This Week: NVDA CEO Huang Keynote AI Speech, BOJ And Fed Decisions

Monday at 1 pm PST, Nvidia (NVDA) CEO Jensen Huang will be giving a keynote speech at the SAP Center in San Jose, CA on the future of Artificial Intelligence (AI). Obviously, Huang is going to hype AI. The real question is whether it can get NVDA’s stock going or if it’s a sell-the-news event.

(Click on image to enlarge)

Overnight the Bank of Japan (BOJ) will be making an interest rate decision and there is a lot of speculation that they may raise rates for the first time since 2007. The weak Yen makes imports quite expensive for import-dependent Japan. And on Friday, the country’s largest union agreed to a 5% increase in wages – putting further upward pressure on inflation. The problem is that Japan has the highest level of debt to GDP in the developed world. Raising rates will increase the cost of servicing all that debt. It’s not clear to me how the government would finance this. (For more, see “Something Is Happening In Japan”, Top Gun Financial, December 21, 2022).

(Click on image to enlarge)

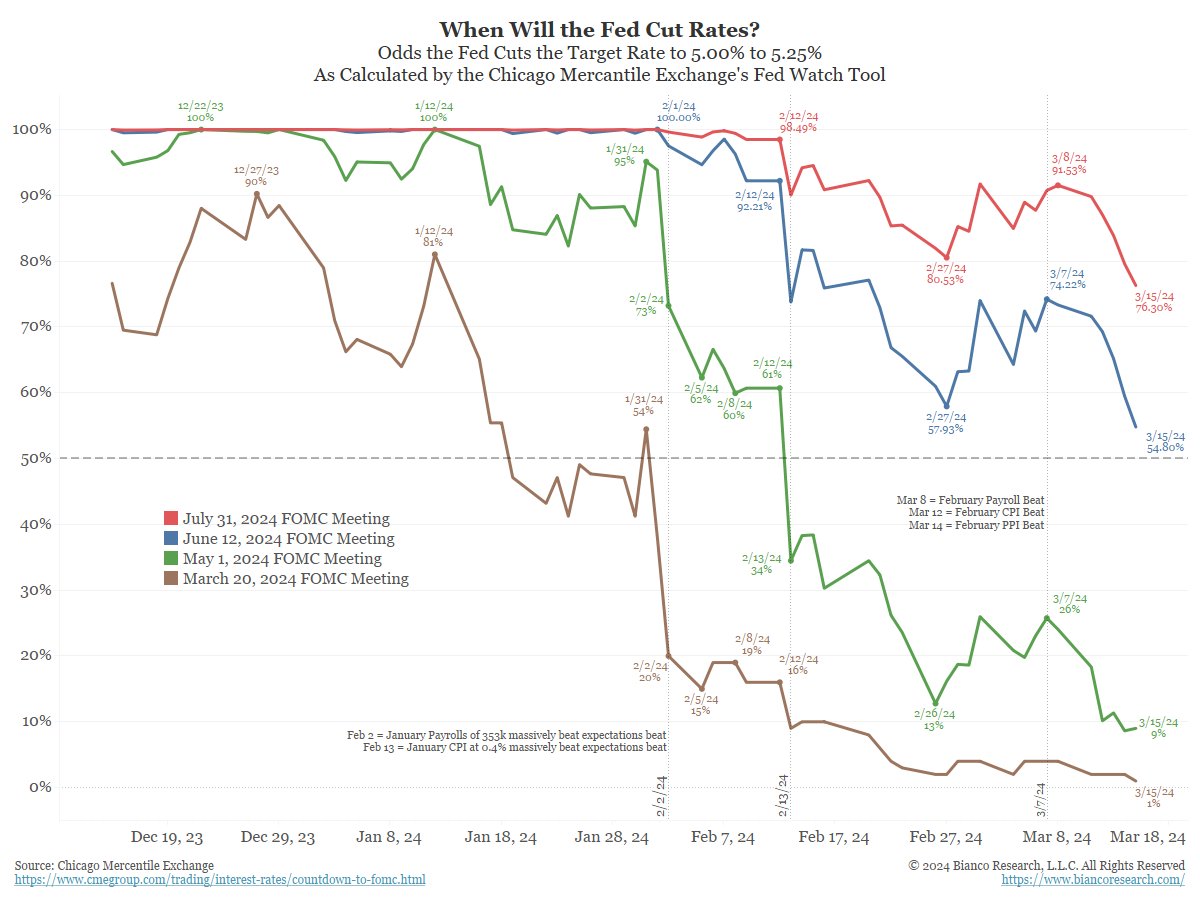

Lastly, of course, there is the Fed Decision on Wednesday at 2 pm EST. A May rate cut has been taken off the table by last week’s slightly hotter-than-expected February CPI and June is now about 50/50. While the Fed won’t make a policy change on Wednesday, investors will be scrutinizing the statement and Powell’s press conference for hints about the Fed’s thinking and course of action going forward.

More By This Author:

Sticky Inflation And The Neutral Rate

Sticky Inflation Means Higher For Longer And The Magnificent 7 Are Out Of Gas

The Return Of Higher For Longer, DLTR: A Tale Of Two Economies