over the next few months."

All of which reminds us of a great hit from 2010, I Need A Dollar by Aloe Blacc.

Have a good rest of the week.